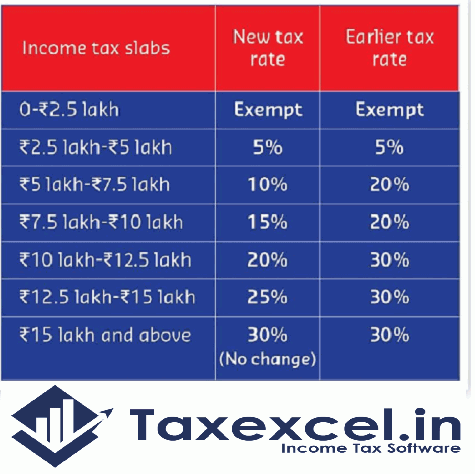

How to calculate your tax for the F.Y.2020-21 as per Income Tax Act. As per the new Budget 2020 introduced a new section 115 BAC, where given two option that is one is New Tax Regime ( New Tax Slab) and another is Old Tax Regime ( Old Tax Slab). If you opt-in the New Tax Regime then you can not entitled any benefits of Income Tax Section except NPS, or if you Opt-in as Old Tax Regime, then you can get all the Tax Benefits as per the Income Tax Act. As given below:-

Let's begin with

a few basics. Income tax is the most popular form of tax which is levied on an

individual's income. The term individual applies to not just a person but also

includes Hindu undivided family company cooperative societies and trusts. In

this article, we will focus on personal income tax, as that is what impacts

most of us, the government levies taxes on your taxable income.

Taxable income is defined as the income of an individual minus any allowable tax deductions. In simpler words. this is the amount of one's total income, which is subject to income tax. As much as this taxable income may seem simple to get to it is a process laced with calculations and adjustments made with various tax deductions tax exemptions and tax rebate. So now let's look at how you get to this taxable income.

Also you may like:- Automated Income Tax Calculator All in One for the West Bengal Government Employees for the Financial Year 2020-21 as per new and old tax regime

Step One:- calculate your gross income, start by writing down the annual gross salary that you get. This will include all the components of your salary including HRA, LTA special allowances, etc. Next, take out the exemptions provided on the salary components. The major exemptions you get are HRA that is house rent allowance and LTA, which is live travel allowance for HRA. Remember you can claim HRA only if you live in a rented house. If you have your own accommodation or live with your parents, then HRA is fully taxable. Also, the tax exemptions under HRA is taken as the lowest of the following amounts

Actual HRA received

50% of basic plus D.A. for persons living in the metro,

40% living in Non-Metro Cities,

Actual rent paid less 10% of basic plus D.A.

After removing these exemptions available to you the actual exemption of H.R.A.

Also you may like:-

Automated Income Tax House Rent Exemption Calculator U/s 10(13A)

Remove the

standard deduction of Rs.50,000 given to all by the government. Now you will

arrive at your net salary. Next, you need to add income, you might have

received from other sources. This could be rental income interest earned from

deposits capital gains you might have seen, etc.

Step Two: - Remove deductions to arrive at your taxable income, the government encourage taxpayers with incentives to reduce their tax liability by providing avenues, where they could reduce their taxable income, next, you deduct investments or expenses eligible under section 80C.

Also you may like:-

Automated Income Tax Calculator All in One for the Andhrapradesh State Government Employees for the Financial Year 2020-21 as per new and old tax regime

The biggest

section and this is section 80C, wherein you can claim Rs.1.5 lakh deduction

under various investments like as PPF, LSS, mutual funds, Sukanya samriddhi yojana,

Premium paid for term insurances are some of the most popular ways to claim

this deduction. Also, if you have a home loan, the principal amount paid

between in the financial year can be claimed as a deduction in this section for

taxpayers.

Who are investing in the NPS, there is an additional Rs. 50,000 deduction they can avail under Section 80 CCD (1B), which is over and above, 1.5 lakh rupees limit under Section 80C. Next, you can claim deductions under Section 80 D of the Income Tax Act on the premium paid towards medical insurance. Unlike the umbrella of 1.5 lakh rupees limit under Section 80 C, which can be availed by all taxpayers section add limit depends on the age of the insured, and the age of family members included in the insurance. If you'd like to know more about deductions under Section 80 C and section 80 D on these topics.

Also you may like:-

Automated Income Tax Calculator All in One for the Bihar State Government Employees for the Financial Year 2020-21 as per new and old tax regime

Now, given the tax have introduced section 80TTA to provide a deduction of Rs.10,000 on the interest income from a savings account from Bank or Post Office.

Next, if you

have an education loan. You can claim deduction on interest component paid.

Apart from this,

if you have a home loan. The interest portion of the EMI paid for the financial

year can be claimed as a deduction, up to a maximum of Rs.2 lakh under Section

24. This is over and above the deduction on the principal portion under Section

80C.

Step three:-You will arrive at the net taxable income by subtracting all the eligible deductions from the gross taxable income; you will arrive at your total income on which income tax will be levied based on the income tax law you fall in.

At this juncture, you should know the applicable income tax rates and tax slabs to the relevant financial year.

Also you may like:-

Automated Income Tax Calculator All in One for the Non-Government Employees for the Financial Year 2020-21 as per new and old tax regime

Step Four:- Calculate your taxes. After arriving at your net taxable income, you are required to calculate and pay taxes as per the slab and rates applicable for the first 2.5 lakh rupees of your taxable income,

In case your total income after deductions doesn't exceed 5 lakh rupees, you can claim rebate under the section, 87A of Rs.12,500.

Also you may like:-

Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E for the Financial Year 2020-21 as per new and old tax regime

One more thing.

If your total income is between 50 lakh and 1 crore rupees, then you need to

pay a surcharge of 10%. and if your income is between 1 crore, and above then

you have to pay 20% surcharge.

Tax liability. Also, as you can see tax deductions can help you save a lot of tax, and there are some great avenues to help you not only achieve this but also help reduce stress around finances. So go ahead and download the Automated Income Tax Calculator for the Salaried Persons by clicking on the link below and get a personalized tax saving plan.

Feature of this Excel Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2020

3)

Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2020-21 (Updated Version)

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Govt and Private Concern’s Salary

Pattern

6)

Individual Salary Sheet

7) Individual

Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

10) Automatic Convert the amount into the in-words without any Excel Formula