Introduction

Exemptions and Deductions under the Old Tax Regime-A Guide for the Financial Year 2023-24. In the complex realm of taxation, Therefore, understanding exemptions and deductions is crucial for every taxpayer. The financial year 2023-24 brings with it a set of rules that dictate how individuals can reduce their taxable income. In other words, In this article, we will delve into the specifics of Section 80C and Section 10 of the Income Tax Act, unravelling the opportunities they offer.

Exemptions and Deductions under the Old Tax Regime-A Guide for the Financial Year 2023-24

Section 80C – Investment Deduction

1. However, Who can claim Section 80C exemption?

- Individuals and HUFs are eligible for Section 80C exemptions.

2. Above all, Maximum deduction allowed under Section 80C?

- Rs 1.5 lakh annually from the taxpayer's total income.

3. Section 80C List of deductions

- ELSS Funding

- Share Linked Savings Scheme

- National Pension Scheme

- ULIPs

- Fixed Deposits for Tax Savings

- Public Provident Fund

- Savings Scheme for Senior Citizens

- Sukanya Samriddhi Yojana

- And more...

4. Limit of exemption under Section 80C

- The total amount chargeable under sections 80C, 80CCC, and 80CCD(1) combined is Rs 1,50,000.

5. Additional Deduction

- In addition, An additional deduction of Rs 50,000 is allowed under 80CCD(1B).

Section 10 of IT Act, 1961: After that, Housing Rent Allowance (HRA) Deduction

6. Conditions for HRA Deduction

- Actual HRA received by the employee

- HRA is 40% of rent in non-metro cities or 50% for metro cities.

- Actual rent paid is less than 10% of wages.

Section 10(14): Exclusion of Special Expenses

7. Disqualification under Section 10(14) (i)

- Travel allowance

- Daily allowance

- Uniform Allowance

- Academic or Research Scholarship

- Assistant Allowance

8. Similarly, Deduction under Section 10(14) (ii)

- Early Childhood Education Subsidy

- Tribal District Subsidy

- Agricultural Area Compensatory Allowance

- Border Area Allowance

- And more...

Deductions under Section 16

9. Ordinary Depreciation under Section 16 (ia)

- Similarly, Standard deduction of Rs. 50,000

10. Sports Allowance under Section 16 (ii)

- In other words, Deductions based on salary and sports subsidies are granted.

11. Service tax or service tax under Section 16 (iii)

- However, The deduction is available in the year professional tax is paid.

Deductions under Chapter VI A

12. Above all, Chapter VI A Deductions

- 80D, 80DD, 80DDB, 80E, 80EE, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80TTA, 80TTB, 80U, 87A.

13. Maximum Limits and Eligibility

- In addition, Varying from health insurance premiums to charitable donations, each section has its maximum deduction limit and eligibility criteria.

In conclusion,

Therefore, Navigating the intricate landscape of tax exemptions and deductions demands meticulous attention. As you prepare for the financial year 2023-24, understanding these provisions can significantly impact your tax liability.

FAQs

1. Can I claim deductions under both Section 80C and Section 10?

- Yes, taxpayers can avail themselves of deductions under both sections.

2. Are there any changes in the deduction limits for the upcoming financial year?

- As of now, there are no announced changes. Keep an eye on updates for any amendments.

3. Is there a specific order in which I should claim these deductions?

- While there's no strict order, it's advisable to prioritize based on your financial situation.

4. Can I claim deductions if I switch jobs during the financial year?

- Yes, you can claim deductions even if you switch jobs, provided you meet the eligibility criteria.

5. How do I keep track of my deductions throughout the year?

- Maintain a meticulous record of your investments, expenses, and receipts to ensure accurate claims.

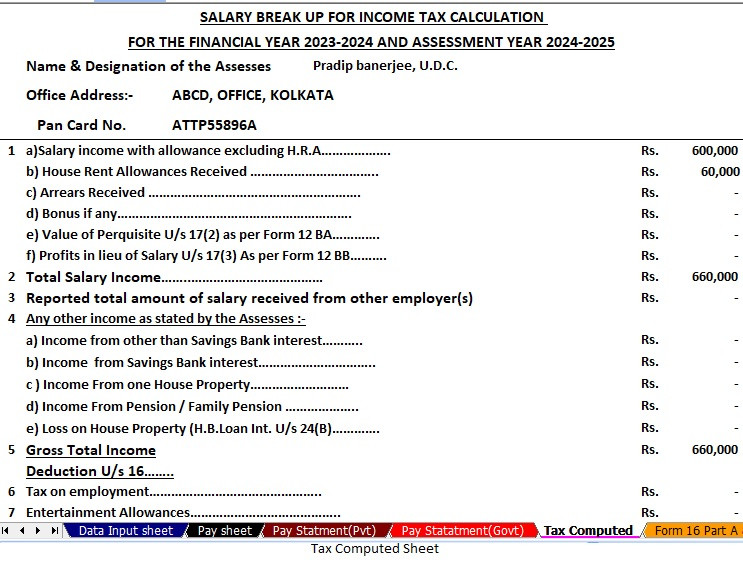

Download Auto Calculate Income Tax Preparation Software All in One in Excel for the Government and Non-Government Employees for the Financial Year 2023-24 as per Budget 2023

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as a New or Old Tax Regime

3) For instance, This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) For instance, Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2023-24 (Update Version)

5)For instance, Automated Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) For instance, Automated Income Tax Revised Form 16 Part B for the F.Y.2023-24