Under section 80U, in computing the total income of an individual, being a resident, who, at any time during the previous year, is certified by the medical authority to be a person with a disability, there shall be allowed a deduction of a sum of fifty thousand rupees. However, where such individual is a person with severe disability, a higher deduction of one lakh rupees shall be allowable. DDOs should note that 80DD deduction is in the case of the dependent of the employee whereas 80U deduction is in the case of the employee himself. However, under both the Sections the employee shall furnish to the DDO following:

As the Tax Benefits can be availed by the Phy.disable person below 80% Rs. 75,000/- & above 80% Rs. 1,25000/- for the F.Y.2016-17

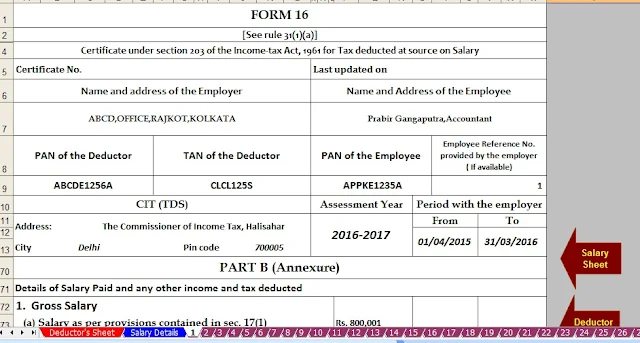

Click here to Download the Automatic Master of 100 employees Form 16 Part B for the Financial Year 2016-17 and Assessment Year 2017-18 (This Excel Based Software can prepare at a time 100 employees Form 16 Pat B , You can also prepare more than 1000 employees Form 16 Part B by this One Software)

1. A copy of the certificate issued by the medical authority as defined in Rule 11A(1) in the prescribed form as per Rule 11A(2) of the Rules. The DDO has to allow deduction only after seeing that the Certificate furnished is from the Medical Authority defined in this Rule and the same is in the form as mentioned therein.

2. Further in cases where the condition of disability is temporary and requires reassessment of its extent after a period stipulated in the aforesaid certificate, no deduction under this section shall be allowed for any subsequent period unless a new certificate is obtained from the medical authority as in 1 above and furnished before the DDO.