Financial plan 2018-19 and the Finance Bill 2018 have been tabled in Parliament. The Income Tax Slab rates have been kept unaltered by the Finance Minister for the Financial Year 2018-19 (Assessment Year 2019-2020).

Expense arranging is a vital piece of a budgetary arrangement. Regardless of whether you are a salaried individual, an expert or an agent, you can spare assessments to a certain degree through appropriate duty arranging.

The Indian Income Tax act takes into consideration certain Tax Deductions/Tax Exemptions which can be professed to spare duty. You can subtract assess derivations from your Gross Income and your assessable pay gets diminished to that degree.

Pay Tax Deductions List FY 2018-19/AY 2019-20 (Chapter VI-A conclusions list) Section:- 80c

The greatest expense exclusion limit under Section 80C has been held as Rs 1.5 Lakh as it were. The different venture roads or costs that can be asserted as expense derivations under area 80c are as underneath;

• PPF (Public Provident Fund) • EPF (Employees' Provident Fund)

• Five year Bank or Post office Tax sparing Deposits

• NSC (National Savings Certificates)

• ELSS Mutual Funds (Equity Linked Saving Schemes)

• Kid's Tuition Fees

• SCSS (Post office Senior Citizen Savings Scheme )

• Principal reimbursement of Home Loan

• NPS (National Pension System)

• Life Insurance Premium

Section:- 80CCC

Commitment to the annuity plan of LIC (Life Insurance Corporation of India

Section:- 80CCD

A representative can add to Government told Pension Schemes (like National Pension Scheme – NPS). The commitments can be up to 10% of the pay (salaried people) and Rs 50,000 extra tax cut u/s 80CCD (1b) was proposed in Budget 2015.

According to the past Budget 2017-18, the independently employed (individual other than the salaried class) can contribute up to 20% of their gross pay and the equivalent can be deducted from the assessable pay under Section 80CCD (1) of the Income Tax Act, 1961, as against current 10%.

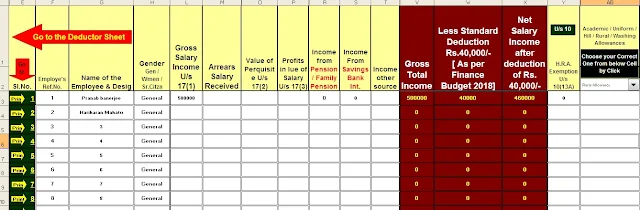

Download Automated Income Tax Form 16 Part B for Financial Year 2018-19 [ This Excel Utility can prepare at a time 100 employees Form 16 Part B ]

To guarantee this finding, the worker needs to add to Govt perceived Pension plans like NPS. The 10% of compensation limit is relevant for salaried people just and Gross salary is appropriate for non-salaried. The meaning of Salary is just 'Dearness Allowance.' If your manager likewise adds to Pension Scheme, the entire commitment sum (10% of compensation) can be asserted as expense finding under Section 80CCD (2).

Mercifully take note of that the Total Deduction under segment 80C, 80CCC and 80CCD(1) together can't surpass Rs 1,50,000 for the money related the year 2018-19. The extra expense conclusion of Rs 50,000 u/s 80CCD (1b) is far beyond this Rs 1.5 Lakh limit.

Commitments to 'Atal Pension Yojana' are qualified for Tax Deduction under area 80CCD.

Section:- 80D

In the association spending plan 2018, the legislature of India

• Health Insurance and Senior Citizens: In Budget 2018, it has been proposed to raise the greatest duty finding the limit for senior subjects under Section 80D of the Indian Income Tax Act 1961. The present furthest reaches of assessment derivation took into consideration FY 2017-18 for senior natives is Rs. 30,000 which will be expanded to Rs 50,000, from FY 2018-19 (AY 2019-20) onwards.

o Under Section 80D an assessee, being an individual or a Hindu unified family, can guarantee a derivation in regard of installments towards yearly premium on medical coverage approach, preventive wellbeing registration or restorative use in regard of senior national (over 60 years old).

o As of FY 2017-18, just Very Senior Citizens (who are over 80 years old), can guarantee a conclusion of up to Rs 30,000 acquired towards restorative consumption, on the off chance that they don't have medical coverage. The Budget 2018 has expanded this to Rs 50,000 and furthermore enabled similar adaptability to senior natives. Indeed, even people who pay premiums for their reliant senior subjects guardians can guarantee the extra conclusion on health care coverage premium (or) restorative use.

• Single premium Health Insurance approach/Multi-year Mediclaim arrangement :

o In an instance of single premium medical coverage strategies having a front of over one year, it is recommended that the conclusion will be permitted on the proportionate reason for the number of years for which medical coverage cover is given, subject to the predefined money related limit.

