Benefits of New Tax Regime for the F.Y.2023-24 and A.Y.2024-25|New Tax Regime for Financial Year

(F.Y) 2023-24 (Change w.e.f. Assessment Year (A.Y) 2024-25)

Even under the new tax regime, one can save tax if one is aware and well-informed about the exemptions, exemptions, and deductions allowed under the IT Act 1961.

The Government of India has made the New Tax Regime a standard tax regime from F.Y 2023-24 which automatically entered the new tax regime approach if taxpayers do not specifically opt out of the old tax regime. In this New Tax Regime, the table of income was changed and the @25% rate will no longer exist, with the aim of simplifying the tax collection process and reducing bureaucracy.

You may also like- Download and Prepare at a time 50 Employees Form 16 Part A and B for the Financial Year 2022-23 and Assessment Year 2023-24 in Excel

The Union Budget for 2023 has announced that certain exemptions and deductions available in opting out of the old tax regime will also be applicable in New Tax Regime from Y 2024-25. Thus, to get the most out of tax in New Tax Regime, taxpayers must be aware of the calculated exemptions and deductions:

1. Standard Deduction in the new tax regime under Section 16(ia) of Rs. 50,000 as per the Income Tax Act as well as Budget 2023.

The Union Budget 2023 has also enhanced tax benefits for those earning a salary of Rs 15.50 lakh or more. 52,500 as Standard Deduction in this section.

2. Standard Deduction U/s 24a and Home Loan Interest U/s24b: If a landlord earns rental income by providing rent to his house to the tenant, 30% Standard Deduction @ annual value of the landlord net (NAV) u/s 24a and B. Interest on home loan u/s 24b is chargeable to I.T. Besides if city tax is paid by the landlord on his rented house, it is allowed under New Tax Regime from the tax year 2023-24.

3. Increase in 87A exemption: A resident person is entitled to a maximum tax exemption of Rs. 12,500/- more than Rs. 5.0 lakh by FY 2022-23. This will be before adding a maximum of Rs.25,000 (H&EC @4%), where the taxable income does not exceed Rs. 7.0 lakhs, under the New Tax Regime as per Section 87A of the IT Act, 1961 of A.Y 2024-25. So, a salaried taxpayer will not be eligible to pay tax up to an income of Rs. 7.50 lacs claiming standard deduction under the New Tax Regime from AY 2024-25. But most importantly, under the OTR, it will continue in this section with a maximum exemption of Rs. 12,500 (before adding H&EC @4%) where taxable income does not exceed Rs. 5.0 lakhs.

Income Tax Slab for A.Y.2024-25

|

Tax

Slab |

Rates |

|

Up to Rs. 3,00,000 |

NIL |

|

Rs. 300,000 to Rs. 6,00,000 |

5% on income that exceeds Rs 3,00,000 |

|

Rs. 6,00,000 to Rs. 900,000 |

Rs 15,000 + 10% on income more than Rs 6,00,000 |

|

Rs. 9,00,000 to Rs. 12,00,000 |

Rs 45,000 + 15% on income more than Rs 9,00,000 |

|

Rs. 12,00,000 to Rs. 1500,000 |

Rs 90,000 + 20% on income more than Rs 12,00,000 |

|

Above Rs. 15,00,000 |

Rs 150,000 + 30% on income more than Rs 15,00,000 |

Income Tax Slab for People between 60 to 80 Years

|

Tax

Slabs |

Rates |

|

Rs. 3 lakhs |

NIL |

|

Rs. 3 lakhs -

Rs. 5 lakhs |

5.00% |

|

Rs. 5 lakhs -

Rs. 10 lakhs |

20.00% |

|

Rs. 10 lakhs and

more |

30.00% |

You may also like- Download and Prepare at a time 50 Employees Form 16 Part B for the Financial Year 2022-23 and Assessment Year 2023-24 in Excel

4. Change in Income Tax Schedule and Removal of @25% Rate, under AY 2024-25 New Tax Regime: The income tax schedule and tax rate below are proposed under AY 2024-25 New Tax Regime. Thus, in the hands of the taxpayer, there will be a tax saving of Rs. 37,500 (i.e. Rs. 1,87,500 - Rs. 1,50,000) (H&EC @4%) up to an income of Rs. 15.0 lakhs.

5. National Pension Scheme (NPS) Employer Contribution: New Tax Regime has neither an investment benefit up to Rs.1.50 lakh nor an 80 c. 50,000 u/s 80CCD(1B) is available. In addition, the NPS contribution of the employer is available in the deductible NTR as per section 80CCD(2), up to a maximum of 10% on the employee’s base salary and DA (if provided for in the terms of employment), in which case the employer contributes occurs. For government employees (Central and State), the limit is 14%

You may also like- Download and Prepare One

by One Form 16 Part A & B and Part B for the Financial Year 2022-23 and

Assessment Year 2023-24 in Excel

7. Maturity Amount of Public Provident Fund (PPF) and Sukanya Samridhi Yojana (SSY): Maturity

the amount received from Public Provident Fund (PPF) and Sukanya Samriddhi Yojana (SSY) not

taxable from 2023 tax year -24 under New Tax Regime will be and also though the benefit of tax-free up to Rs 1.50

lakh under Section, 80C is only available for investments made in PPF and SSY under Opt-in Tax

Regime.

