As a deduction, claim exemption less than Rs. 3.75 deficits and opt for the new tax regime - the Finance

Ministry calculates this by analyzing past tax collection data.

A few years ago, Finance Minister Nirmala Sitharaman introduced a new tax regime. But ordinary taxpayers were not showing much enthusiasm because the old tax structure had many tax exemptions. But this time, the finance minister tilted the new tax structure. He hopes this will encourage people to pay taxes in this way. Many calculations have already begun to determine how much money is earned in cash and what method of filing income tax returns is helpful. However, a senior Treasury official made the calculation to give to ordinary people. As it turns out, the fewer exemptions and deductions you have, the better it is to get a new tax structure.

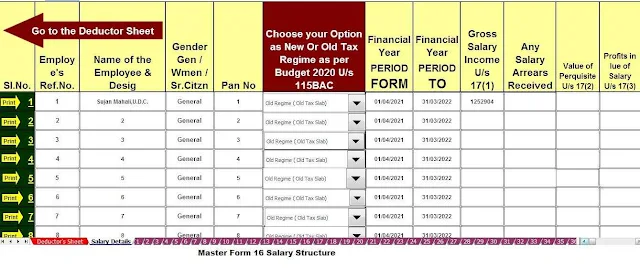

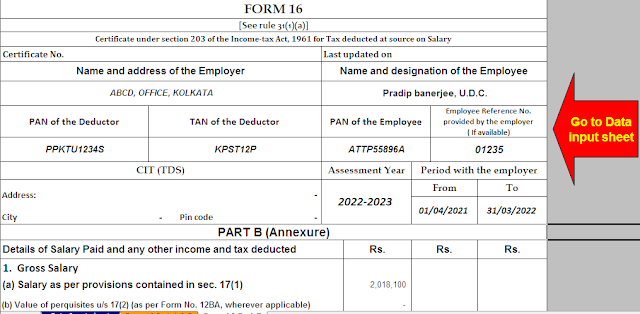

You may also like:- Prepare at a time 50 Employees Form 16 Part B for the Financial Year 2022-23 And Assessment Year 2023-24

According to the budget proposal, those with an annual income of Rs 7 lakh will not have to pay tax under the new tax structure. However, this benefit is not available under the old tax system. A senior finance ministry official said the new tax structure will benefit those who claim a deduction of less than Rs 3.75 lakh while filing IT returns. According to Finance Ministry sources, this figure of 3.75 is not available after analyzing the data on tax collection. The official said they are confident that the majority of the people will ditch the old tax structure and adopt the new tax structure as fewer people will be able to show the Rs 3.75 lakh exemption in the investment, expenditure, and loan sectors.

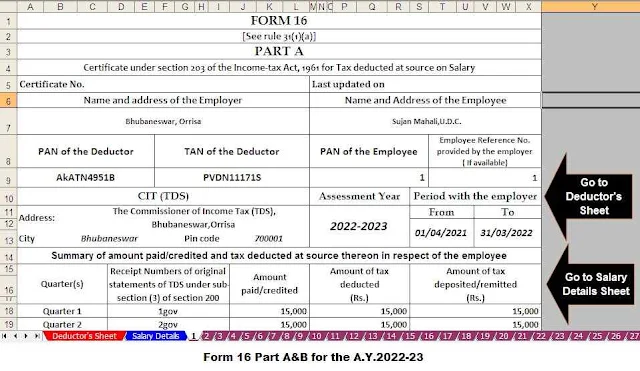

You may also like:- Prepare at a time 50 Employees Form 16 Part A&B

for the Financial Year 2022-23 And Assessment Year 2023-24

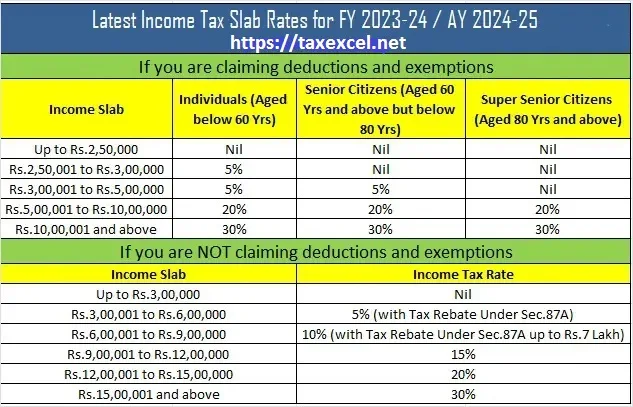

However, the Tax and Customs Administration is confident that the introduction of the new tax structure will reduce the risk for taxpayers, as they will not have to submit proof of tax deductions on their tax returns. Here, the tax can be paid at a flat rate after the standard deduction. Under the new policy, 5 percent tax will be levied between Rs 3-6 lakh, 10 percent between Rs 6-9 lakh, 15 percent between Rs 9-12 lakh, and 20 percent tax on its place of 12-15 lakh rupees. 30% tax on annual income above 15 lakhs. All this is done to gradually move people to the new tax structure.

Note:- It will not be made mandatory under any circumstances, the Finance Minister also clarified.