Employees for the F.Y.2023-24 and A.Y.2024-25 | A tax credit is a tax refund if an individual's tax

liability is less than the tax paid. That is, through the deduction, the individual gets back the entire tax

amount at the end of the year. This means that the discount is different from the basic rejection

threshold.

Tax allowance according to the tax regime

Exemption threshold till 2022-23 financial year under old and new tax regimes. Taxpayers opting for any scheme till this financial year will get a rebate of up to Rs.500. 12,500, your income is Rs. 5 lakhs.

New Tax Exemption of New Tax Regime

In the new tax regime through the Union Budget 2023, the tax exemption limits are increased. Individuals who have opted for the new tax regime have a taxable income of up to 50,000 rubles. Can claim rebate up to Rs 7 lakh. 25,000 under section 87A. In other words, under the new tax regime, the limit is Rs. 12,500 to Rs. 25,000 under the new tax regime.

So, if an individual opts for the new tax regime in the financial year 2023-24 and his taxable income is Rs. 7 lakhs. Then he can claim a discount of up to Rs.500. 25,000.

Deduction limits under the old tax regime

Under the old tax regime, there is no change in the exemption threshold under section 87A. So, a person opting for the old tax regime can claim a deduction of up to Rs. 12,500 only if your tax is up to Rs.50,000. 5 lakhs.

How to claim rebate benefits?

Tax deduction benefits can be claimed by following steps:

1. Calculate your gross income for the relevant financial year

2. Subtract all deductions, allowances, and exemptions (including standard income)

3. Declare this income when you file your income tax return

4. If you have opted for the new scheme and your taxable income is Rs. 7 rupees then you can claim a discount. 25,000 or the amount of tax paid, whichever is less.

5. However, if you have opted for the old scheme and your taxable income is Rs. 5 rupees then you can claim a discount. 12,500 or the amount of tax paid, whichever is less.

Illustration

|

Particulars |

Income from the old tax regime (F.Y.2022-2023) (Rs.) |

Income or Revenue under New Tax Regime (F.Y 2022-2023) (Rs.) |

Old Tax Regime Income (F.Y 2023-24) (Rs.) |

Revenue from New Tax Regime (F.Y 2023-24) (Rs.) |

|

Gross Total Income |

6,00,000 |

5,00,000 |

7,00,000 |

7,00,000 |

|

Standard Deduction |

50,000 |

N/A |

50,000 |

50,000 |

|

Deductions under Section |

1,50,000 |

N/A |

1,50,000 |

N/A |

|

National Pension Scheme deduction |

50,000 |

50,000 |

50,000 |

50,000 |

|

Total Income |

3,50,000 |

4,50,000 |

5,00,000 |

6,00,000 |

|

Rebate under Section 87A |

5,000 |

10,000 |

10,000 |

15,000 |

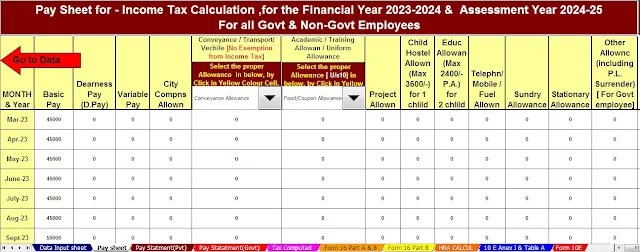

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24