Download Automatic Preparation 50 Employee Master of Form 16 Part B in Excel. In the realm of efficient tax management, mastering the creation of Form 16 Part B in Excel is an invaluable skill. This article will guide you through the process of preparing Form 16 Part B for 50 employees simultaneously in Excel for the Financial Year 2023-24.

To embark on this journey, you must first open Excel and ensure that it is equipped with the necessary features for data manipulation and calculations. Begin by organizing your employee data, including details such as PAN numbers, salary information, and deductions.

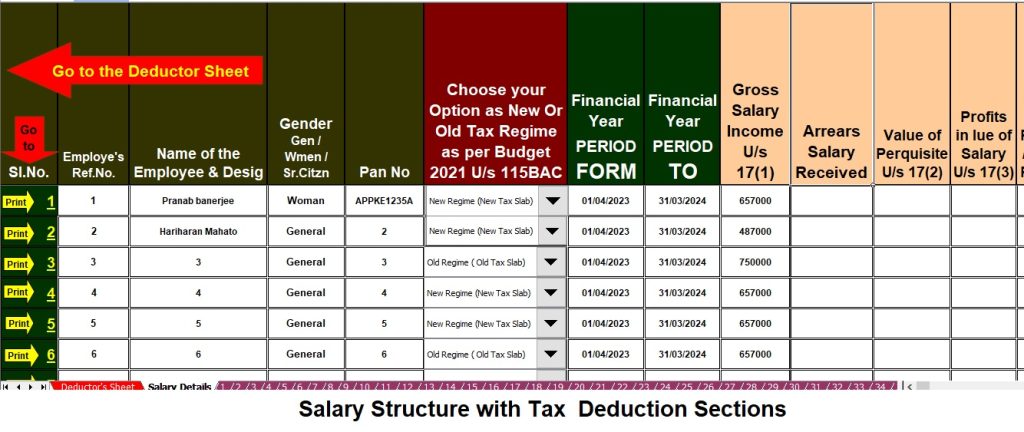

With the information at your fingertips, create a template in Excel, allocating separate columns for each crucial piece of data. This structured approach facilitates easy data entry and manipulation as you progress through the preparation process.

Utilize Excel's built-in functions to automate calculations for taxable income, deductions, and net income. This not only expedites the process but also minimizes the likelihood of errors, ensuring the accuracy of the final Form 16 Part B.

To further streamline the procedure, consider using Excel's data validation features to set constraints on specific data inputs, reducing the risk of discrepancies. This meticulous approach ensures that the information entered aligns with the required format and criteria.

One key aspect of Form 16 Part B is the comprehensive representation of salary details, including basic pay, allowances, and any additional perks. In Excel, employ formulas to aggregate these components accurately, providing a clear and concise overview of the employee's earnings.

Deductions play a pivotal role in tax calculations, and Excel's formulaic capabilities can simplify this intricate process. Factor in deductions such as Provident Fund contributions, professional tax, and any other applicable exemptions to arrive at the taxable income.

As you progress through the Excel spreadsheet, ensure that you validate the accuracy of each calculation. Excel's auditing tools, including trace precedents and dependents, can assist in identifying and rectifying any formula-related discrepancies that may arise.

Once satisfied with the accuracy of your calculations, proceed to generate the Form 16 Part B for each of the 50 employees. Excel's 'Fill Down' feature allows you to replicate formulas efficiently, significantly reducing the time and effort required for this bulk task.

To add a professional touch to the final output, format the Excel sheet to present information in a clear and easily understandable manner. Consider using colour-coded cells, borders, and appropriate fonts to enhance the visual appeal of Form 16 Part B.

As a prudent measure, save the Excel file in a secure location, ensuring that it is easily accessible for future reference or amendments. This step is crucial for maintaining an organized record of employee tax information and facilitating seamless audits when necessary.

In conclusion, mastering the creation of Form 16 Part B in Excel for 50 employees simultaneously is a valuable skill that enhances efficiency and accuracy in tax compliance. By harnessing the power of Excel's functions and features, you can simplify the process and ensure a seamless preparation of Form 16 Part B for the Financial Year 2023-24.

Download Automatic Income Tax Master of Form 10 Part B in Excel which can prepare at a time 50 Employees Form 16 Part B for the FY 2023-24

Feature of this Excel Utility

- This Excel Utility can prepare at a time 50 Employees Form 16 both of Part A and B for FY 2023-24

- This Excel Utility can prepare Automatic your Income Tax Liabilities as per the Income Tax Slab New and Old Tax Regime

- This Excel Utility have a unique Salary Structure for Individual as per the Budget 2023

- This Excel Utility have all the amended Income Tax Sections as modified in the Budget 2023-04 as per New and Old Tax Regime

- This Excel Utility can prevent your doubling or duplicating the PAN number of each employee, so you have no fear of double or duplicating name and PAN entry

- For Print Form 16 both of Parts B in A-4 Papers Size

- Automatic Convert the Amount to in words without any Excel Formula

- This Excel Utility can be used by both Government and Non-Government concerned

- This Excel Utility is just an Excel File, Download and start filling in data in the input sheet and it magically prepares at a time 50 Employees Form 16 Part A&B

- You can prepare and Save the Employee's Data in your System. It works Office 2003, 2007 and 2010 also 2011 ms Office