Conclusion: It is essential that the taxpayer carefully consider the needs, requirements, or future

financial objectives, regarding the alternative of any tax system, whether old or new, before making

any decision, that one person On the basis it makes your savings and investment decision. Thus, before

deciding to choose between the two tax systems, the taxpayer must consider the tax benefits arising

from them as a short-term objective, but also savings and investment strategies in accordance with

future financial ambition as a long-term goal.

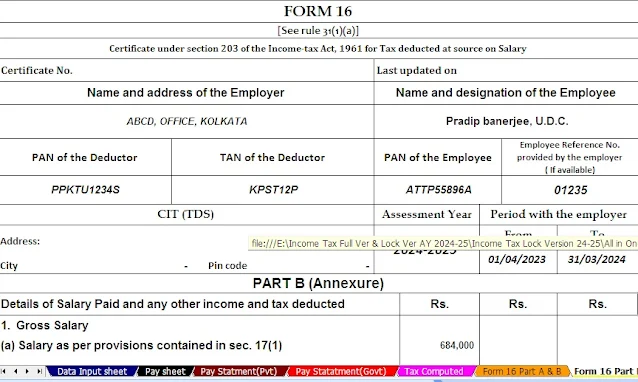

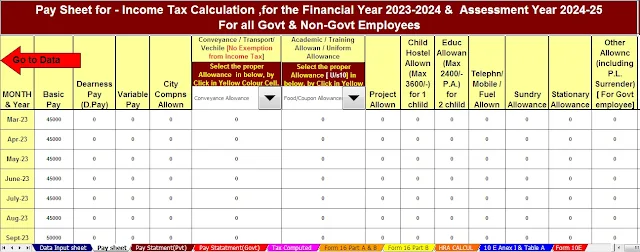

Download Automated Income Tax Preparation Excel-Based Software

All in One for the Government & Non-Government (Private) Employees for the

F.Y.2023-24 and A.Y.2024-25

Features of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

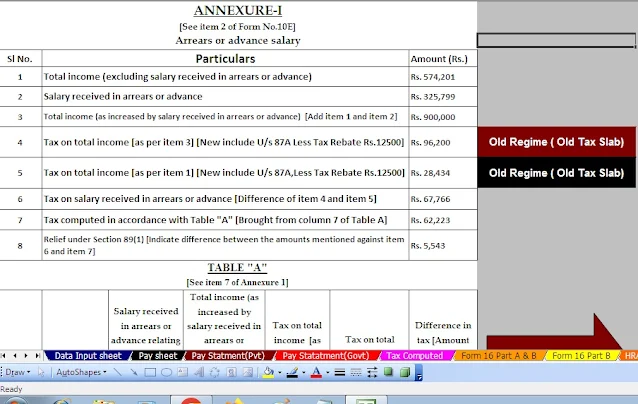

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

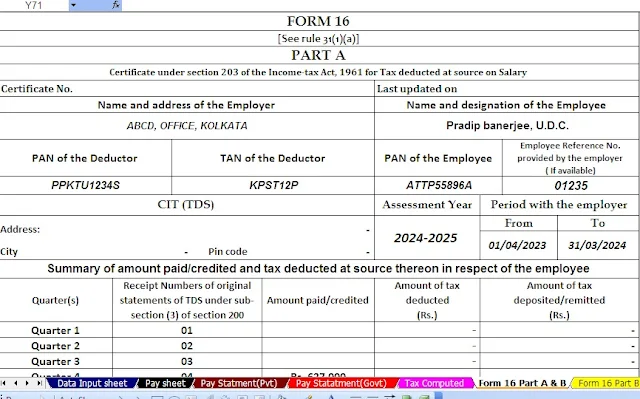

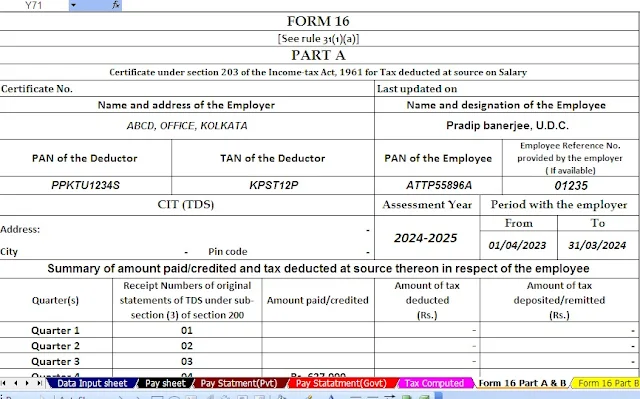

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24