Experts, however, said that it is a very nominal benefit to the salaried class.

Giving a relief to a salaried category, minister Arun Jaitley nowadays planned a regular deduction of Rs 40,000 in place of transport allowance and medical compensation entailing a revenue sacrifice of Rs 8,000 crore. The minister, however, didn't propose any amendment within the tax slabs or rates for individual taxpayers.

“In order to supply relief to salaried taxpayers, I propose to permit a regular deduction of Rs 40,000/- in place of this exemption in respect of transport allowance and compensation of miscellaneous medical expenses,” Jaitley aforementioned whereas presenting the Budget 2018-19 in Parliament nowadays. the quality deduction, that is provided to pay earners, was out of print from the assessment year 2006-07.

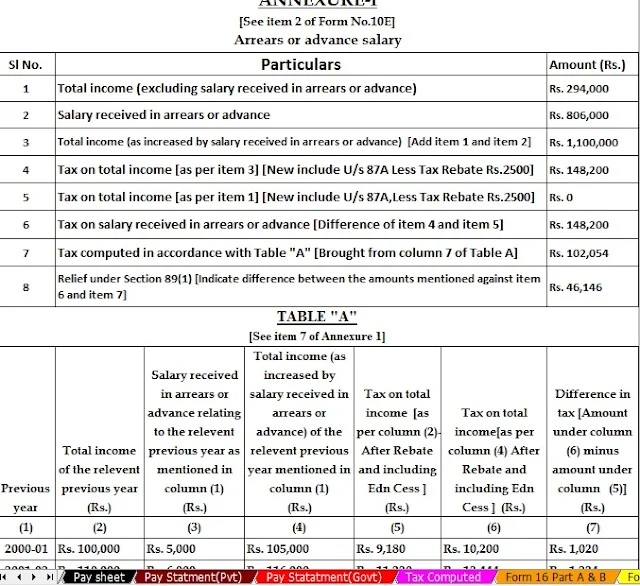

Download Automated Arrears Relief Calculator U/s 89(1) with Form 10E for F.Y.2018-19 and Ass Year 2019-20

Experts, however, aforementioned that it's an awfully nominal profit to the salaried category. “Standard deduction of Rs forty,000 p.a. for salaried people appears to be an awfully nominal profit because the current non-taxable limit for disbursal compensation of 15,000 p.a. and transport allowance exemption of Rs1,600 p.m. is any way resulting in a complete non-taxable pay of Rs 34,200 p.a.,” Alok Agrawal, Senior Director, Deloitte Bharat aforementioned.

The minister aforementioned the govt. had created several positive changes within the personal income-tax rate applicable to people within the last 3 years. “Therefore, I don't propose to create any longer amendment within the structure of the revenue enhancement rates for people,” he said.

Jaitley conjointly noted that there's a general perception within the society that individual business persons have higher financial gain as compared to the salaried category. However, revenue enhancement knowledge analysis suggests that a major portion of non-public income-tax assortment comes from the salaried category, he determined.

According to Jaitley, for the assessment year 2016-17, 1.89 large integer salaried people have filed their returns and have paid a total tax of Rs one.44 hundred thousand large integer that works resolute average tax payment of Rs seventy-six,306/individual salaried payer.

As against this, the aforementioned that one.88 large integer individual business taxpayers together with professionals, World Health Organization filed their returns for constant assessment year paid a total tax of Rs 48,000 large integer that works resolutely a median tax payment of Rs twenty-five,753/individual business payer.

Jaitley aforementioned with the exception of reducing paperwork and compliance, this may facilitate social class workers even a lot of in terms of reduction in their liabilities. “The revenue price of this call is or so Rs 8,000 crores,” he said. {the total the entire the World Health Organizationle|the full|the overall} variety of salaried workers and pensioners who can enjoy this call is around two.5 crores.