Deduction under Section 16 of the Income Tax Act: Understand the benefits and eligibility criteria with

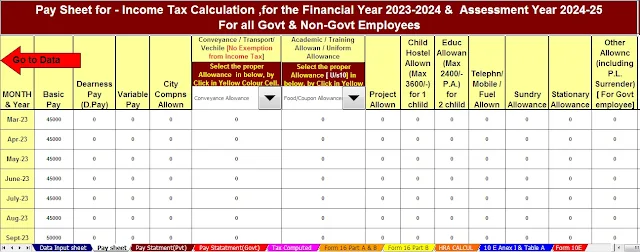

Excel Income Tax preparation software for government and non-government employees for F.Y.2023-

24 and A.Y.2024-25.

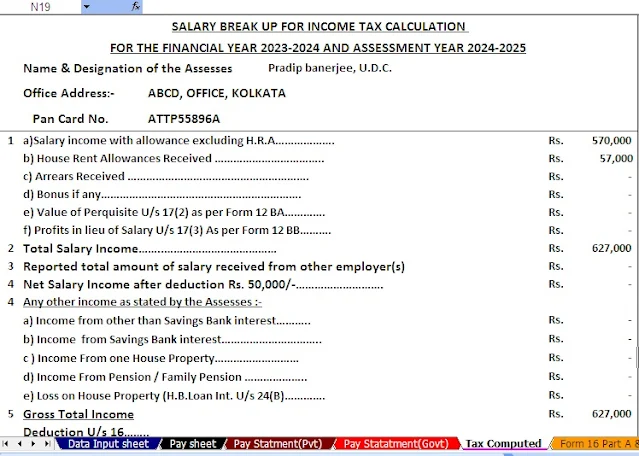

Exemption under Section 16 of the Income Tax Act: Understanding Benefits and Eligibility Criteria | The Income Tax Act of 1961 provides various exemptions to taxpayers to reduce their taxable income and save taxes. One such benefit is available under Section 16 of the Income Tax Act, which allows employees to claim deductions from salary income. In this article, we will discuss the benefits of Chapter 16 relief and the criteria for claiming this relief.

Section 16 Income Benefits Section 16 of the Income Tax Act allows employees to claim the following benefits:

1. Standard Reduction: Rs. 50,000 or the salary amount, whichever is less, can be exempted from taxable income. This discount applies to all salaried employees.

2. Entertainment Allowance: Rs. 5,000 or 1/5th of pay (excluding any allowance, allowance, or other benefits), whichever is less, can be claimed as relief by government employees.

3. Business Tax: The amount of business tax paid in a financial year can be claimed as a deduction.

Criteria for Eligibility for Chapter 16| A taxpayer must meet the following criteria to file for Chapter 16:

1. The taxable person must be an employee.

2. The taxpayer must have received a salary during the financial year.

3. The taxpayer must have paid business tax during the financial year.

4. In the case of representative subsidy, only government employees can claim this discount.

It is important to note that income under Chapter 16 can be claimed by individual taxpayers and not by Hindu Undivided Families (HUFs) or other taxpayers.

How to claim a Section 16 deduction, the taxpayer has to file an Income Tax Return (ITR) and show the details of the income claimed in the return. Taxpayers can request the submission of revised tax returns either by using ITR form.

Conclusion

Payment under Section 16 of the Income Tax Act protects salaried taxpayers from paying higher taxes by reducing their taxable income. The criteria for claiming this deduction is simple and taxpayers can easily claim this deduction by filing their income tax returns. So, if you are a salaried employee, take advantage of this deduction and reduce your tax liability.

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

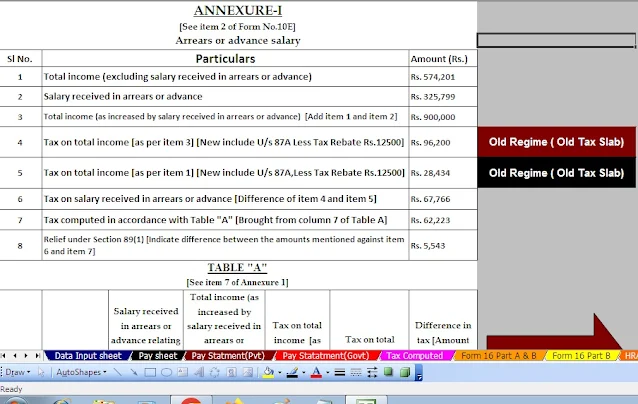

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

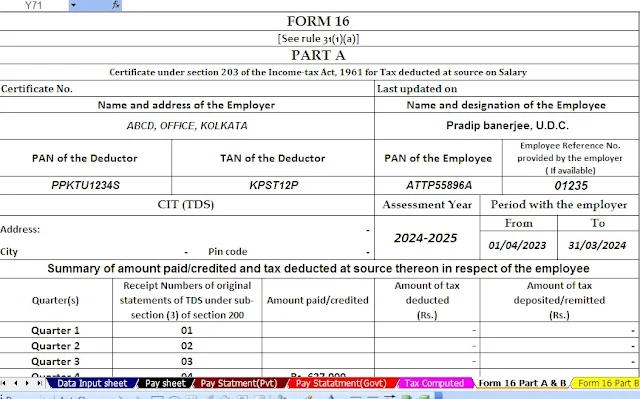

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24