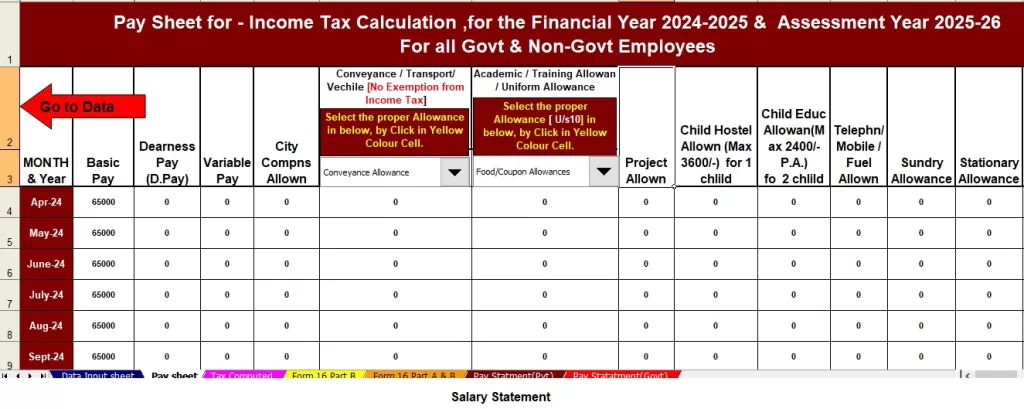

Are you ready to tackle your taxes with ease? Say goodbye to the headache of manual calculations and cumbersome spreadsheets. Introducing the Automatic Income Tax Calculator All in One in Excel for both government and non-government employees, tailored specifically for the Fiscal Year 2024-25 as per Budget 2024. Whether you're a seasoned tax filer or a newcomer to the process, this tool is designed to streamline your tax preparation journey.

Table of Contents

| Sr# | Headings |

| 1 | Understanding the Importance of an Automatic Calculator |

| 2 | Key Features of the Automatic Income Tax Calculator |

| 3 | How to Download and Install the Calculator |

| 4 | Using the Calculator Effectively |

| 5 | Benefits for Government Employees |

| 6 | Benefits for Non-Government Employees |

| 7 | Compatibility and Accessibility |

| 8 | Why Choose an Automatic Calculator? |

| 9 | Staying Updated with Budget 2024 Changes |

| 10 | Conclusion |

Therefore, Understanding the Importance of an Automatic Calculator

However, Navigating through tax laws and regulations can be overwhelming. In other words, An automatic calculator simplifies this process by handling complex calculations effortlessly. It eliminates errors and ensures accuracy, saving you both time and stress.

Above all, Key Features of the Automatic Income Tax Calculator

1. User-Friendly Interface: For instance, The calculator boasts an intuitive design, making it accessible to users of all skill levels.

2. Comprehensive Tax Computation: Above all, From income tax to deductions and exemptions, this tool covers all aspects of tax preparation.

3. Customization Options: Tailor the calculator to your specific financial situation with customizable fields and settings.

4. Real-Time Updates: Stay informed about changes in tax laws and regulations with automatic updates.

5. In addition, Error Detection: Say goodbye to manual errors! The calculator detects and alerts you to potential mistakes, ensuring accuracy.

How to Download and Install the Calculator

After that, Downloading and installing the Automatic Income Tax Calculator is a breeze. Simply visit our website, locate the download link, and follow the step-by-step instructions. After that, Within minutes, you'll have access to a powerful tool that simplifies tax preparation.

You can also download Automatic Income Tax Form 16 Part A and B Preparation Excel-Based Software for the Financial Year 2023-24

Similarly, Using the Calculator Effectively

Maximize the benefits of the calculator by familiarizing yourself with its features. Experiment with different scenarios to understand how various factors impact your tax liability. Similarly, Don't hesitate to reach out to our support team if you encounter any challenges along the way.

Benefits for Government Employees

Above all, Government employees can take advantage of specific deductions and exemptions tailored to their profession. The calculator ensures that you maximize your tax savings while staying compliant with government regulations.

In addition, Benefits for Non-Government Employees

Non-government employees also reap the rewards of using the Automatic Income Tax Calculator. However, From freelance workers to corporate professionals, this tool caters to individuals across all sectors, helping them navigate the intricacies of tax preparation.

Similarly, Compatibility and Accessibility

The calculator is designed to be compatible with a wide range of devices and operating systems. Whether you prefer to work on your desktop, laptop, or mobile device, you can access the calculator anytime, anywhere.

Why Choose an Automatic Calculator?

Therefore, Manual tax calculations are prone to errors and inconsistencies. By opting for an automatic calculator, Similarly, you mitigate the risk of mistakes and ensure that your tax returns are accurate and compliant. Plus, the time-saving benefits allow you to focus on what matters most to you.

However, Staying Updated with Budget 2024 Changes

In other words, The Automatic Income Tax Calculator is updated regularly to reflect changes in tax laws and regulations, including those outlined in Budget 2024. Rest assured that you're always equipped with the latest information to navigate the tax landscape effectively.

In conclusion,

In conclusion, the Automatic Income Tax Calculator All in One in Excel is a game-changer for tax preparation. Whether you're a government employee or working in the private sector, this tool simplifies the process, saving you time and ensuring accuracy. However, Say goodbye to tax season stress and hello to financial peace of mind!

For instance, FAQs (Frequently Asked Questions)

1. After that, How often is the calculator updated with changes in tax laws and regulations? The calculator is updated regularly to reflect the latest changes, including those outlined in Budget 2024.

2. Is the calculator compatible with both Windows and Mac operating systems? Yes, the calculator is compatible with both Windows and Mac operating systems, ensuring accessibility for all users.

3. For instance, Can I customize the calculator to my specific financial situation? Absolutely! The calculator offers customization options, allowing you to tailor it to your individual needs and circumstances.

4. Similarly, Does the calculator provide support for complex tax scenarios? Yes, the calculator is equipped to handle complex tax scenarios, ensuring accuracy and compliance with regulations.

5. How can I access customer support if I encounter any issues with the calculator? In addition, You can reach out to our dedicated customer support team via email or phone for assistance with any questions or concerns you may have.

Download Automatic Income Tax Calculator All in One in Excel for the All Salaried Employees for the F.Y.2024-25 as per Budget 2024This Excel Utility boasts the following features:

- It prepares and calculates your income tax based on the New Section 115 BAC, accommodating both the New and Old Tax Regime.

- Above all, You have the flexibility to choose between the New and Old Tax Regime using this Excel Utility.

- Specifically tailored for All Salaried Employees, this Excel Utility introduces a unique Salary Structure.

- Enjoy the convenience of automated Income Tax Revised Form 16 Part A&B for the F.Y.2024-25.

- Additionally, benefits from automated Income Tax Revised Form 16 Part B for the F.Y.2024-25.