Today, we talk about paying less tax on the money you make from your savings. It's all about a rule called Section 80TTA.

What's Section 80TTA?

Section 80TTA is a special rule in our tax law. It helps us save money when we have savings accounts in banks or post offices.

Who Can Use Section 80TTA?

To use Section 80TTA, you need:

- A Savings Account: This is where you keep your money safe.

- A Bank or Post Office: Your account must be in one of these.

How Much Money Can You Save?

Therefore, You can save up to ₹10,000 every year. This means if you make ₹10,000 or less from your savings, you don't pay any tax on it.

How to Count Your Savings?

In other words, Here's how you can find out how much money you made:

- See Your Savings: Look at how much money you made from your savings account.

- Check ₹10,000: If it's less than ₹10,000, you don't pay tax on it. You keep it all.

- More Than ₹10,000: If you made more than ₹10,000, you still only pay tax on ₹10,000. The extra money is safe from tax.

Why Use Section 80TTA?

However, Using Section 80TTA is good for two big reasons:

- Pay Less Tax: You keep more of your money because you don't pay tax on it.

- Save More: It encourages us to save our money in banks or post offices, which is good for our future.

Above all, How to Use Section 80TTA?

In addition, Here's what you do:

- Keep Records: Write down how much money you made from your savings.

- Use the Right Form: When you file your tax papers, use the form called ITR-1 or the one that's right for you.

- Tell About Your Savings: In the form, say how much money you made from your savings in "Income from Other Sources."

- Say It's Section 80TTA: When you're asked about deductions, tell them it's "Section 80TTA" and take away ₹10,000.

- File Your Taxes: Make sure you fill in the form right and send it before the deadline.

To Sum Up

After that, Section 80TTA is a simple way to save money on the tax you pay for your savings. All you need is a savings account in a bank or post office. Similarly, If you make ₹10,000 or less from your savings, you don't pay any tax on it. It's a good way to keep more of your money for yourself.

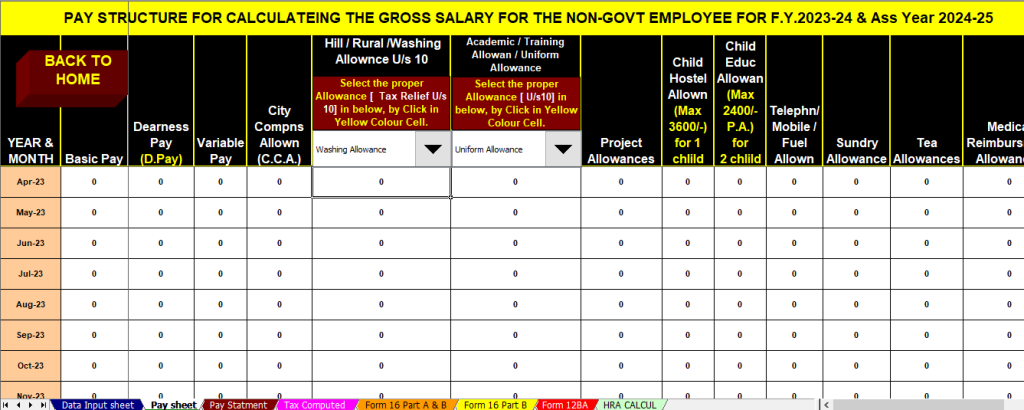

Download Automated Income Tax Preparation Excel-Based Software All in One for the Non-Government (Private) Employees for theF.Y.2023-24 and A.Y.2024-25

In conclusion, Features of this Excel Utility

- The Tax Calculation will be as per the Budget 2023 with New and Old Tax Regime U/s 115 BAC

- This Excel Utility has its own Salary Structure as per the Non-Government (Private) Employees' Salary Structure

- This Excel Utility can prepare automatically your Income tax Computed Sheet Just fill in the Data

- This Excel Utility can Calculate your House Rent Exemption U/s 10(13A)

- For instance, This Excel Utility have a separate Salary Sheet

- For instance, This Excel Utility automatically your Arrears Relief Calculation U/s 89(1) with Form 10E

- This Excel Utility can prepare at a time your Form 16 Part B automatically

- This Excel Utility can prepare at a time Form 16 Part A and B