Introduction: Simplify Your Tax Calculations with Our All-in-One Solution

In today’s fast-paced world, time is of the essence, especially when it comes to handling financial matters. With tax season looming ahead, both government and non-government employees are faced with the daunting task of calculating their income tax. However, fret not, for we have the perfect solution to streamline this process – our Automatic Excel-Based Income Tax Calculator.

What Sets Our Income Tax Calculator Apart?

Comprehensive Coverage

Our Income Tax Calculator is meticulously designed to cater to the diverse needs of both government and non-government employees. Whether you’re a salaried individual, a freelancer, or a business owner, our tool ensures accuracy and efficiency in tax calculations.

User-Friendly Interface

Gone are the days of complex tax forms and confusing calculations. Therefore, Our Excel-based calculator boasts a user-friendly interface that simplifies the entire process. In other words, With just a few clicks, you can input your financial data and generate accurate tax estimates within minutes.

Inclusion of Form 10E

However, One of the unique features of our calculator is its integration with Form 10E. This form is essential for employees seeking relief under Section 89(1) of the Income Tax Act, 1961. By including Form 10E, we ensure compliance with all legal requirements, thus offering our users peace of mind.

For instance, Updated for F.Y.2024-25 and A.Y.2025-26

In line with the latest budget announcements for the fiscal year 2024-25, our Income Tax Calculator is updated with the most current tax slabs, deductions, and exemptions. This ensures that your tax calculations are always accurate and up-to-date with the latest regulations.

How to Use Our Income Tax Calculator

- Download the Excel File: Simply click on the download link provided on our website to access the Excel-based Income Tax Calculator.

- Enter Your Financial Details: Above all, Open the downloaded file and input your income, deductions, exemptions, and other relevant details into the designated fields.

- Generate Tax Estimates: Once you’ve entered all your financial data, click on the “Calculate” button to generate instant tax estimates.

- Review and Print: For instance, Review the calculated tax estimates to ensure accuracy. You can then print the results for your records or further analysis.

Why Choose Our Income Tax Calculator?

Accuracy Guaranteed

In addition, Our Income Tax Calculator is built on robust algorithms that ensure precise calculations every time. Say goodbye to manual errors and discrepancies – with our tool, you can trust that your tax estimates are accurate to the last penny.

Time-Saving Solution

Time is money, and we understand the value of both. After that, By automating the tax calculation process, our tool saves you valuable time that can be better spent on other important tasks.

Compliance with Legal Requirements

Tax laws and regulations are constantly evolving, making compliance a challenging task. With our Income Tax Calculator, you can rest assured that your tax calculations adhere to the latest legal requirements, minimizing the risk of penalties or audits.

Free of Cost

Yes, you read that right – our Income Tax Calculator is absolutely free to use! We believe that everyone deserves access to reliable tax calculation tools without breaking the bank.

Conclusion: Simplify Your Tax Season Today!

In conclusion, our Automatic Excel-Based Income Tax Calculator is the ultimate solution for simplifying your tax calculations. Whether you’re a government employee, a non-government employee, or a freelancer, our user-friendly tool ensures accuracy, efficiency, and compliance with legal requirements. Say goodbye to the headache of manual tax calculations and embrace the convenience of our all-in-one solution. Download our Income Tax Calculator today and take the first step towards a hassle-free tax season!

Download the All-in-One Excel-based Income Tax Preparation Software for Government and Non-Government Employees for the Financial Year 2024-25, in accordance with Budget 2024.

Features of this Excel Utility include:

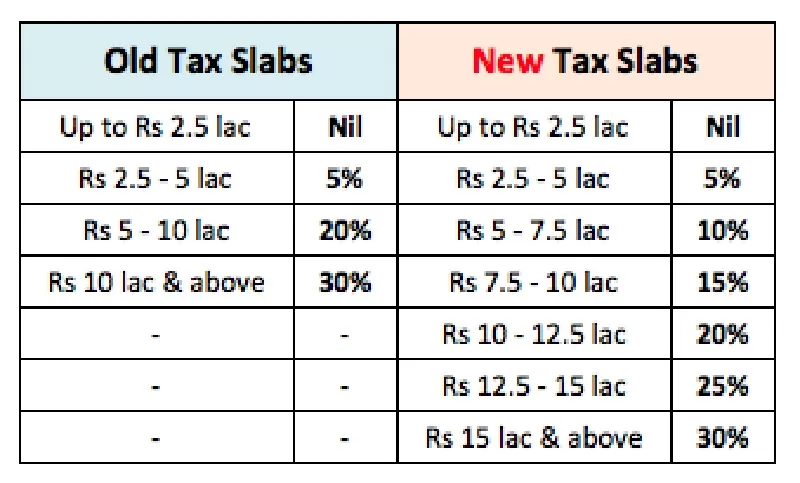

1) Calculation of income tax based on the New Section 115 BAC, applicable to both the New and Old Tax Regimes.

2) Option to select either the New or Old Tax Regime.

3) Unique Salary Structure tailored for both Government and Non-Government Employees.

4) Automated Income Tax Arrears Relief Calculator under Section 89(1) with Form 10E for the Financial Years 2000-01 to 2024-25 (Updated Version).

5) Automated generation of Revised Form 16 Part A&B for the Financial Year 2024-25.

6) Automated generation of Revised Form 16 Part B for the Financial Year 2024-25.