Boost Indian taxpayers were hoping

for lower tax rates and increase tax limit deductions, in budget 2020, our

finance minister surprised everyone by announcing a new tax regime. This new

tax regime did have lower tax rates but took away all the deductions and

exemptions available to the taxpayers, and it was announced that the taxpayer

can choose between the old and the new tax regime U/s 115 Back.

So now, most of us have to decide which regime to opt through the new option Form 10-IE for. And that can be confusing. So if you are wondering which tax regime, the existing or new works

best for you. This article helps you decide that.

So, let's start. while our current tax system has high tax rates. As per the Income Tax Act many of the tax exemptions

section to reduce your tax. The Government of India through the addition of

clauses to the Income Tax Act has given Indian taxpayers 70 exemptions and

deduction options, through which they can bring reduce their taxable income and

hence pay less tax.

While exemptions are part of your salary that you don't pay taxes on like HRA,

LTA deductions involve investing, saving, or spending on specific items. In

fact, by claiming deductions under Section 80C, you can bring down your taxable

income by rupees 1.5 lakh. Apart from this, there are several other sections

that let you claim deductions on things, ranging from interest on your home and

education loans to premiums you pay for health insurance.

Here are the most common exemptions and deductions availed by Indian taxpayers,

these exemptions and deductions together can bring down your taxable income by

lakhs. However, it also means that every year, you have to find ways to

optimize your salary and investments, so as to keep your taxable income to the

minimum.

Now, let's look at the new tax regime. The new tax regime is different from the

existing system in two aspects, 1st in the new tax regime, the tax labs have

increased and the tax rates have lowered in the sub rupees 15 lakh range. 2nd,

all the exemptions and deductions that were being used by taxpayers in the

existing regime won't be available in the new regime.

Here is a comparison between the existing, and the new tax slabs.

So now that you have learned the difference between the regimes arises the

question, which one should you pick. Unfortunately, there is no single answer

to this as Indian tax rules are complex in nature. While figuring out what

options to go for might look complicated if you approach it in a systematic

way, it is not quite difficult to figure out. Here is what you need to do.

Step one, calculate all the exemptions that you are availing like HRA, LTA,

phone bills, etc. Remember, all these become taxable. If you are willing to

choose to revert to the new tax regime.

Step two, look at the deductions that you claim as a salaried employee to

deductions that you automatically get or the standard deduction of rupees

50,000, and your contribution towards your employee provident fund that is EP F

in the new regime, you won't be able to claim deductions, even on EP F, even

though you will continue putting money in it. Moreover, you cannot claim

deductions on home loan repayments for a premium paid for insurance policies

which still now have helped to reduce your taxable income.

Now, combine these exemptions and deductions and subtract them from your salary to see what is the taxable income and what it would be. If you let go of these deductions and exemptions. This should be the deciding factor for which regime, you should go for wondering how deductions and exemptions will impact taxes in both regimes.

You may like: - Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E for the Financial Year 2020-21(Updated Version)

Let us understand with an example. First, let us take the example of someone

who is availing, very few exemptions and deductions. This is Permit Sing is a

bank employee who earns rupees 8 lakh, a year being salaried, he contributes

towards CPF, and also gets HRA and LTA. In this Financial Year 2020-21, he

availed rupees 25,000 on his travelling, and he will be claiming it due to his

family obligations. He is not able to save anything beyond his CPF

contribution.

Now let's take out the tax amount he has to pay in the existing regime, and the

new regime. As you can see, in this case to the new tax system works better. In

fact, in the existing tax regime, Arijit will end up paying rupees 4,763 more

in taxes. Lastly, let us take the example of someone who avails all major

exemptions, as well as deductions. Here is Permit. He earns rupees 20 lakh

annually. avails the full rupees 1.5

lakh limit of Section 80C through a combination of contribution to EP F, and l

SS mutual funds. Besides this, he has bought health insurance, for which he

paid a premium of rupees 25,000, that he claims as a tax deduction, under

Section 80 D. Also, to save more taxes from his salary. He made additional

investments of rupees 30,000 in NPS similar to them it. He also claimed the LTA

amount of rupees 25,000, which is tax-exempt.

Now, let's see which tax regime will benefit him. In this case, the existing

tax lab works better. It will result in lower taxes, with the difference of

rupees 24,960. So, this is how you decide which regime to choose.

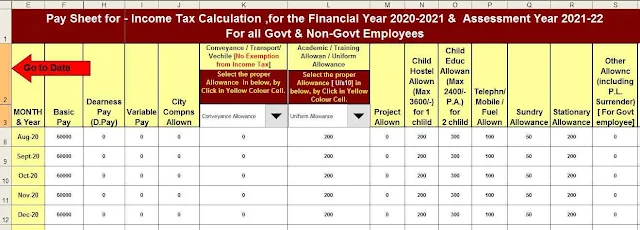

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2020-21 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

7) Individual Salary Sheet