In the ground of personal finance management, tax preparation is a critical undertaking that requires accuracy, efficiency, and the right tools to simplify the process. As private employees navigate through the complexities of tax regulations, having access to an all-in-one tax software solution can be a game-changer. This article dives into the benefits and features of utilizing All in One Tax Software in Excel for Private Employees and how it can significantly streamline the tax filing process.

Private employees often find themselves juggling various financial responsibilities, including tax preparation. Traditional methods of manual tax calculations can be time-consuming and prone to errors. This is where All in One Tax Software in Excel emerges as a powerful ally. By leveraging the capabilities of Microsoft Excel, employees gain access to a versatile platform that combines computation accuracy with user-friendly interfaces.

Key

Features of All-in-One Tax Software

1. User-Friendly Interface

Navigating through tax forms and calculations can be daunting, especially for individuals without an accounting background. This software boasts an intuitive user interface that guides users through each step of the tax preparation process. This reduces the chances of errors and ensures that all necessary fields are accurately filled.

From W-2s to 1099s, different tax forms must be completed based on an individual's financial situation. The software comes equipped with an extensive library of pre-built tax forms, catering to a wide range of scenarios. Users can simply input their financial data, and the software automatically populates the relevant forms, saving time and minimizing the risk of mistakes.

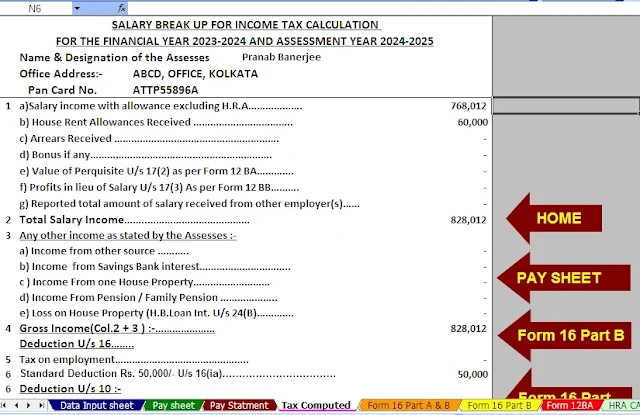

One of the standout features of this software is its ability to perform complex tax calculations with ease. Whether it's calculating deductions, credits, or taxable income, the software employs advanced algorithms to ensure accuracy. This automation not only reduces the chance of errors but also expedites the entire tax preparation process.

Mistakes in tax filing can lead to delays in refunds or even legal consequences. The software includes real-time error checks that alert users to potential discrepancies or missing information. This proactive approach empowers users to rectify issues before submission, ensuring a smoother tax filing experience.

Handling sensitive financial information requires a high level of security. All in One Tax Software in Excel prioritizes data security and employs encryption protocols to safeguard user data. This gives users the peace of mind that their personal and financial information remains confidential.

Getting started with All in One Tax Software in Excel is a straightforward process. Here's a step-by-step guide to help you begin:

After downloading the software, you'll be prompted to create a user profile in Master Data Input Sheet and Salary Structure Sheet. Provide accurate information to ensure that the software can its calculations to your specific financial situation.

Carefully input all relevant financial data, including income sources, deductions, and expenses. The software's intuitive interface will guide you through each section.

Once you've completed the data input, review the generated tax forms and calculations. The software's error-checking feature will highlight any potential issues that require attention. Make necessary corrections and submit your tax forms electronically.

In

Conclusion

Features of this Excel utility:-

1) This Excel utility perfectly prepares your income tax according to your U/s 115BAC option.

2) This Excel utility has a completely revamped Income Tax section as per Budget 2023

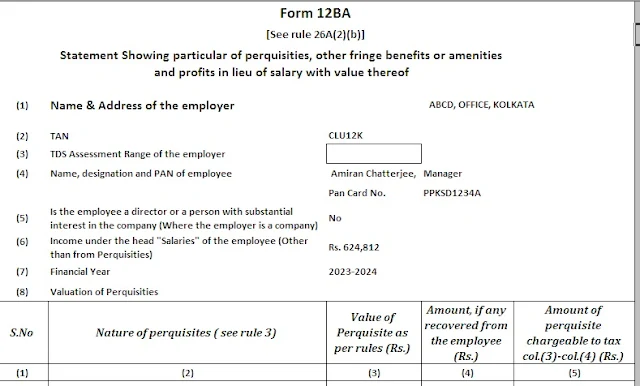

3) Computerized Income Tax Form 12 BA

4) Automatic computation Income Tax Exemption rented house U/s 10(13A).

5) Individual salary structure according to government and private group salary model

6) Individual Pay Sheet

7) Individual tax datasheet

8) Automatic Income Tax Form 16 Part A&B revised for the financial year 2023-24

9) Automatic Income Tax Form 16 Part B revised for the financial year 2023-24