Introduction to Form 16

Form 16 is a crucial document issued by employers to their employees, detailing the salary earned and taxes deducted during the financial year. It serves as a certificate of tax deduction at source (TDS) and is essential for filing income tax returns.

Understanding Part A and Part B of Form 16

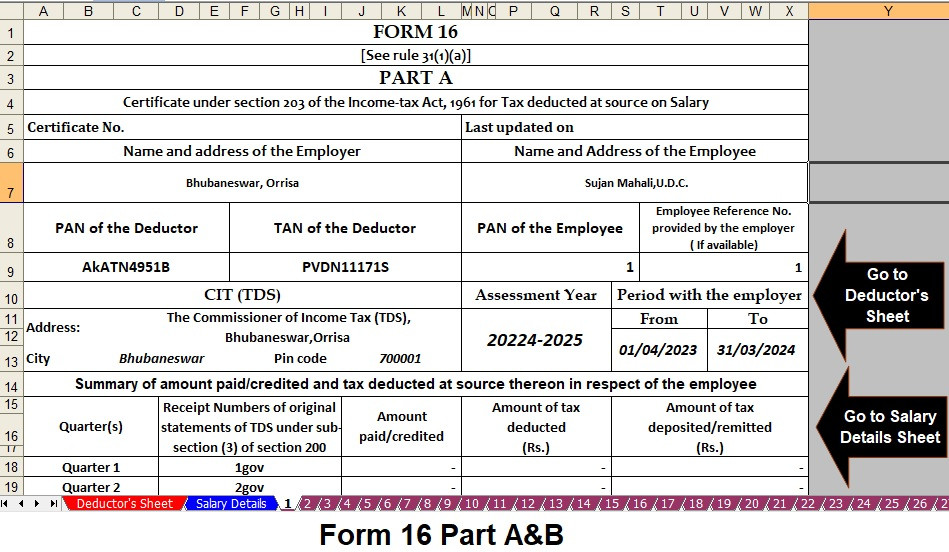

Form 16 consists of two sections: Part A and Part B. Part A contains details of tax deducted and deposited with the government, along with the employee's PAN and TAN details. Part B includes the computation of income, deductions, and tax payable by the employee.

Changes in Tax Regimes for F.Y. 2023-24

The financial year 2023-24 brings forth new tax regimes, impacting the computation of taxes and deductions for employees. It's crucial to stay updated with these changes to ensure accurate Form 16 preparation.

Importance of Automating Form 16 for 50 Employees

In today's digital era, manual preparation of Form 16 for multiple employees can be time-consuming and prone to errors. Automating the process streamlines operations and ensures compliance with tax regulations.

Benefits of Using Excel for Form 16 Automation

Excel provides a versatile platform for automating Form 16 preparation. Its calculation features and customizable templates make it ideal for handling complex tax computations efficiently.

Step-by-Step Guide to Preparing Form 16 for 50 Employees

Gathering Employee Information

Begin by collecting necessary details such as employee salaries, deductions, and investment proofs for accurate tax computation.

Downloading Part A and Part B Templates

Download standardized templates for Part A and Part B of Form 16 from authorized sources or customize them according to your organization's requirements.

Entering Employee Details in Part A

Fill in employee-specific information such as name, PAN, TAN, employer details, and tax deducted at source in Part A of the template.

Calculating Income and Deductions

Use Excel formulas to calculate taxable income, deductions under various sections, and net taxable income for each employee.

Filling Part B with Tax Computation

Enter the computed tax liability, tax payments, and refunds (if any) in Part B of the Form 16 template.

Generating Form 16 for Each Employee

Once all information is accurately entered, generate individual Form 16 documents for each employee using Excel's printing or PDF conversion features.

Ensuring Accuracy and Compliance

Verify all calculations and entries to ensure accuracy and compliance with tax laws and regulations. Any inconsistencies could result in penalties or legal consequences.

Comparing New and Old Tax Regimes

Evaluate the tax implications under the new and old tax regimes to choose the most beneficial option for your employees.

