Introduction

In the realm of personal finance, tax preparation is a critical process that demands careful attention and

strategic planning. As tax laws continue to evolve and become increasingly complex, understanding the

nuances of tax preparation has never been more important. In this comprehensive guide, we will delve

into the world of tax preparation, demystifying the process and providing valuable insights to help you

navigate this annual ritual seamlessly.

Table of Contents

Understanding Tax Preparation: An Overview

Gathering Essential Documents for Tax Filing

Choosing Between Standard Deductions and Itemized Deductions

Exploring Tax Credits and Deductions: Maximizing Your Savings

Navigating Self-Employment Taxes: A Guide for Freelancers

Tax Preparation Software: A Modern Approach to Filing Taxes

The Role of Tax Professionals: When to Seek Expert Assistance

Avoiding Common Tax Preparation Mistakes

Tax Planning: Strategies for Future Financial Well-being

Tax Audits: What You Need to Know to Stay Prepared

State Taxes: Understanding and Managing Regional Tax Liabilities

Tax Implications of Life Events: Marriage, Parenthood, and More

Tax-Advantaged Investments: Building Wealth while Reducing Tax Burden

Ethical and Legal Approaches to Tax Optimization

Remaining Knowledgeable: Staying Abreast of Tax Law Revisions

Understanding Tax Preparation: An Overview

Tax preparation is the process of organizing and filing your financial information to comply with the

legal requirement of paying taxes. It involves calculating your tax liability, ensuring accurate

documentation, and submitting the necessary forms to the appropriate tax authorities. A well-prepared

tax return can lead to minimized tax liability and potentially larger refunds.

Gathering Essential Documents for Tax Filing

Before you embark on your tax preparation journey, it's essential to gather all the necessary documents.

These may include W-2 or 1099 forms from employers, receipts for deductible expenses, records of

charitable contributions, and any relevant financial statements.

Choosing Between Standard Deductions and Itemized Deductions

One crucial decision during tax preparation is choosing between the standard deduction and itemized

deductions. The standard deduction is a fixed amount that reduces your taxable income, while itemized

deductions allow you to claim specific expenses. Deciding which method to use can significantly

impact your tax liability.

Exploring Tax Credits and Deductions: Maximizing Your Savings

Tax credits and deductions are powerful tools for reducing your tax burden. Tax credits directly lower

your tax liability, while deductions reduce your taxable income. Research and identify credits and

deductions applicable to your situation to ensure you're not leaving money on the table.

Navigating Self-Employment Taxes: A Guide for Freelancers

Freelancers and self-employed individuals have unique tax responsibilities. Understanding how to

calculate and pay self-employment taxes, deduct business expenses, and contribute to retirement

accounts is essential for managing your tax obligations as an independent worker.

Tax Preparation Software: A Modern Approach to Filing Taxes

In the digital age, tax preparation software has become increasingly popular. These user-friendly tools

guide you through the tax preparation process, help you accurately input your financial data, and can

even e-file your return for a quicker refund.

The Role of Tax Professionals: When to Seek Expert Assistance

While tax preparation software is convenient, there are instances when seeking the expertise of a tax

professional is prudent. Complex financial situations, evolving tax laws, or concerns about potential

audits may warrant the guidance of a qualified tax professional.

Avoiding Common Tax Preparation Mistakes

Mistakes on your tax return can lead to delays, penalties, or even audits. Common errors to avoid

include mathematical miscalculations, incorrect social security numbers, and omitting income or

deductions. Careful review and attention to detail can help you sidestep these pitfalls.

Tax Planning: Strategies for Future Financial Well-being

Tax planning extends beyond the annual ritual of filing taxes. By strategically managing your finances

throughout the year, you can make decisions that optimize your tax situation, such as contributing to

retirement accounts, investing in tax-advantaged funds, and aligning major financial moves with

potential tax benefits.

Tax Audits: What You Need to Know to Stay Prepared

The prospect of a tax audit can be daunting, but being prepared can alleviate stress. Maintain

meticulous records, keep copies of filed returns, and understand your rights and responsibilities in the

event of an audit.

State Taxes: Understanding and Managing Regional Tax Liabilities

In addition to federal taxes, many individuals are subject to state taxes. These taxes vary widely based

on your geographical location. Understanding the tax regulations in your state and planning

accordingly can help you manage your overall tax liability.

Tax Implications of Life Events: Marriage, Parenthood, and More

Life events such as marriage, having children, or buying a home can have significant tax implications.

It's crucial to understand how these milestones affect your tax situation and explore potential tax

benefits that may arise.

Tax-Advantaged Investments: Building Wealth while Reducing Tax Burden

Certain investments offer tax advantages that can contribute to building wealth over time. Examples

include contributions to retirement accounts, health savings accounts (HSAs), and 529 plans for

education savings. Exploring these options can help you achieve your financial goals while minimizing

taxes.

Ethical and Legal Approaches to Tax Optimization

While it's important to take advantage of legitimate tax-saving strategies, it's equally important to

navigate the fine line between optimization and evasion. Abiding by ethical and legal standards in your

tax planning ensures you remain in compliance with tax laws.

Staying Updated: Remaining Current with Tax Law Amendments

Tax laws are not static; they evolve over time. Staying informed about changes to tax regulations,

deductions and credits ensure that you continue to make well-informed financial decisions.

Conclusion

In the intricate world of tax preparation, knowledge is power. By understanding the nuances of tax laws,

leveraging deductions and credits, and making informed financial choices, you can navigate tax season

with confidence. Whether you choose to utilize tax preparation software or seek the guidance of a

professional, the key to success is preparation and proactive planning.

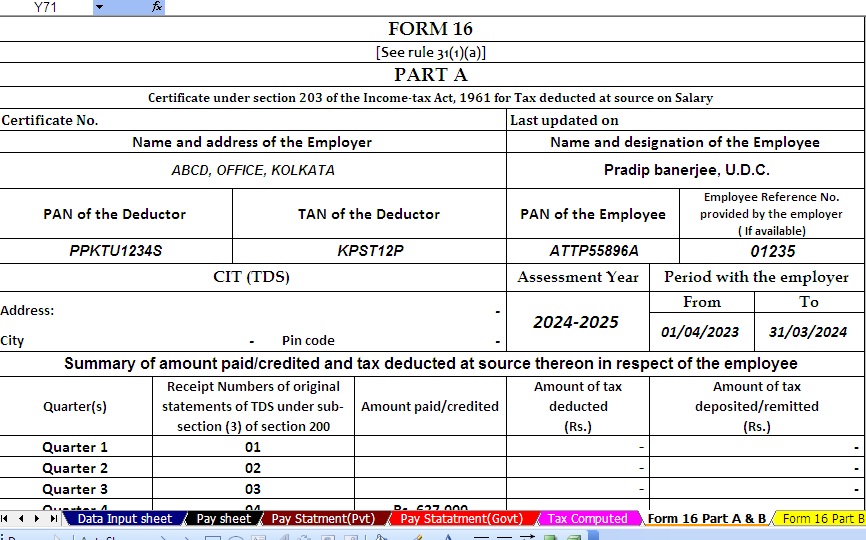

Download Automated Income Tax Preparation Excel-Based Software All in One for the Government & Non-Government (Private) Employees for the F.Y.2023-24 and A.Y.2024-25

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as a New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employees Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2023-24