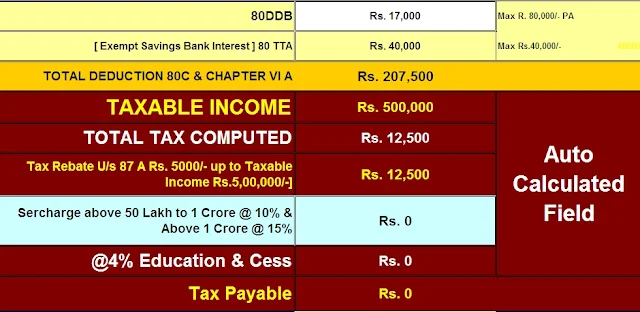

In the following FY 2019-20, an assessment refund has been given to just the individuals who fall in the Rs. 5 lakh salary section

• Together with the expansion in the standard finding, the absolute assessment sparing comes up to Rs. 13,520 for somebody in the Rs. 5 lakh section

Download Automatic Income Tax Calculator for the Financial Year 2019-20 and Ass Year 20120-21 as per Budget 2019

NEW DELHI: Then spending plan, account serves Piyush Goyal has not changed the pay charge sections for the money related year 2019-20 yet has given alleviation to white-collar class salaried citizens by discounts and expanding the standard conclusion edge.

Provision 8 of the Finance Bill presented in parliament on Friday tries to change segment 87A of the Income Tax Act to give help to singular citizens by permitting a discount on a yearly salary of up to ₹5 lakh.

For salaried people, standard reasoning has been raised from the current ₹40,000 to ₹50,000. This will give an extra tax reduction of ₹4,700 crore to in excess of 3 crore compensation workers and retired people.

In the progressing 2018-19, salary up to ₹2.5 lakh isn't assessable for people beneath the age of 60. Those over 60 years yet under 80 years appreciate a tax-exempt pay of up to ₹3 lakh while for those over 80 the tax-exempt salary goes up to ₹5 lakh.

As per the present pieces, in the event that all out salary is more than₹2.5 lakh however up to ₹5 lakh, at that point the complete expense outgo is 5% of the sum by which the all-out pay surpasses ₹2.5 lakh. For money between ₹5 lakh and ₹10 lakh, the assessment outgo is 20% of the sum by which the all-out salary surpasses ₹5 lakh plus₹12,500.

In the 2019-20, a refund has been given to just the individuals who fall in the ₹5 lakh piece. Together with the expansion in the standard derivation, the all out assessment sparing is ₹13,520.Income tax rates for individuals below 60 years:

Net Income after 80C deduction

|

Tax

|

Benefit

|

|||

AY 2019-20

|

AY 2020-21

|

AY 2019-20

|

AY 2020-21

|

||

Net Income

|

Increase in Standard Deduction

|

Net Income

|

|||

5,10,000

|

10,000

|

5,00,000

|

13,520

|

-

|

13,520

|

10,60,000

|

10,000

|

10,50,000

|

1,35,720

|

1,32,600

|

3,120

|

58,10,000

|

10,000

|

58,00,000

|

17,79,492

|

17,76,060

|

3,432

|

1,08,10,000

|

10,000

|

1,08,00,000

|

36,54,378

|

36,50,790

|

3,588

|

Income tax rates for senior citizens:

Resident Individual who is a senior citizen

Pre -Budget

Net Taxable Income (after deductions)

|

300,000

|

350,000

|

400,000

|

500,000

|

1,000,000

|

Tax

|

-

|

2,500

|

5,000

|

10,000

|

110,000

|

Rebate

|

-

|

2,500

|

-

|

-

|

-

|

Balance Tax

|

-

|

-

|

5,000

|

10,000

|

110,000

|

Cess

|

-

|

-

|

200

|

400

|

4,400

|

Total

|

-

|

-

|

5,200

|

10,400

|

114,000

|

Post -Budget

Net Taxable Income (after deductions)

|

300,000

|

350,000

|

400,000

|

500,000

|

1,000,000

|

Tax

|

-

|

2,500

|

5,000

|

10,000

|

110,000

|

Rebate

|

-

|

2,500

|

5,000

|

10,000

|

-

|

Balance Tax

|

-

|

-

|

-

|

-

|

110,000

|

Cess

|

-

|

-

|

-

|

-

|

4,400

|

Total

|

-

|

-

|

-

|

-

|

114,000

|

Saving

|

-

|

-

|

5,200

|

10,400

|

-

|