Tips for Streamlining the Process

Utilize Excel's features such as autofill, pivot tables, and conditional formatting to streamline the Form 16 preparation process and minimize errors.

Common Mistakes to Avoid

Avoid common pitfalls such as incorrect data entry, miscalculations, and overlooking tax-saving opportunities while preparing Form 16.

Future Considerations for Form 16 Automation

Stay updated with advancements in tax laws and technology to continuously improve and optimize the Form 16 preparation process for future years.

Conclusion

Automating Form 16 preparation for 50 employees in Excel for F.Y. 2023-24 offers numerous benefits, including time savings, accuracy, and compliance. By following a systematic approach and leveraging Excel's capabilities, organizations can streamline operations and ensure seamless tax filing for their employees.

FAQs on Form 16 Preparation

What is Form 16?

Form 16 is a certificate issued by employers to employees, providing details of salary, tax deductions, and TDS for a specific financial year.

Why is Form 16 important for employees?

Form 16 serves as proof of TDS for employees and is essential for filing income tax returns and claiming tax refunds.

How does automation benefit Form 16 preparation?

Automating Form 16 preparation saves time, minimizes errors, and ensures compliance with tax regulations, enhancing efficiency and accuracy.

Can Form 16 be prepared manually?

While possible, manual preparation of Form 16 for multiple employees is time-consuming and prone to errors, making automation a preferred choice.

What are the consequences of incorrect Form 16 filing?

Incorrect Form 16 filing can lead to penalties, legal implications, and delays in income tax processing for employees.

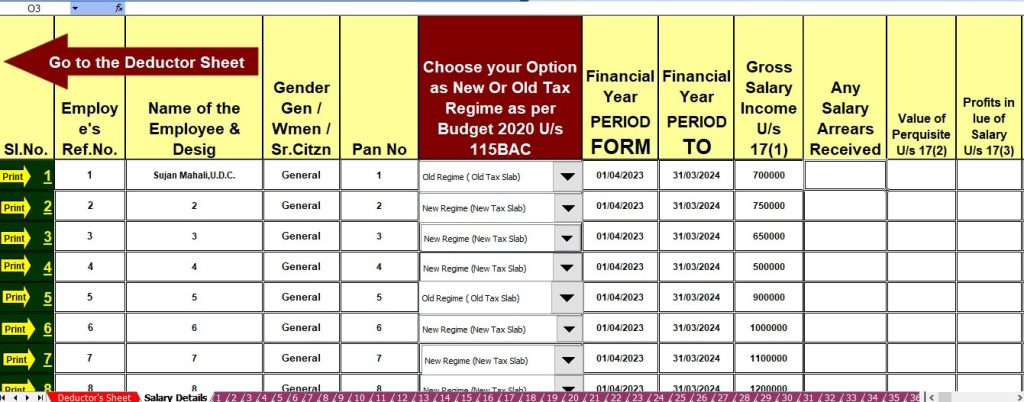

Download the Automatic Income Tax Master of Form 16 Part A and B in Excel, which can prepare Form 16 for 50 employees simultaneously for the Financial Year 2023-24 and Assessment Year 2024-25.

Features of this Excel Utility:

- This Excel Utility can generate Form 16 for Part A and B for 50 employees at once for FY 2023-24.

- Automatically calculates Income Tax Liabilities based on the New and Old Tax Regime.

- Incorporates a unique Salary Structure for Individuals as per the Budget 2023.

- Includes all amended Income Tax Sections from the Budget 2023-24 for both New and Old Tax Regime.

- Prevents duplication of PAN numbers, ensuring accurate employee records.

- Print Form 16 Part B in A4 paper size.

- Automatically converts amounts into words without needing Excel formulas.

- Suitable for use by both Government and Non-Government entities.

- Simply download the Excel file and start entering data in the input sheet; it will automatically generate Form 16 for 50 employees at once.

- Allows you to save employee data on your system. Compatible with Office versions 2003, 2007, 2010, and 2011.