Are you grappling with income tax arrears and searching for a seamless solution? Look no further! Therefore, In this article, we'll delve into the realm of automatic income tax relief using Form 10E in Excel, spanning from the fiscal year 2000-01 to 2024-25, and its relevance for the assessment year 2025-26.

Table of Contents

| Sr# | Headings |

| 1. | Understanding Income Tax Arrears |

| 2. | Introduction to Form 10E |

| 3. | Benefits of Using Excel for Tax Calculation |

| 4. | How to Use the Excel-Based Calculator |

| 5. | Eligibility Criteria for Relief Under Section 89(1) |

| 6. | Steps to Fill Form 10E |

| 7. | Importance of Filing Tax Arrears Correctly |

| 8. | Impact on Tax Liability |

| 9. | Deadline for Filing Form 10E |

| 10. | Consequences of Non-Compliance |

| 11. | Understanding Assessment Year 2025-26 |

| 12. | Conclusion |

| 13. | FAQs |

However, Understanding Income Tax Arrears

In other words, Income tax arrears refer to the tax liability that remains unpaid for a specific financial year. These may arise due to various reasons such as incorrect tax calculations, delayed filing, or discrepancies in income declaration.

Introduction to Form 10E

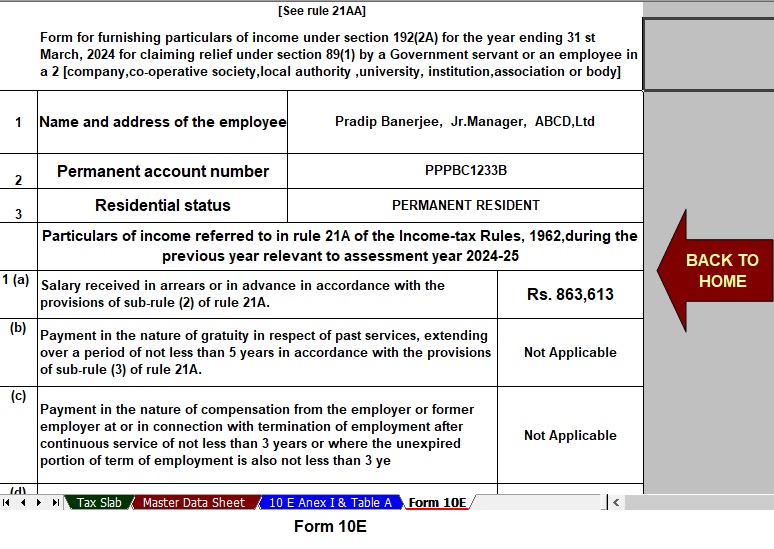

Form 10E is a crucial document prescribed by the Income Tax Department for claiming relief under section 89(1) of the Income Tax Act. In addition, It allows taxpayers to seek relief for arrears or advance salary pertaining to multiple years.

After that, the Benefits of Using Excel for Tax Calculation

Excel-based calculators offer a user-friendly interface, enabling taxpayers to compute their tax liabilities swiftly and accurately. Similarly, Its flexibility and accessibility make it a preferred choice for tax-related calculations.

How to Use the Excel-Based Calculator

Simply input your financial data such as income, deductions, and arrears details into the designated cells of the Excel sheet. The calculator will automatically generate the tax relief amount, simplifying the entire process.

Eligibility Criteria for Relief Under Section 89(1)

Taxpayers who receive salary in arrears or in advance are eligible to claim relief under section 89(1). However, certain conditions such as timely filing of Form 10E and adherence to prescribed guidelines must be met.

Steps to Fill Form 10E

Filling Form 10E involves providing detailed information about your income, arrears, and tax deductions. Ensure accuracy and completeness while filling out the form to avoid any discrepancies during assessment.

Importance of Filing Tax Arrears Correctly

Accurate filing of tax arrears is paramount to avoid penalties and legal implications. Form 10E serves as a tool to rectify any discrepancies in tax calculations and ensures compliance with regulatory requirements.

Impact on Tax Liability

Claiming relief under section 89(1) can significantly reduce your tax liability, thereby providing financial respite and enhancing your disposable income. It mitigates the burden of paying additional taxes on arrears received.

Deadline for Filing Form 10E

Taxpayers must file Form 10E before the expiry of the relevant assessment year to avail of the benefits of tax relief. Failing to adhere to the deadline may result in forfeiture of relief and additional tax liabilities.

Consequences of Non-Compliance

Non-compliance with the provisions of Form 10E can lead to penalties, interest charges, and legal repercussions. It is imperative to adhere to the prescribed guidelines and timelines to avoid adverse consequences.

Understanding Assessment Year 2025-26

The assessment year 2025-26 denotes the period during which the income earned in the financial year 2024-25 is assessed for taxation purposes. Familiarizing yourself with the nuances of the assessment year is essential for effective tax planning.

In conclusion,

In conclusion, leveraging Excel-based automatic income tax relief calculators coupled with Form 10E can streamline the process of claiming tax relief for arrears. By adhering to prescribed guidelines and deadlines, taxpayers can mitigate their tax liabilities and achieve financial stability.

FAQs

What is Form 10E?

For instance, Form 10E is a document used for claiming relief under section 89(1) of the Income Tax Act for arrears or advance salary.

Who is eligible to file Form 10E?

Taxpayers who receive salary in arrears or in advance can file Form 10E to claim relief under section 89(1).

How does Form 10E impact tax liability?

Form 10E helps reduce tax liability by providing relief for arrears received, thereby lowering the overall tax burden on taxpayers.

What are the consequences of not filing Form 10E?

Failure to file Form 10E within the prescribed deadline may result in penalties, interest charges, and additional tax liabilities for taxpayers.

When should Form 10E be filed?

Form 10E should be filed before the expiry of the relevant assessment year to avail of the benefits of tax relief on arrears.

For instance, By integrating these insights into your tax planning strategy, you can navigate the complexities of income tax arrears with confidence and efficiency. Above all, Remember, that accurate compliance is the key to financial peace of mind.

Download Automatic Income Tax Arrears Relief Calculator with Form 10E in Excel from the Financial Year 2000-01 for the Financial Year 2024-25(A.Y.2025-26 as per Budget 2024