Deduction in respect of Medical Treatment, etc. and deposit made for maintenance of handicapped dependents – Deduction under section 80DD

As we have discussed earlier deduction under section 80C, 80D, 80CCC, 80CCD and other deduction. Here, we’ll talk about deduction under section 80DD related to medical treatment etc and deposit made for the maintenance of handicapped dependents.

Who is allowed to get deduction under section 80DD?

Any individual or HUF can claim the deduction under section 80DD under the following conditions.

Conditions to Claim Deduction u/s 80DD

The following conditions must be satisfied to claim the deduction u/s 80DD.

1) If you have any one or more handicapped dependents and you incurred any expenditure related to his/her medical treatment, training, and rehabilitation including nursing.

2) If you have deposited amount for the benefit of a person with a disability to get insurance in the scheme of the Life Insurance Corpn or other insurance company or the Unit Trust of India.

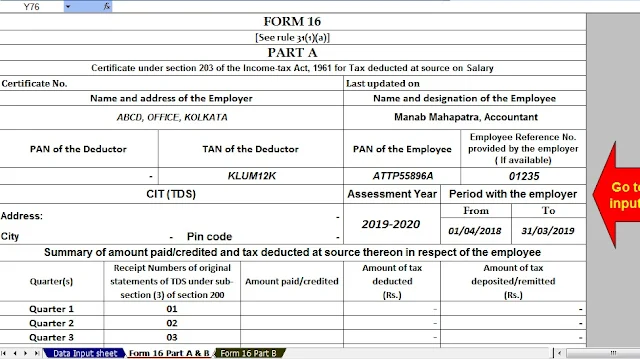

Download Automated Income Tax Form 16 Part B for Financial Year 2018-19 & Ass Year 2019-20 [ This Excel Utility can prepare One by One Form 16 Part B for F.Y.2018-19]

Amount of Deduction

As per the provision of section 80DD the amount is allowed up to Rs.75,000 in aggregate. The deduction can be claimed up to Rs.1,25,000 if the person with sever disability.

Other Important Conditions

As the deduction is allowed only for the dependent handicapped person. So the amount deposited in any approved insurance scheme is purely for the benefit of the person with a disability. So you have to clear one thing that person with a disability should have the nominee or any other person or the trust to receive the payment under the scheme for the benefit of the handicapped dependent and in the event of the death the amount of annuity or any lump-sum should be paid for the benefit of the handicapped person.

In case the handicapped dependent predeceases the sub-scriber assesse, the amount for which deduction has been claimed shall be deemed to be the income of the assesse for the previous year in which such amount is received.

Some Important Provisions Related to Deduction under section 80DD

- According to circular no.702 dated 3rd April, 2015, the deduction is allowable in full if the conditions mentioned fulfilled.

- Another important circular no. 775 dated 26th March, 1999, the employee need only to furnish a medical certificate from a Govt. Hospital and a declaration in writing duly signed certifying the actual amount of expenditure on account of medical treatment etc of the handicapped dependent and receipt for the amount paid or deposited in the scheme of LIC/UTI then the deduction shall be allowable. Therefore DDOs may not insist upon production of vouchers or any bills by the employees.

Who is dependent?

In the case of an individual

- Individual himself

- Spouse

- Children

- Parents

- Brothers

- Sisters

In the case of HUF

- Members

You must note here that the dependent should wholly or mainly dependent to you and has not claimed any deduction u/s 80U in the computation of his income.

What is Disability?

If the disability is over 40% as per the Person with Disability (Equal Opportunities, Protection of Rights and Full Participation) Act, 1995 then it is treated under the section 80DD.

What is Severe Disability?

If the person disability is over 80% as per the Disability Act, 1995 then it is treated as Severe Disability under section 80DD.