In today's fast-paced world, financial planning has become more critical than ever. Every individual aims to optimize their earnings while also minimizing their tax liabilities. Therefore, One of the avenues that taxpayers can explore is the Income Tax Section 80TTA. Similarly, This article delves into the various advantages of this section, highlighting how it can be a beneficial tool for maximizing your savings.

Table of Contents

- Introduction

- Understanding Income Tax Section 80TTA

- Benefits of Income Tax Section 80TTA

- Tax Exemption on Savings Account Interest

- Accessible to Individuals and HUFs

- No Restriction on the Number of Savings Accounts

- Encouragement of Small Savings

- Tax Efficiency and Financial Planning

- Eligibility Criteria

- How to Claim Deductions under Section 80TTA

- Difference Between Section 80TTA and 80TTB

- Documents Required for Claiming Deductions

- Factors to Consider for Maximum Savings

- Choosing the Right Savings Account

- Monitoring Interest Accrual

- Consolidating Savings

- Long-Term Financial Goals

- Common Misconceptions

- Section 80TTA vs. Section 10(15)

- Applicability to Fixed Deposits

- Case Studies: Real-Life Examples

- Tips for Effective Financial Planning

- How to Section 80TTA Benefits Senior Citizens

- Risks and Limitations to Keep in Mind

- Consulting a Financial Advisor

- Conclusion

Introduction

When it comes to managing personal finances, the Income Tax Act of India offers various provisions to ease the burden of taxation. One such provision is Section 80TTA, In other words, which provides deductions on the interest earned from savings accounts. This deduction aims to promote a culture of savings while simultaneously reducing the tax liability of individuals and Hindu Undivided Families (HUFs).

However, Understanding Income Tax Section 80TTA

Section 80TTA of the Income Tax Act, introduced in the Finance Act of 2012, allows individuals and HUFs to claim deductions on the interest earned from their savings accounts. Above all, This includes interest earned from a savings account with a bank, co-operative society, or post office. The section plays a crucial role in encouraging people to save money and develop a savings habit.

Benefits of Income Tax Section 80TTA

In other words, Tax Exemption on Savings Account Interest

In addition, Under Section 80TTA, taxpayers can claim a deduction of up to Rs.10,000 on the interest earned from their savings accounts. This exemption can lead to substantial tax savings, especially for individuals who maintain significant balances in their savings accounts.

Accessible to Individuals and HUFs

After that, One of the significant advantages of Section 80TTA is its broad applicability. Both individuals and HUFs are eligible to claim deductions under this section. This inclusivity ensures that a wide range of taxpayers can avail themselves of its benefits.

However, No Restriction on the Number of Savings Accounts

Unlike some other tax-saving provisions, Section 80TTA does not impose any restrictions on the number of savings accounts that can be considered for deductions. This is particularly advantageous for individuals who hold multiple savings accounts for various financial goals.

Above all, Encouragement of Small Savings

Similarly, Section 80TTA is designed to promote small savings among taxpayers. In addition, By offering a deduction on savings account interest, the government encourages individuals to set aside money for emergencies and future expenses.

Tax Efficiency and Financial Planning

After that, The provision aligns with the broader goal of tax efficiency and financial planning. Taxpayers can use the savings from the deduction to further invest or save, contributing to their overall financial well-being.

Eligibility Criteria

To avail of the benefits of Section 80TTA, individuals and HUFs must meet certain criteria. The savings account must be held with a bank, co-operative society, or post office, and the interest earned should be from these accounts.

How to Claim Deductions under Section 80TTA

Taxpayers can claim deductions under Section 80TTA while filing their income tax returns. It's essential to provide the necessary details, such as the interest earned and the bank's name, in the appropriate sections of the ITR form.

Difference Between Section 80TTA and 80TTB

Section 80TTA and 80TTB both pertain to deductions on interest income, but they cater to different demographics. While Section 80TTA is applicable to individuals and HUFs, Section 80TTB provides a similar benefit to senior citizens.

Documents Required for Claiming Deductions

Taxpayers need to maintain proper documentation of their interest earnings from savings accounts. Bank statements and passbooks serve as crucial documents for claiming deductions under Section 80TTA.

Factors to Consider for Maximum Savings

Choosing the Right Savings Account

Selecting a savings account with a competitive interest rate is paramount. Higher interest rates directly contribute to increased savings and tax deductions.

Monitoring Interest Accrual

Regularly monitoring the interest earned helps taxpayers keep track of their savings and ensures accurate reporting while filing taxes.

Consolidating Savings

Similarly, Consolidating funds into a single savings account can simplify financial management and maximize the benefits under Section 80TTA.

Long-Term Financial Goals

Aligning savings with long-term financial goals ensures that individuals optimize the deductions while simultaneously planning for their future.

Common Misconceptions

Section 80TTA vs. Section 10(15)

After that, It's essential to differentiate between Section 80TTA and Section 10(15) of the Income Tax Act, as they cater to different types of interest income.

Applicability to Fixed Deposits

In addition, Contrary to common misconceptions, Section 80TTA does not extend its benefits to interest earned on fixed deposits.

Above all, Case Studies: Real-Life Examples

To illustrate the practical implications of Section 80TTA, let's explore a couple of real-life scenarios showcasing the potential tax savings.

