Introduction:

The process of income tax preparation can be a daunting task, especially with the complex regulations and changing laws. However, with the help of advanced technology and innovation, auto preparation of income tax has become a breeze. In this post, we will explore the benefits of using income tax preparation software in Excel for FY 2023-24, catering to both government and non-government employees. Let's dive in!

1. Embrace the Power of Excel:

Therefore, Excel, the widely popular spreadsheet software, has been revolutionizing various industries for decades. With its versatile functionality and data management capabilities, Excel provides an efficient platform for automating income tax preparation. In other words, By harnessing the power of Excel, professionals and individuals can simplify their tax filing process and save valuable time.

2. Income Tax Preparation Software in Excel:

However, Imagine having a reliable software tool that automatically calculates your income tax liabilities, eligible deductions, and exemptions, all within the familiar interface of Excel. This software eliminates the need to manually crunch numbers and ensures accurate calculations, minimizing the risk of errors. Additionally, Excel's intuitive interface allows users to customize and personalize their tax reports as per their requirements.

3. Comprehensive Reporting:

The income tax preparation software in Excel offers a wide range of features to compile comprehensive tax reports. It enables users to import relevant financial data, such as salary statements, investment details, and rental income, effortlessly into designated Excel templates. Above all, With just a few clicks, the software generates high-quality reports, including income statements, a summary of deductions, and tax payable, providing a holistic view of your tax position.

4. Automation for Govt Employees:

For government employees, tax preparation often involves additional complexities due to perks, allowances, and deductions specific to their line of work. The Excel software incorporates pre-built formulas that automatically factor in these unique variables, simplifying the tax calculation process. Moreover, it stays up-to-date with the latest income tax slabs and regulations, ensuring accurate and compliant results every time.

5. Tailored Solutions for Non-Govt Employees:

In addition, Non-government employees have their own set of challenges in income tax preparation. The Excel-based software accommodates diverse income sources, such as freelance earnings, capital gains, and business incomes, allowing users to enter this information seamlessly. The automated calculations compute the tax liabilities, enabling non-government employees to efficiently manage their annual tax filing obligations.

Conclusion:

Preparing income tax should no longer be a stressful and time-consuming task. By utilizing advanced income tax preparation software in Excel for FY 2023-24, both government and non-government employees can streamline their tax filing experience. With its user-friendly interface, comprehensive reporting capabilities, and automation features, this software offers a breakthrough solution to simplify the income tax preparation process. Make the most of this innovative technology and pave the way for an effortless and error-free tax.

Download Auto Calculate Income Tax Preparation Software All in One in Excel for the Government and Non-Government Employees for the Financial Year 2023-24 as per Budget 2023

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as a New or Old Tax Regime

3) For instance, This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

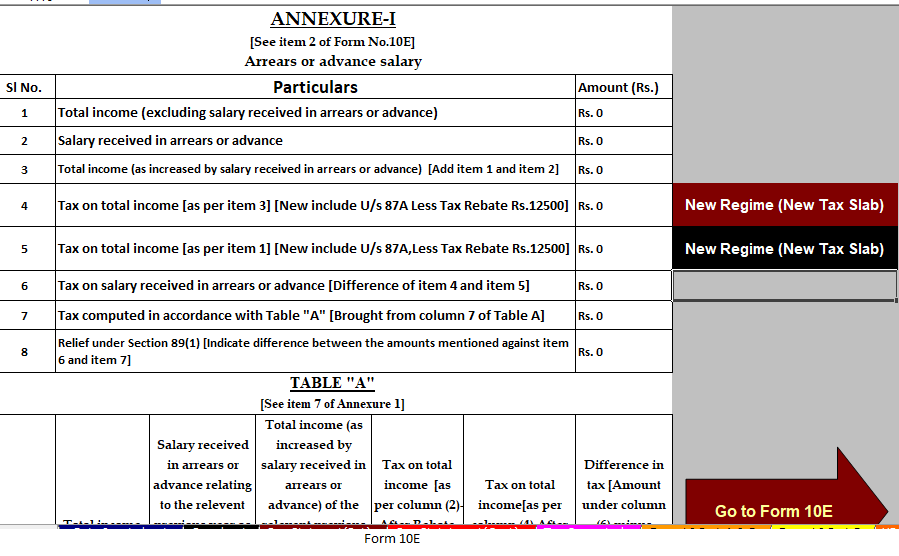

4) For instance, Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2023-24 (Update Version)

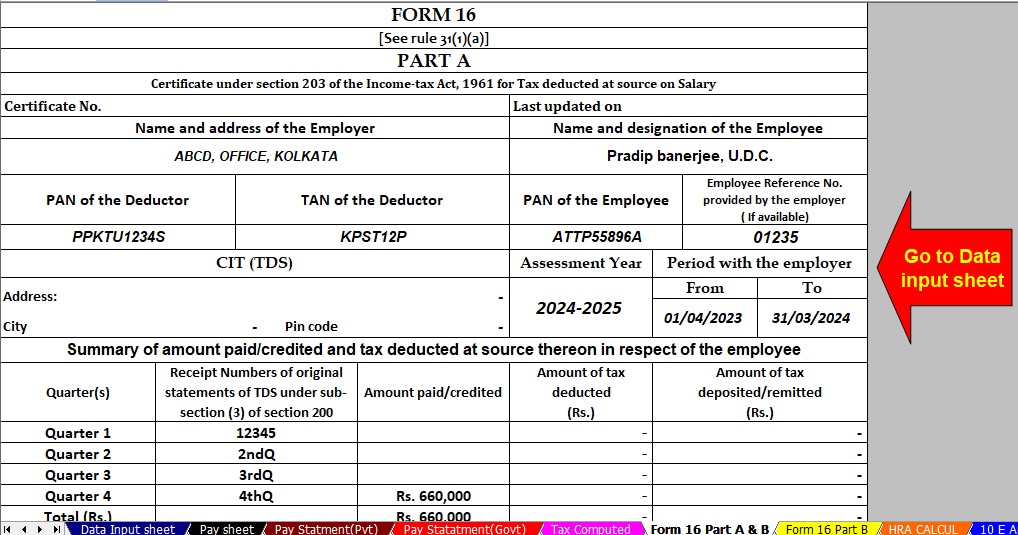

5) For instance, Automated Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) For instance, Automated Income Tax Revised Form 16 Part B for the F.Y.2023-24