Introduction

Income tax planning is a vital aspect of personal finance. One of the most significant sections in the Indian Income Tax Act is Section 80C. In this article, we will delve into the details of Section 80C, breaking down its various aspects and offering insights into how you can maximize its benefits to optimize your tax liability.

Before we dive into the nitty-gritty of Section 80C, let's understand its relevance and significance in the realm of tax-saving and financial planning.

What is Income Tax Section 80C?

Section 80C of the Income Tax Act, of 1961, is a provision that allows individual taxpayers to claim deductions on specific investments and expenses. Therefore, The maximum deduction allowed under this section is ₹1.5 lakh, which can substantially reduce your taxable income. In other words, It is essential to note that Section 80C falls under the 'Earnings from House Property' category, and it is available to individuals and Hindu Undivided Families (HUFs).

Eligible Investments under Section 80C

1. Equity-Linked Saving Schemes (ELSS)

Equity-Linked Saving Schemes are a popular choice among investors. However, These are mutual fund schemes that invest primarily in equities and offer the dual benefit of tax savings and the potential for capital appreciation. Above all, Investments in ELSS funds are eligible for deductions under Section 80C.

2. Public Provident Fund (PPF)

In addition, The Public Provident Fund is a long-term savings avenue with a lock-in period of 15 years. It is a secure option and the interest earned is tax-free, making it a preferred choice for conservative investors.

3. Employee Provident Fund (EPF)

Contributions made to your Employee Provident Fund account qualify for deductions under Section 80C. This not only helps you save on taxes but also ensures you are building a retirement corpus.

4. National Savings Certificate (NSC)

The National Savings Certificate is a government-backed savings instrument that can be purchased from post offices. The interest on NSC is eligible for deductions under Section 80C.

5. Tax-saving Fixed Deposits

Banks offer special fixed deposits that come with a lock-in period of five years and qualify for deductions under Section 80C. These fixed deposits provide both safety and assured returns.

6. Sukanya Samriddhi Yojana

This scheme is designed to promote the welfare of the girl child. Investments made under this scheme are eligible for deductions under Section 80C.

7. Tuition Fees

If you have children and are paying tuition fees for their education, you can claim a deduction under Section 80C. This provision is especially beneficial for parents looking to save on taxes while investing in their children's future.

The Importance of Tax Planning

Effective tax planning through Section 80C can substantially reduce your tax liability. By making strategic investments in eligible financial instruments, you not only save on taxes but also create a corpus for various financial goals. Here are some key takeaways:

1. Start Early

Tax planning should be a year-round endeavour, not just a last-minute rush. By starting early, you can carefully evaluate your options and make informed decisions.

2. Diversify Investments

Diversification is a prudent approach to financial planning. Instead of putting all your money in one investment, consider spreading it across different instruments to minimize risk and maximize returns.

3. Long-Term Perspective

Many Section 80C investments come with a lock-in period. While this may limit liquidity in the short term, it is essential for achieving long-term financial goals.

4. Keep Records

Maintaining proper records of your investments and expenses is crucial. It ensures a smooth process during tax filing and helps in case of any scrutiny.

Conclusion

In conclusion, Section 80C is a powerful tool for reducing your tax liability and securing your financial future. By making informed investments in the eligible options, you can not only save on taxes but also work towards achieving your financial goals. It is crucial to consult a financial advisor or tax expert to create a customized tax-saving plan that aligns with your financial objectives.

Remember, while Section 80C is a valuable provision, it is just one piece of the larger puzzle of financial planning. To truly leave other websites behind and optimize your online presence, consider partnering with experts who understand the intricacies of tax planning and can provide comprehensive guidance tailored to your specific needs.

So, when it comes to Section 80C and optimizing your financial future, make informed choices, stay ahead of the game, and consult the experts. Your financial well-being depends on it.

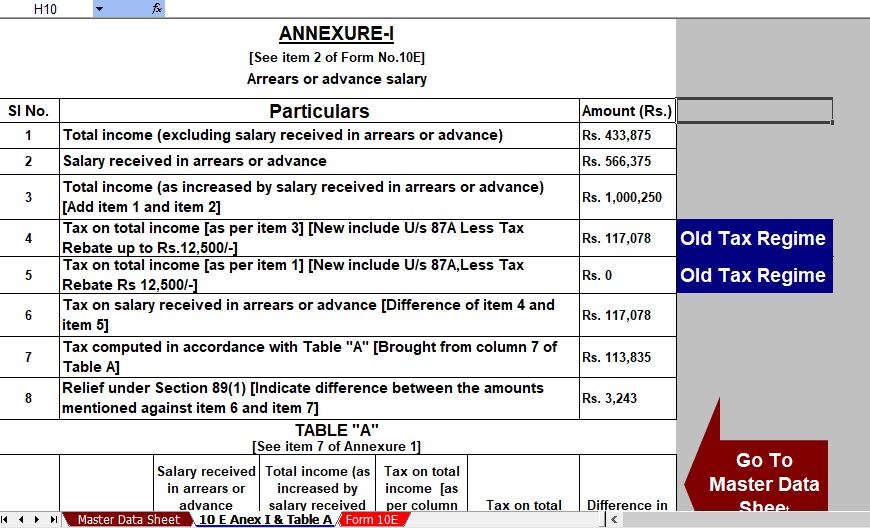

Download Auto Calculate Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the FY 2000-01 to F.Y.2023-24 in Excel