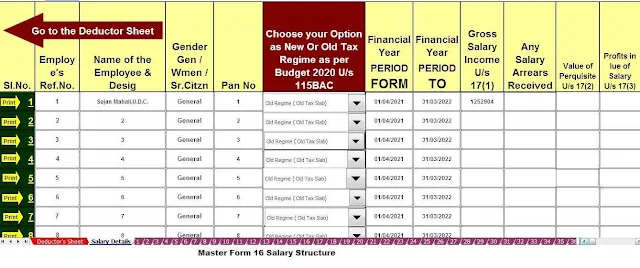

Download and Prepare at a time 50 Employees Form 16 Part A and B and Part B for the F.Y.2022-23 |

You must check your Form 16 Part A and Part B before filing your Income Tax Return for the

A.Y.2023-24| Form 16 A.Y 2023-24: Salaried employees will receive Form 16 from employers this

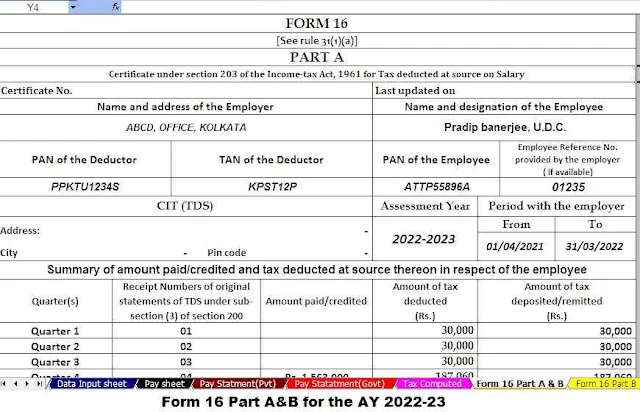

month. In this Form 16 Part A has the details of tax deducted at source (TDS) by the employer in

respect of the employee. In addition to TDS, it includes a detailed summary of the salary paid by the

employer.

The ITR filing deadline for A.Y 2023-24 is 31st July. Before filing ITR, below you should check Form 16.

Check your tax regime

First of all, you need to check what tax regime is considered when calculating Form 16.

If a new tax regime is chosen, use the Income Tax Calculator to compare the tax credits and exemptions to see which regime is more beneficial.

Taxpayers who are salaried and do not have business income can switch to the positive mode when filing their taxes.

Check all inputs

You must ensure that Form 16 is entered and approved.

Otherwise, you can include the income (covered by section VIA) when you file your return. Usually, these forms are generated automatically, and many sites allow you to submit them to automate your ITR, which makes filling easier and faster.

PAN and personal details

You should also check that the PAN shown in Form 16 matches your PAN. like as, your name, address, employer's TAN, and PAN are correctly mentioned.

View Part A and Part B of Form 16

You should go through Part A of Form 16 carefully, where the tax and the taxes paid by your employer as TDS are calculated. Compare the tax deduction details in Part A of Form 16 with the information in Form 26AS and the Annual Information Statement (AIS).

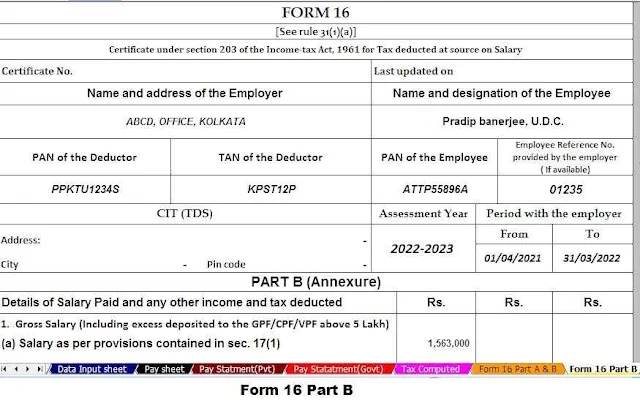

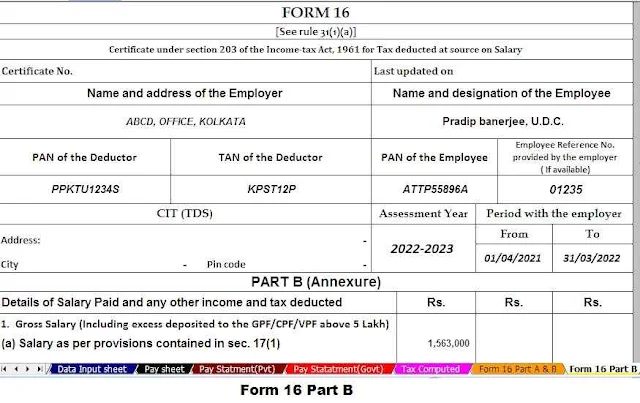

Part B shows the details of your salary income and the income you claim, which leads to your salary income. Form 16 correctly mentions the tax deductions and deductions you claim.

Check for tax credits

You need to compare the tax deducted from your salary income with Form 16, 26AS, and AIS taxes.

If you notice any inconsistencies, notify your employer immediately and ask them to correct the information on Form 16 to ensure that the correct details match Form 26AS and AIS.

Jobs are changing and so are many

employers

If you change jobs in the 2022-23 tax year, you must collect a Form 16 from all employers. This will help you determine your taxable income and ensure accurate reporting. Ideally, when starting a new job, you should inform your current employer of your previous employer's earned income to avoid tax problems.

By verifying the information in Form 16, cross-checking it with your own slips, 26AS, and AIS forms, and resolving any discrepancies with your employer, you can ensure that your ITR is filed accurately and avoid potential problems with the revenue department. tax It is always advisable to consult a tax professional or use online tax filing platforms to ensure the accuracy of your ITR return,