Employers everywhere start receiving the Form 16 during this time of the year. So what is Form 16? Form 16 is a TDS Certificate that contains details of TDS deducted and deposited on your behalf by your employer to the Central Government.

Still confused, let introduce you to about Form 16. Now that employer generates and shares Form 16, but how does the employer generates forms? So let's start from the beginning of the financial year.

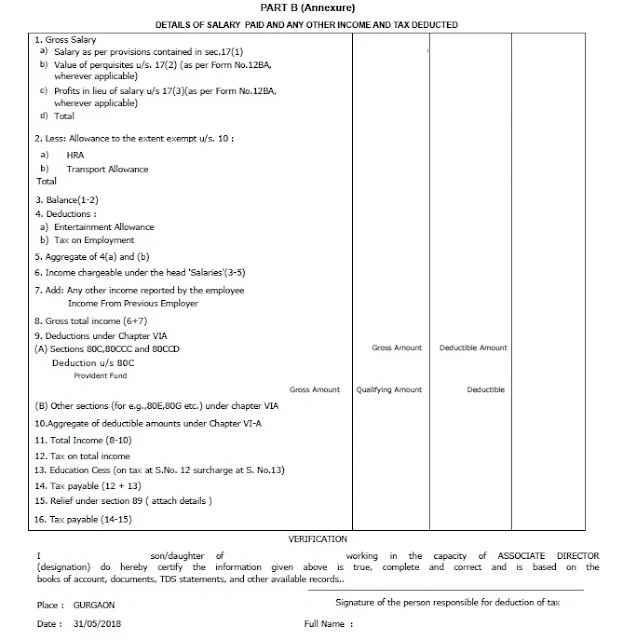

For starters, Mr.A and his colleagues declare the tax saving investment they plan to make for the financial year like tax saving mutual funds, FDS and payments like premium of Life Insurance, children tuition fee and medical insurance U/s 80D.

The employer uses this information to determine taxable income, and deduct TDS accordingly. Now Mr.A suddenly remembered he had heard about CTC during his placement, but forgot what it was. So let's do a quick recap for him. CTC is the cost the company best for years. It includes his basic salary allowances House Rent Allowances can be in focus, it's like food coupons and mobile bills and any other bonuses after subtracting the Professional Tax and TDS from his salary.

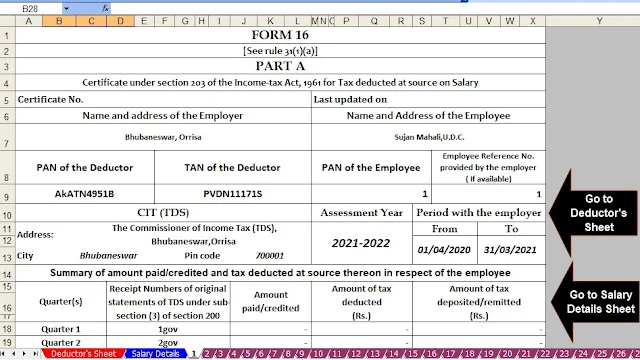

Download Automated Income Tax Form 16 Part B (This Excel Utility Prepare One by One Form 16 Part B)

The amount employer deposits into your bank account, each month is his take home salary during April to March. Mr.A may have some military proof of investments made to the employer for verification, the employer finds everything in order, so continues to deduct and deposit the TDS each month, and file its quarterly return the employer can in turn download the Form 16 from the government website commonly known as TRACES.

Since we have switched jobs during the year, Mr. A will receive Two (2) Form 16, one Form 16 from her past employer, and another Form 16 from current employer.

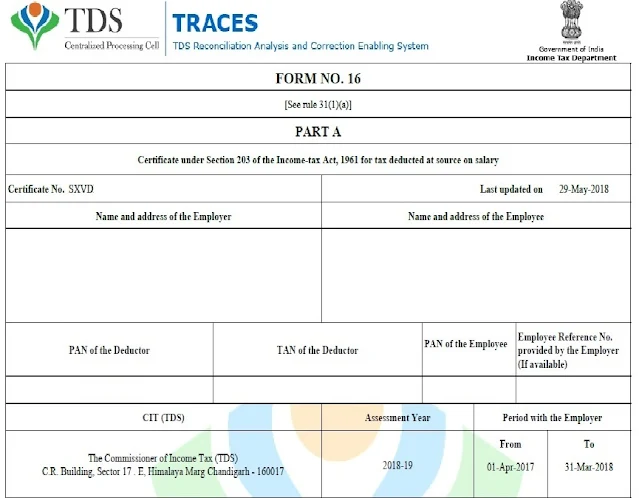

The Form 16 has two parts. Part A is the details of employee’s Tax Deposited Certificate and Part B includes the breakdown of salary deductions and tax computation.