Tips for Effective Financial Planning

For instance, Apart from claiming deductions under Section 80TTA, implementing robust financial planning strategies can lead to holistic financial well-being.

How to Section 80TTA Benefits Senior Citizens

While senior citizens have their dedicated section, 80TTB, Section 80TTA indirectly benefits them through general tax efficiency and planning.

Risks and Limitations to Keep in Mind

However, Taxpayers should be aware of the potential risks and limitations associated with Section 80TTA to make informed financial decisions.

Consulting a Financial Advisor

In other words, For personalized advice tailored to individual financial situations, consulting a financial advisor is always recommended.

In conclusion,

Therefore, section 80TTA stands as a testament to the government's commitment to promoting savings and reducing tax burdens. Offering deductions on savings account interest empowers individuals and HUFs to secure their financial future while contributing to the nation's economic growth.

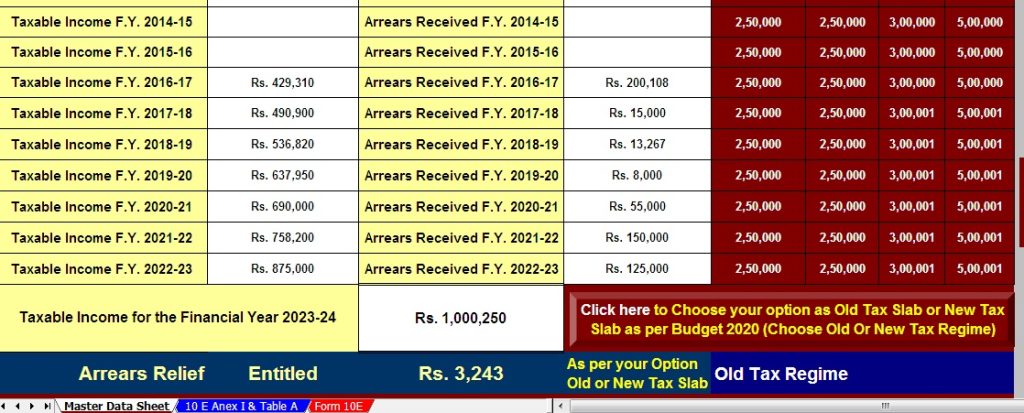

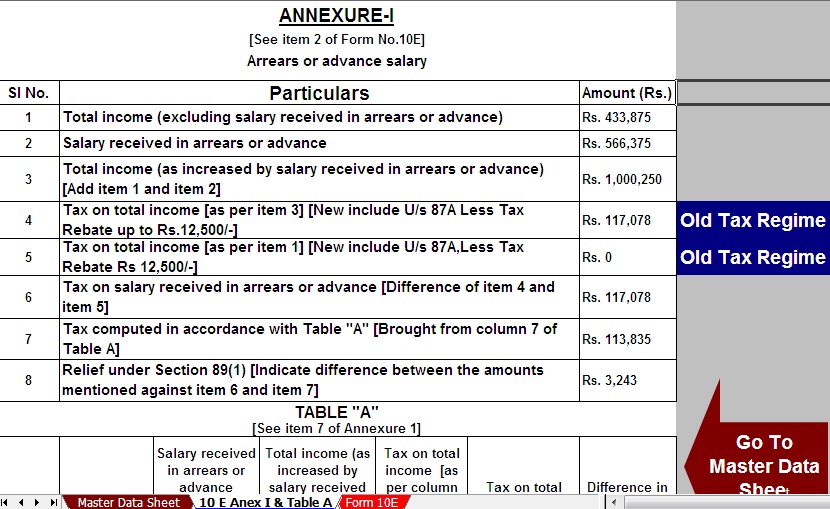

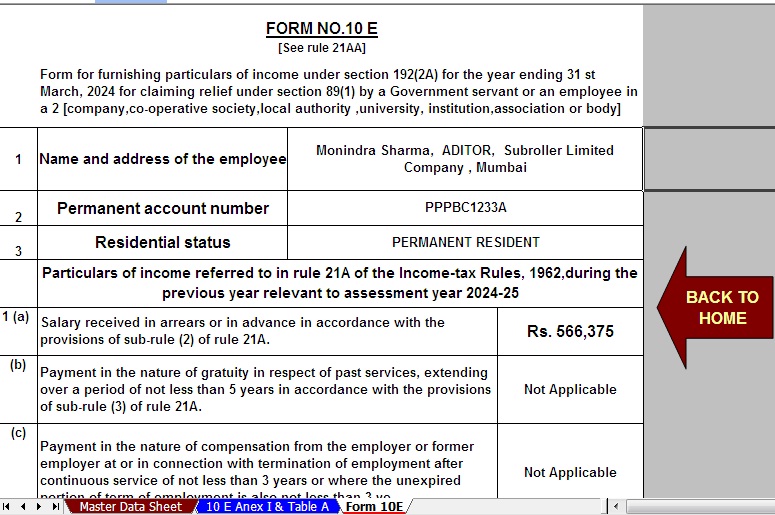

Download the automated U/s 89(1) income tax arrears calculator with Form 10E from tax year 2000-01 to tax year 2023-24 (updated version)