New income tax regime disallowed deductions| Below is a list of key tax deductions that are claimed

under the current tax regime but not under the new income tax regime:

• Exemptions under Section VI-A, ie Section 80C; 80CCC; employee contribution 80CCD; 80D; 80DD; 80DDB; 80E; except under 80EEA, 80CCD(2) and 80JJAA;

• Interest on home loans (Section 24 b);

• Waiver of travel concession;

• Housing rent subsidy;

• Subsidy for the income of minors;

• Standard discount;

Receiving an allowance for representation;

• Exemption from SEZ unit;

• Exemptions under sections 32AD, 33AB, 33ABA;

Deductions

for donations or research expenses;

• Exemptions under sections 35AD and 35CCC;

• Reduction of family pension.

Exemptions allowed by the new income tax

regime

Although many tax deductions and exemptions are not claimed under the new tax regime, the following deductions are allowed under the existing rules:

• Employer's contribution to pension account notified under section 80CCD(2) of the Income Tax Act. However, this deduction cannot exceed 10% of the employee's previous year's salary.

• Up to 30% of employee fringe benefits under section 80JJAA of the Income Tax Act.

• Transport Subsidy is given to disabled workers (Drivers) to move between their place of residence and place of work.

Transport subsidy is provided for carrying out official functions.

• Any allowance is given to cover the cost of the tour/travel.

• Per diem allowance is given to cover the normal allowance when the employee has to work at a place other than his usual place of work.

Which regime you choose for a better

result

While the new regime comes with flat income tax rates, it also removes many tax exemptions. For example, you cannot claim certain basic tax deductions available under Section VI-A of the Income Tax Act. In addition, you should give up the old exemption regime, under the old tax regime, any salaried person or pensioner can avail it, regardless of their annual income.

So the answer to which one is better depends on two factors – your annual income and the deductions and allowances you claim under the old tax regime. If your total tax amount is lower under the old (existing) tax regime, file ITR at old tax rates.

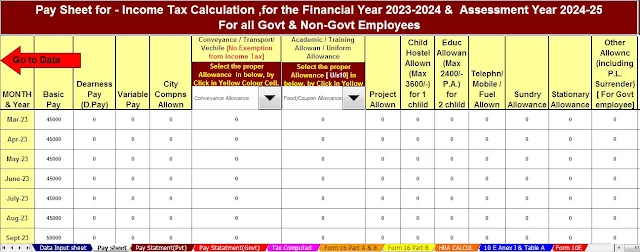

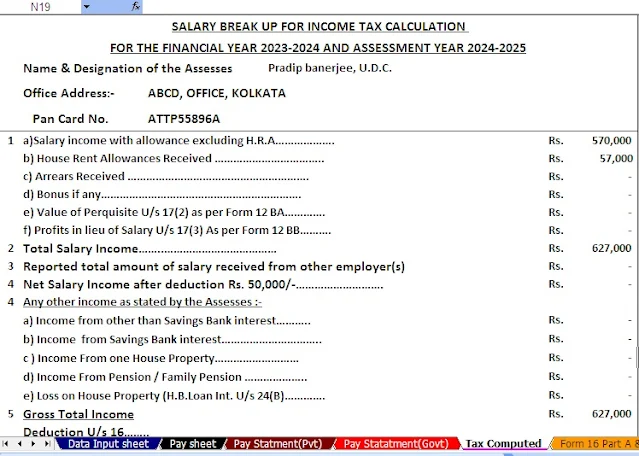

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

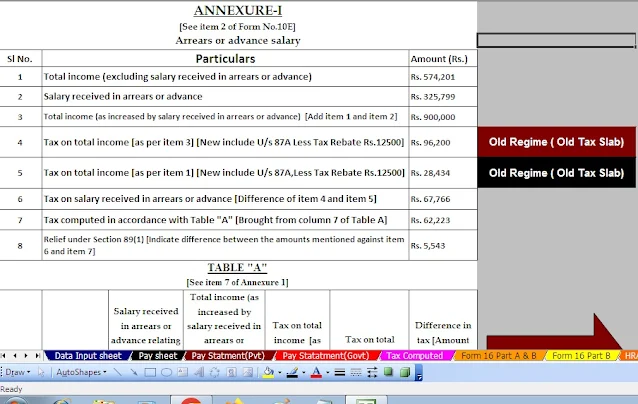

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

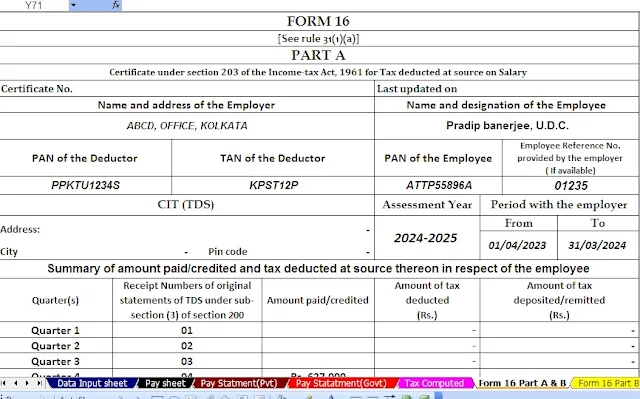

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24