Income tax preparation can be a daunting task, but with the right tools, it can become a smooth and efficient process. Therefore, One such tool that many individuals and professionals rely on is income tax preparation software in Excel. In other words, In this article, we'll explore the benefits, features, and how-to of using Excel for tax preparation.

Benefits of Using Excel for Income Tax Preparation

Efficiency and Organization

One of the primary advantages of using Excel for tax preparation is the efficiency it offers. However, Excel allows you to create well-organized worksheets where you can input all your financial information. With designated cells for income, deductions, and calculations, you can keep your financial data neatly arranged.

Flexibility in Handling Various Tax Situations

Excel provides the flexibility to handle various tax situations. Whether you have a simple tax return or a complex one with multiple income sources and deductions, Excel's versatility makes it a suitable choice. Above all, You can customize your worksheets to accommodate your unique financial scenario.

In addition, Customization Options

Excel's customizable templates and functions give you the freedom to tailor your tax preparation to your specific needs. After that, You can create personalized formulas and functions to automate calculations and ensure accuracy. This flexibility sets Excel apart from other tax preparation tools.

Key Features of Income Tax Preparation Software in Excel

Formulas and Functions

Excel's robust library of formulas and functions simplifies tax calculations. You can use built-in functions like SUM, VLOOKUP, and IF to perform various computations. Similarly, These functions save time and reduce the chances of manual errors.

Data Validation

Data validation in Excel ensures that you input accurate information. This feature helps in preventing mistakes by setting criteria for the data entered. Excel will prompt you if the data doesn't meet the specified conditions.

Automated Calculations

Excel's ability to perform automated calculations is a game-changer for tax preparation. Once you set up your worksheet with the necessary formulas, Excel will handle the calculations, reducing the chances of errors and saving you time.

How to Set Up an Income Tax Worksheet in Excel

Creating an income tax worksheet in Excel is a straightforward process. Follow these steps to get started:

- Organizing Income and Deductions: Create separate sections for income and deductions. Label each section clearly.

- Utilizing Excel Functions for Calculations: Use Excel functions to calculate total income, deductions, and tax owed. Ensure that all formulas are correctly set up.

Common Excel Functions for Tax Preparation

Therefore, In tax preparation, several Excel functions come in handy:

- SUM Function: Use this to add up totals in various categories, such as income and deductions.

- VLOOKUP Function: VLOOKUP helps you retrieve tax rates or other information from a separate table.

- IF Function: IF statements allow you to create conditional calculations. For instance, you can set up an IF statement to calculate tax owed based on income.

Excel Templates for Tax Preparation

In other words, Excel offers pre-designed templates for tax preparation. These templates come with built-in functions and formatting, making the process even more accessible. However, you can customize these templates to match your specific needs.

However, Data Security and Privacy

Maintaining the security and privacy of your financial data is paramount during tax preparation. When using Excel, follow these tips to ensure your data is secure:

- For instance, Password Protection: Password-protect your tax worksheets to prevent unauthorized access.

- For instance, Regular Backups: Make regular backups of your Excel files to prevent data loss.

Above all, Common Errors to Avoid

In addition, To ensure the accuracy of your tax return, it's essential to avoid common errors. These mistakes can lead to discrepancies and potential issues with the tax authorities. Some errors to avoid include:

- Incorrect data entry.

- Misusing Excel functions.

- Forgetting to update tax rates based on the latest regulations.

After that, Integrating Excel with Tax Filing Software

Excel can be seamlessly integrated with tax filing software. Similarly, This integration streamlines the e-filing process, allowing you to submit your tax return electronically. This combination of Excel and dedicated tax software offers a comprehensive solution for tax preparation and filing.

Therefore, Choosing the Right Income Tax Preparation Software

Above all, Selecting the right income tax preparation software is crucial for a smooth tax preparation process. Consider these tips to assist you in making the best decision:

- Take into account the intricacies of your tax circumstances

- Make a comparison between the features and pricing of various software choices

- Review feedback and seek advice from colleagues.

In other words, Excel vs. Dedicated Tax Software

When deciding between Excel and dedicated tax software, it's essential to weigh the pros and cons of each approach.

- Pros of Excel:

- Customization options.

- Cost-effective.

- Familiarity for many users.

- Cons of Excel:

- Requires manual data entry.

- May lack specific tax-related features.

- Pros of Dedicated Tax Software:

- Automated data import.

- Extensive tax support.

- E-filing capabilities.

- Cons of Dedicated Tax Software:

- Costlier than Excel.

