Download Automatic All in One IncomeTax Preparation Excel Based Software for Govt & Non-Govt (PrivateEmployees) for F.Y.2016-17.

|

| Main Data Input sheet |

|

| Salary Structure for Govt & Non-Govt Employees |

|

| Tax Compute Sheet |

|

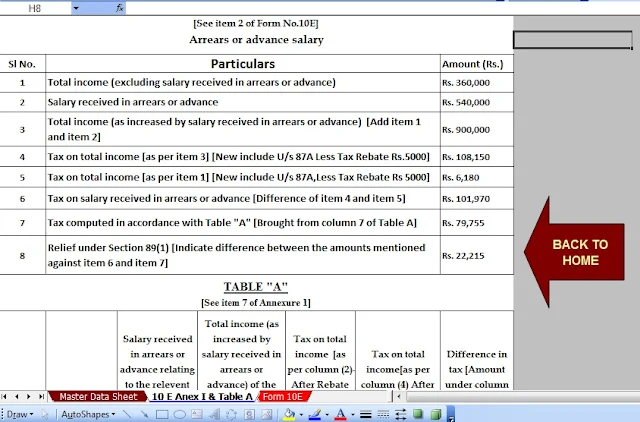

| Main Data Input Sheet for Arrears Relief Calculator |

|

| Arrears Relief Calculator with Form 10E |

|

| Automatic Form 16 Part A&B |

Feature of this Excel Utility :-

1) Prepare at a time Individual

Salary Structure as per Govt & Non-Gvt Employees Salary pattern.

2) Prepare Individual Salary Sheet

3) Prepare Individual Tax Compute

Sheet

4) Automatic H.R.A. Exemption

Calculation U/s 10(13A)

5) Automatic Arrears Relief

Calculator with Form 10E from F.Y. 2000-01 to 2016-17

6) Automatic Income Tax Form 16 Part

A&B for F.Y.2016-17

7) Automatic Income Tax Form 16 Part

B for F.Y.2016-17

8) Automatic Convert the amount in

to the In-Words

Below given a Snapshot where you can guess the All

Income Tax Deduction and the Tax Section Limit for the Financial Year 2016-17

Section

80C/80CCC/80CCD: Investment

in EPF, ELSS, PPF, FD, NPS, NSC, Pension Plans, Life Insurance, SCSS, SSA and

NPS. Also includes Home Loan Principal repayment, Tuition Fees, Stamp Duty (Best Tax Saving Investments u/s 80C) Max.Limit Rs.1.5 Lakh

Section

80CCD(1B): Investment

in NPS (Should you Invest Rs 50,000 in NPS to Save Tax u/s 80CCD (1B)?), Max limit Rs. 50,000/-

Section

24: Interest paid on

Home Loan for Self occupied homes. No Limit for Rented house, Max Limit Rs. 2,00,000/-

Section

80EE: Additional exemption

on Home Loan Interest for First time home buyers. (Budget 2016), Max Limit Rs. 50,000/-

Section

80E: Interest paid on

Education Loan. No upper/lower Limit! (Tax Benefit on Education Loan

(Sec 80E) , Actual Expenses

Section 80CCG: 50%

of investment in RGESS approved stocks & mutual funds. Max investment limit

is Rs 50,000 (RGESS – Save Taxes up to Rs 25000)

Section

80D: Premium payment for

medical insurance for self and parents. Also includes Rs 5,000 limit for

preventive health checkup (Making Sense of Tax Benefit on

Health Insurance u/s 80D), For Medical Insurance for below 60 years Rs. 25,000/- and Sr.Citizen Rs. 30,000/-

Section

80DDB: Treatment of Serious

illness for self and dependents (Limit of Rs 80,000 for person above 80 years,

Rs 60,000 for person above 60 years and Rs 40,000 for rest)

Section

80U: Physically Disabled

Tax payer (Rs 75,000 for 40% to 80% disability and Rs 1,25,000 for more than

80%)

Section 80DD: Physically

Disabled Dependent (Rs 75,000 for 40% to 80% disability and Rs 1,25,000 for

more than 80%)

Section

80G: Donation to approved

charitable funds like Prime Minister Relief fund, etc

Section

80GGA: Donations for

scientific research or rural development

Section

80GGC: Donations to

political parties

Section 80GG: In case you do not receive HRA from employer or are

self-employed but NO house in your name (Claim Tax Benefit for Rent Paid

u/s 80GG

Section 80TTA: Interest

received in Savings Account,Max Limit Rs. 10,000/-

Section 87A :- Tax Rebate Rs.5000/-

who’s taxable income less then 5 Lakh