Consistently, CBDT issues a yearly circular around December/January to direct employers and employees to understand the different standards identifying with TDS on pay rates. The Circular is useful in understanding under all the applicable arrangements under the Income-tax Act, circulars, warnings, and so on which an employer and employee should know about and go along before the financial year-end of 31st March.

You may also like:- Automated Income Tax Salary Arrears Relief Calculator U/s 89(1) for the F.Y. 2020-21 with Form 10E

According to the above mentioned, CBDT has given a Circular No. 20/2020 on third December 2020 containing directions according to TDS U/s 192 on salary TDS during the F.Y 2020-21 (A.Y 2021-22), remembering clarifications for following issues:

Download CBDT Circular No.20/2020 Dtd.03/12/2020 in PDF Format

• Rates of Income-tax according to Finance Act, 2020

• Wide plan of TDS on compensations

• Employee/Employers answerable for deducting tax at source and their obligations

• Calculation of income under the head 'Compensations'

• Discount u/s 87A of Rs. 12,500 for people having all-out income up to Rs.5 lakh

• TDS on an salary of amassed balance under perceived fortunate asset and commitment from affirmed superannuation amount

• Customs to acquire proof/confirmation of cases

• Computation of tax to be deducted

• Delineations and Structures

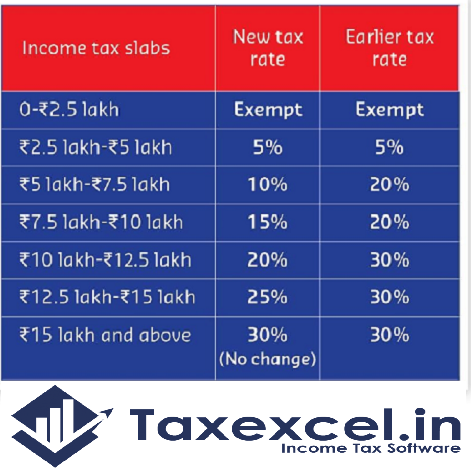

What's more, the circular likewise clarifies about the calculation of tax under the recently embedded concessional tax system u/s 115BAC of the Income-tax Act where absolute income is needed to be registered without the advantage of determining exceptions, derivations, set-off of misfortunes and extra deterioration. A preview of tax rates for F.Y 2020-21 under the ordinary arrangements of the Act viz a viz section 115BAC. PICTURE OF NEW AND OLD TAX SLAB U/S 115 BAC

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Non-Government Employee’s

Salary Structure.

4) Automated

12 BA for the F.Y.2020-21

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2020-21

7) Individual Salary Sheet