Money related arrangement 2018: Changes in Income Tax Rules

1. Standard Deduction of Rs 40,000 for Salaried and Pensioners

2. Transport Allowance and Medical Reimbursement No more obligation cleared for salaried

3. Cess moved from 3% to 4% (renamed as Health and Education Cess)

4. Rs 50,000 interest compensation for senior inhabitants survey exempted under as of late displayed Section 80TTB

5. Therapeutic inclusion Premium Tax prohibition limit extended to Rs 50,000 u/s 80D for senior nationals

6. Extended deduction for restorative treatment u/s 80DDB for senior nationals up to Rs 1 lakh

7. 10% evaluation on whole deal capital augmentations (above Rs 1 Lakh) on stocks and esteem based shared resources. Moreover, 10% benefit appointment charge constrained on benefit paid by esteem regular resources.

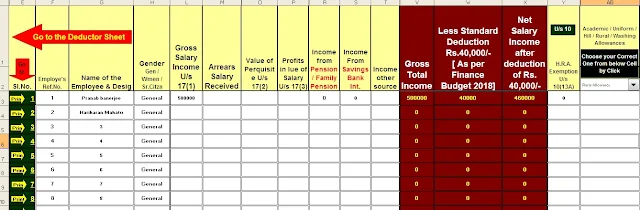

Download Automated Income Tax Form 16 Part A&B for the Financial Year 2018-19 [ This Excel Utility can prepare at a time 100 Employees Form 16 Part A&B ] ( Who are not able to Download the Form 16 Part A from the Income Tax Department, they can use this Excel Utility)

Referencing Some Points I am constantly asked

1. There is NO duty decrease on Infrastructure Bonds

2. There is NO extraordinary evaluation piece for Men and Women

We give a brief of all the evaluation saving fragments underneath:

1. Region 80C/80CCC/80CCD

These 3 are the most conspicuous portions for cost saving and have a package of decisions to save obligation. The best special case joining all the above sections is Rs 1.5 lakhs. 80CCC deals with the advantages things while 80CCD joins Central Government Employee Pension Scheme.

You can investigate the going with for cost-saving endeavors:

1. Employee/Voluntary Provident Fund (EPF/VPF)

2. PPF (Public Provident store)

3. Sukanya Samriddhi Account

4. National Saving Certificate (NSC)

5. Senior Citizen's Saving Scheme (SCSS)

6. 5 years Tax Saving Fixed Deposit in banks/post work environments

7. Life Insurance Premium

8. Pension Plans from Life Insurance or Mutual Funds

9. NPS

10. Equity Linked Saving Scheme (ELSS – commonly known as Tax Saving Mutual Funds)

11. Central Government Employee Pension Scheme

12. Principal Payment on Home Loan

13. Stamp Duty and enlistment of the House

14. Tuition Fee for 2 youths

Download Automated Income Tax Form 16 Part A&B for the Financial Year 2018-19 [ This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B ] ( Who are not able to Download the Form 16 Part A from the Income Tax Department, they can use this Excel Utility)

We have finished an extensive examination of all the above open decisions and you can pick which is the best for you.

2. Region 80CCD(1B) – Investment in NPS

Monetary arrangement 2015 has allowed additional rejection of Rs 50,000 for enthusiasm for NPS. This is continued with this year also. We have finished an aggregate examination which you can scrutinize by tapping the association underneath.

3. A portion of eagerness on Home Loan (Section 24)

The interest paid up to Rs 2 lakhs on home credit for self-included or rented home is exempted u/s 24. Earlier there was NO limit on interest finding on rented property. Money related arrangement 2017 has changed this and now the appraisal special case limit for interest paid on home development is Rs 2 lakhs, autonomous of it acting normally had or rented. In any case for rented homes, any disaster in excess of Rs 2 lakhs can be passed on forward for up to 7 years.

4. The portion of Interest on Education Loan (Section 80E)

The entire interest paid (with no farthest limit) on guidance credit in a cash-related year has met all requirements for discovering u/s 80E. In any case, there is no thinking on boss paid for the Education Loan.

The development should be for the guidance of self, life accomplice or children just and should be taken for looking for after full-time courses in a manner of speaking. The credit must be taken basically from an avowed generous trust or a budgetary association so to speak.

The thinking is relevant for the year you start paying your leeway and seven extra years following the basic year. So in all that you can ensure preparing advance finding for the most extraordinary eight years.

5. Therapeutic insurance for Self and Parents (Section 80D)

Premium paid for Mediclaim/Health Insurance for Self, Spouse, Children, and Parents meet all prerequisites for end u/s 80D. You can ensure the most extraordinary finish of Rs 25,000 in case you are underneath 60 years of age and Rs 50,000 more than 60 years of age.

