Everything you need to know about Form 16: TDS Certificate for Salary | Employers issue Form 16

TDS certificates to their employees. It is proof of the deduction of tax at source from the worker's

salary. Furthermore, the genesis of this form can be seen in section203 of the Income Tax Act 1961 as

TDS. It is a part of the income under the "salary" heading.

When is Form 16 issued?

Form 16 is issued on the employer's tax deduction from the employee's salary. The tax deducted by the employer must be deposited into the government account.

Relevance of Form 16

Proof of tax withheld at source by the employer is essential. This certificate details a summary of the employee's salary, allowances, and other amounts paid or credited to the employee and the TDS applicable to the employee. This form is issued annually in accordance with the provisions of the Law and can be used to file Income Tax Returns.

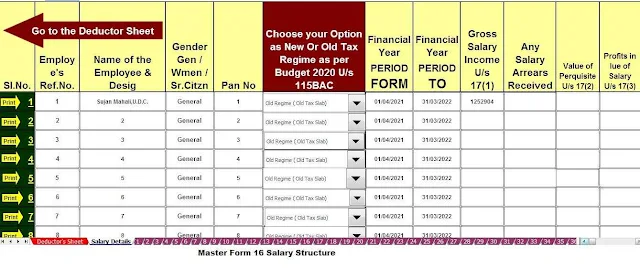

Basics of Form 16:

a) Form 16 is a TDS certificate for salary

b) Is issued to employees with a salary higher than Rs. 2.5 lacs in a fiscal year.

c) If your income is below the exemption threshold of Rs. 2.5 lacs, then there will be no issue of Form 16.

d) If the employee has worked with more than one employer during the applicable tax year, two forms will be issued for the respective employees.

e) Finally, template 16 also contains the details of the employer's TDS deduction and other details of the income that the worker provides to the employer.

For the current fiscal year 2022-2023,

and assessment year 2023-2024, the employee needs the following details to file

their ITR:

1. Salary

2. Exempt Assignments Under Section 10

3. Total amount of salary received from current employer (=1 – 2)

4. Section 16 deductions. Includes standard deduction, entertainment allowance, and employment tax.

5. The Total deductions of U/s16.

6. Income attributed under the heading 'Remuneration' (= 1+ 3- 5)

7. Any other employee-reported income (this includes employee-reported income or loss of residential property offered for TDS and income under Other sources offered for TDS)

8. Other income declared by the employee

9. Total Gross Revenue (= 6 + 8)

10. Breakdown of Chapter VI-A Deductions

11. Addition of Deductions in accordance with Chapter VI-A (Gross Amount and Deductible)

12. Total income (= 9 – 11)

13. Tax payable or refund due

Parts of Form 16

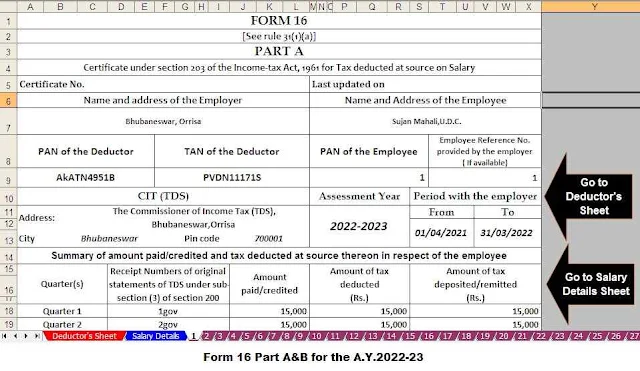

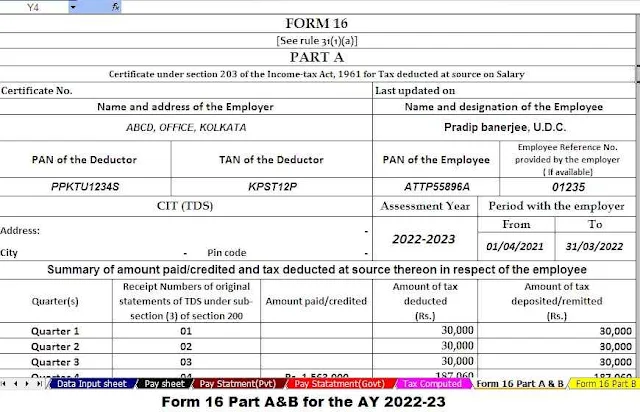

PART A: The Information in Part A are:

1. Employer's name and address

2. Employee name and address

3. TAN and PAN employer

4. PAN employee

5. Summary of the amount paid/credited and withholding tax in relation to the worker

PART B: Part B is the annex to Part A and

the components of Part B are:

1. Wage breakdown

2. Details of Exempt Appropriations Pursuant to Section 10 Specific Appropriations Pursuant to Chapter VI-A:

The

list of deductions is:

1) The deduction for life insurance premium paid, PPF contribution, etc., of article 80.ºC

2) The deduction for contribution to pension funds under section 80 CCC

3) The deduction of the employee's contribution to the pension scheme provided for in no. 80CCD(1)

4) The taxable person's self-contribution deduction for the pension scheme notified under Section 80(1B) CCD

5) The deduction for an employer's contribution to a pension plan under section 80CCD(2)

6) The deduction of health insurance premiums paid under section 80D

7) The deduction for interest paid on loans taken out for higher education under section 80E

8) A deduction for interest payments made on loans taken out for home ownership under Section 80EE

9) The deduction available only to individuals for interest payments made on loans taken out for the acquisition of a residential property for the first time under Section 80EE

10) The deduction for donations made under Section 80G

11) The deduction for rent paid for the house is applicable only to those who are self-employed or for whom the HRA is not part of the salary in accordance with Section 80GG

12(The deduction for interest income on savings accounts under section 80TTA

13) Deduction for Interest Received on Senior Citizens' Deposits Pursuant to Section 80TTB

14) Deductions for a resident individual taxpayer with a disability under Section 80U

4. Relief under Section 89(1)