- Less customization.

However, Cost Analysis

While Excel offers cost-saving benefits, dedicated tax software often comes with

In conclusion,

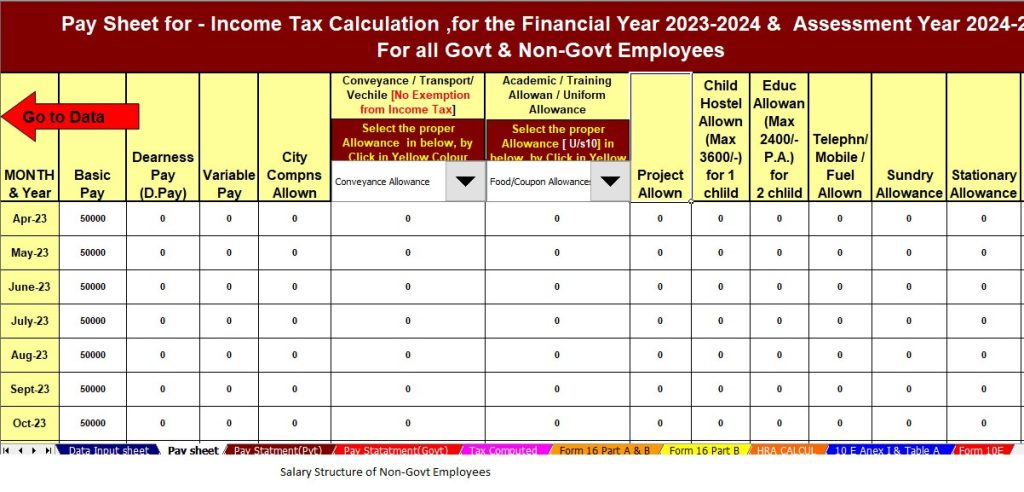

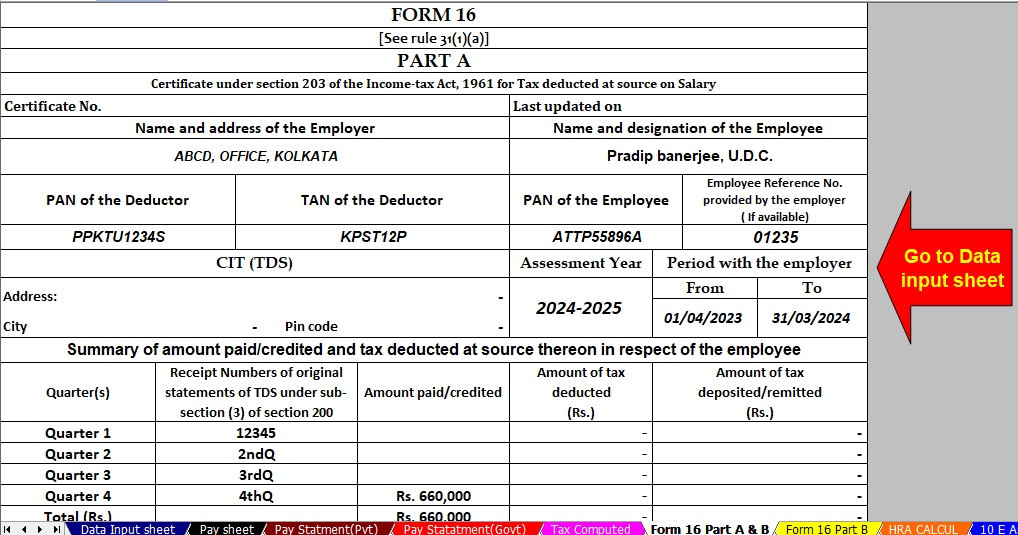

Download Automated Income Tax Preparation Excel-Based Software All in One for the Government and Non-Government (Private) Employees for the Financial Year 2023-24 and Assessment Year 2024-25 U/s 115BAC

Feature of this Excel Utility:-

1) This Excel tool accurately prepares your income tax according to your choice under Section 115BAC

2) This Excel utility includes all updated Income Tax sections in accordance with the 2023 budget.

3) For instance, Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2023-24 (Updated Version)

4)For instance, Automatically calculate income tax house rent exemption under Section 10(13A)

5)For instance, Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

6) Individual Salary Sheet

7)For instance, Individual Tax Computed Sheet

8) For instance, Automated Income Tax Revised Form 16 Parts A and B for the Financial Year 2023-24

9) For instance, Automatically generate Income Tax Revised Form 16 Part B for the Financial Year 2023-24.