Download Automated Income Tax Form 16 Part B for the Financial Year 2018-19 [ This Excel Utility can prepare at a time 100 Employees Form 16 Part B ]

An additional finish of Rs 25,000 can be ensured for acquiring therapeutic inclusion for your people (Rs 50,000 if there ought to emerge an event of either watchman being senior inhabitants). This thinking can be ensured autonomous of gatekeepers being dependent on you or not. At any rate, this favorable position isn't available for buying medicinal inclusion for in-laws.

HUFs can moreover ensure this end for the premium paid for shielding the quality of any person from the HUF.

To profit determination the premium should be paid in any mode other than cash. Money related arrangement 2013 had introduced finding of Rs 5,000 (within the Rs 25,000/30,000 limit) is furthermore mulled over preventive prosperity checkup for Self, Spouse, subordinate Children, and Parents. Its continued to this year too.

6. Treatment of Serious contamination (Section 80DDB)

Cost gained for treatment of certain ailment for self and wards gets an end for Income to evaluate. For senior subjects, the determination entirety is needy upon Rs 1,00,000; while for all others it's Rs 40,000. Ward can be watchmen, buddy, youths or family. They should be totally subject to you.

To ensure the appraisal exemption you require confirmation from ace from Government Hospital

Afflictions Covered:

1. Neurological Diseases

2. Parkinson's Disease

3. Malignant Cancers

4. AIDS

5. Chronic Renal frustration

6. Hemophilia

7. Thalassemia

8. Physically Disabled Taxpayer (Section 80U)

Native can ensure thinking u/s 80U in case he encounters certain insufficiencies or diseases. The determination is Rs 75,000 in case of the common cripple (40% or more noteworthy powerlessness) and Rs 1.25 Lakh for genuine insufficiency (80% or more prominent incapacitate)

A verification from sensory system master or Civil Surgeon or Chief Medical Officer of Government Hospital would be required as proof for the ailment.

Download Automated Income Tax Form 16 Part B for the Financial Year 2018-19 [ This Excel Utility can prepare at a time 50 Employees Form 16 Part B]

Ineptitudes Covered

1. Blindness and Vision issues

2. Leprosy-diminished

3. Hearing impedance

4. Locomotor powerlessness

5. Mental block or disorder

6. Autism

7. Cerebral Palsy

9. Physically Disabled Dependent (Section 80DD)

In case you have a subordinate who is contrastingly abled, you can ensure finding for expenses on his upkeep and helpful treatment up to Rs 75,000 or certified use caused, whichever is lesser. The limit is Rs 1.25 Lakh for extraordinary insufficiency conditions i.e. 80% or a more noteworthy measure of the inadequacies. Ward can be watchmen, mate, children or family. Similarly, the ward should not have ensured any determination for self-failure u/s 80DDB.

To ensure the tax reduction you would require insufficiency support issued by state or central government helpful board.

You can in like manner ensure force exemption on premiums paid forever inclusion methodology (in residents' name) where the debilitated individual is the beneficiary. In case the hindered ward ends before the national, the procedure whole is returned back and treated as pay for the year and is totally assessable.

40% or a more prominent measure of the following Disability is considered for inspiration driving cost avoidance

1. Blindness and Vision issues

2. Leprosy-reestablished

3. Hearing crippling

4. Locomotor disable

5. Mental hindrance or illness

10. Blessings to Charitable Institutions (Section 80G)

The organization urges us to provide for Charitable Organizations by giving cost determination to a comparative u/s 80G. A couple of blessings are exempted for 100% of the entirety gave while for others its half of the gave total. In like manner for most endowments, the best prohibition you can ensure is limited to 10% of your gross yearly compensation. You should observe that just blessings profited or check have met all requirements for an end. Blessings in kind like giving pieces of clothing, sustenance, etc aren't anchored for obligation special case.

How to Claim Sec 80G Deduction?

1. A checked and ventured receipt issued by the Charitable Institution for your blessing is the must

2. The receipt should have the enrollment number issued by Income Tax Dept engraved on it

3. Your name on the receipt should organize with that on PAN Number

4. Also the whole offered should be referenced both in number and words

13. House Rent in case HRA isn't a bit of Salary (Section 80GG)

Download Automated Income Tax House Rent Exemption Calculator U/s 10(13A)

In case, you don't get HRA (House Rent Allowance) as a compensation part, you can at present case house rent induction u/s 80GG. A subject may be either salaried/resigned individual or autonomously utilized.

To benefit this you need to satisfy the going with conditions:

1. The rent paid should be more than10% of the compensation

2. No one in the family including life accomplice, minor youths or self should guarantee a house in the city you are living. If you have a house in a different city, you have to consider rental payment on the identical

The House Rent determination is lower of the 3 numbers:

1. Rs. 5,000 consistently [changed from Rs 2,000 to Rs 5,000 in Budget 2016]

2. 25% of yearly compensation

3. (Rent Paid – 10% of Annual Income)

You need to fill Form no 10BA close by the appraisal frame shape