Preventive wellbeing checkup (Medical checkups) costs to the degree of Rs 5,000/ - per family can be guaranteed as assessment derivations. Keep in mind, this isn't far beyond as far as possible as clarified previously. (Family incorporates: Self, life partner, guardians, and ward youngsters).

Download Automated Income Tax Form 16 Part B for the Financial Year 2018-19 [ This Excel Utility can prepare at a time 50 Employees Form 16 Part B ]

You can guarantee up to Rs 75,000 for spending on restorative medicines of your wards (life partner, guardians, children or kin) who have 40% inability. The duty reasoning breaking point of up to Rs 1.25 lakh if there should arise an occurrence of serious incapacity can be benefited.

Section:- 80DDB

An individual (under 60 years old) can guarantee up to Rs 40,000 for the treatment of indicated basic infirmities. This can likewise be asserted for the benefit of the wards. The assessment finding limit under this segment for Senior Citizens and extremely Senior Citizens (over 80 years) has been overhauled to Rs 1,00,000.

To guarantee Tax findings under Section 80DDB, it is obligatory for a person to get 'Specialist Certificate' or 'Remedy' from an authority working in a Govt or Private clinic.

For the reasons for area 80DDB, the accompanying will be the qualified infections or afflictions:

• Neurological Diseases where the inability level has been affirmed to be of 40% or more; (a) Dementia

(b) Dystonia Musculorum Deformans

(c) Motor Neuron Disease

(d) Ataxia

(e) Chorea

(f) Hemiballismus

(g) Aphasia

(h) Parkinson's Disease

• Malignant Cancers

• Full Blown Acquired Immuno-Deficiency Syndrome (AIDS) ;

• Chronic Renal disappointment

• Hematological issue

1. Hemophilia

2. Thalassaemia

Download Automated One by One Income Tax Form 16 Part A&B and Part B for the Financial Year 2018-19 [ This Excel Utility prepare One by One Form 16 Part A&B and Part B for f.Y.2018-19]

Section:- 24 (B) (Loss under the head Income from House Property)

• From FY 2017-18, the Tax advantage on credit reimbursement of the second house is confined to Rs 2 lakh for each annum possibly (regardless of whether you have different houses the limit is as yet going to be Rs 2 Lakh just and as far as possible isn't per house property).

• The unclaimed misfortune if any will be carted forward to be set away against house property salary of resulting 8 years. In the vast majority of the cases, this can be treated as 'dead misfortune'.

• I trust this is a noteworthy hit to the financial specialists who have purchased numerous houses on a home loan(s) with a goal to spare charges alone.

• Until FY 2016-17, intrigue paid on your lodging credit is qualified for the accompanying tax reductions ;

o Municipal charges paid, 30% of the net yearly pay (standard derivation) and intrigue paid on the advance taken for that house are permitted as seasonings

o After these derivations, your rental payments can be NIL or NEGATIVE and is called 'misfortune from house property' in the last case.

o Such misfortune is as of now permitted to be set off against different heads of pay like Income from Salary or Business and so forth which causes you to bring down you impose risk significantly.

Section:- 80E

On the off chance that you take any credit for higher investigations (in the wake of finishing Senior Secondary Exam), assess conclusion can be guaranteed under Section 80E for a premium that you pay towards your Education Loan. This advance ought to have been taken for advanced education for you, your companion or your youngsters or for an understudy for whom you are a lawful watchman. Vital Repayment on instructive credit can't be asserted as assessment derivation.

There is no restriction on the measure of intrigue you can guarantee as reasoning under area 80E. The finding is accessible for a greatest of 8 years or till the intrigue is paid, whichever is prior.

Section:- 80EE

This was another proposition which had been made in Budget 2016-17. A similar will proceed in FY 2018-19/AY 2019-20 as well. First time Home Buyers can guarantee an extra Tax conclusion of up to Rs 50,000 on home advance intrigue installments u/s 80EE. The beneath criteria must be met for guaranteeing charge derivation under segment 80EE.

• The home credit ought to have been endorsed amid FY 2016-17. • Loan sum ought to be not as much as Rs 35 Lakh.

• The estimation of the house ought not to be more than Rs 50 Lakh and

• The home purchaser ought not to have some other existing private house in his name.

• Such qualified home purchasers can guarantee the exclusion of Rs. 50,000/ - for enthusiasm on home credit under area 80EE from evaluation year starting from 1 st April 2017 and resulting years.

Section:- 80G

Commitments made to certain alleviation reserves and altruistic organizations can be guaranteed as a conclusion under Section 80G of the Income Tax Act. This finding must be asserted when the commitment has been made by means of check or draft or in real money. In-kind commitments, for example, nourishment material, garments, drugs and so forth don't fit the bill for reasoning under area 80G.

Section:- 80GG

The Tax Deduction sum under 80GG is Rs 60,000 for every annum. Segment 80GG is pertinent for each one of those people who doesn't possess a private house and doesn't get HRA (House Rent Allowance)