Download Auto Calculate and Auto Preparation Software in Excel for the Government and Non-

Government Employees for the F.Y.2023-24 and A.Y.2024-25 | People can use it by investing in life

insurance, fixed deposits, loans, charitable giving, and health insurance. Then, people can also opt for

Sukanya Samriddhi Yojana, National Savings Certificate, Old Age Savings Scheme, etc. have invested

in government-funded schemes such as Moreover, investments in EPF and PPF provincial fund

schemes and equity-linked savings schemes (ELSS), U/s 80C

Income tax exemption for medical

liability

Section 80D of the Income Tax Act allows an individual to claim income tax exemption for health insurance premiums and medical expenses relating to preventive check-ups of self, parents, spouse, and dependent children. The withdrawal limit is Rs. 25,000 for youth and Rs. 50,000 for the elderly.

Currently, the exemption under Section 80C is Rs 1.5 Lakh, which will remain the same in the 2023 budget.

You may also like- Download and Prepare at a time 50 Employees Form 16 Part B in Excel for the F.Y.2022-23 andA.Y.2023-24

The standard exclusion limit should be increased

The Finance Minister said that is to extend the Exemption of the standard deduction U/s 16(ia) in the new tax regime for the salaried class and pensioners, including family pensioners. Each salary earner has an income of Rs.15.5 Lakh. or A standard deduction of Rupees Fifty Thousand entitled under the section.

Is there a change under section 80DD?

This is important because different disabilities require different types of treatment. At this time, the mental strain and physical effort of the brothers cannot be compensated. So the least you can do is consider increasing the exclusion limit by one stage.

Below is the limitation limit under

Section 80DDB of the Income Tax Act:

Age of the taxpayer

40,000 or actual expenses less than 60 years, whichever is less

1 lakh from age 60 to 80 or actual expenses, whichever is less

81 years and more than Rs.1 lakh or actual expenses, whichever is less

You may also like- Download and Prepare

at a time 50 Employees Form 16 Part A&B in Excel for the F.Y.2022-23 and

A.Y.2023-24

Exemption under section 80DDB

Section 80DDB of the Income Tax Act was another important provision relating to tax deductions. Under this, individuals, other than NRIs, can claim tax exemption for the treatment of certain diseases. According to the list provided by the Income Tax Department, these include dementia, Parkinson’s disease, cancer, Thalassemia, etc.

However, only the following persons are

allowed to apply for the same-

• Individual taxpayers or "assessees" identified.

• Relationship is parent, sibling, spouse, or child.

• The Indians who live there

• The employee is insured and reimbursed by his employer.

• Undivided individual or Hindu families

• When a taxpayer pays for addiction treatment

The section states that an insurer may obtain a discount if it adjusts premiums based on employer contributions or health insurance.

You may also like- Download and Prepare at a time 100 Employees Form 16 Part B in Excel for the F.Y.2022-23 and A.Y.2023-24

Will the government increase the

exemption limit?

Income tax revenues for life-saving drugs, hospitals, and health insurance are expected to fall.

• Standard deduction

In

For the assessment year (AY) 2022-23, a deduction of 80TTA can be claimed by Hindu undivided individuals and families (HUFs) who have earned interest on their accounts. The maximum amount that can be claimed as withdrawal is INR 10,000 and any interest above this limit will be taxable.

It is important to note that the 80TTA exemption can be claimed only once in a financial year and cannot be carried forward to the next financial year. Therefore, it is important to ensure that you claim the entire amount of INR 10,000 in the financial year in which you earn interest.

The new tax regime introduced in Budget 2023 offers taxpayers a simplified tax structure, and lower tax rates to avoid various exemptions and deductions. The 80TTA exemption is one of the exemptions that taxpayers have to give up if they opt for the new tax regime. It is not eligible to get relief U/s 80TTA and U/s 80TTB under the New Tax Regime from the A.Y.2024-25

It should be noted that the new tax regime is optional and taxpayers can choose to continue with the old tax regime if they wish. The choice depends on your personal financial situation, taxes, and other factors.

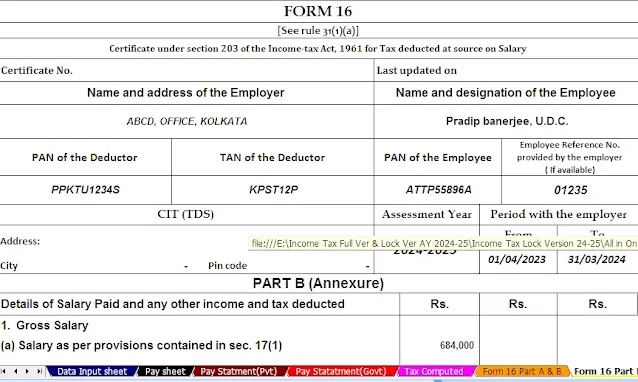

Features of this Excel Utility:-

1) This Excel

utility prepares and calculates your income tax as per the New Section 115 BAC

(New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24