Investments for Section 80C

You can guarantee most extreme derivation of Rs 1.5 Lakhs u/s 80C (counting Sections 80CCC, 80CCD) by putting resources into qualified instruments. Sadly ventures and consumptions permitted u/s 80C is excessively swarmed and that settles on the decision troublesome for a great many people.

The following is the rundown of ventures/costs qualified for reasoning u/s 80C:

Picture of Section 80C

1. Provident Fund (EPF/VPF)

2. Public Provident Fund (PPF)

3. Sukanya Samriddhi Account (SSA)

4. National Saving Certificate (NSC)

5. Senior Citizen's Saving Scheme (SCSS)

6. Tax Saving Fixed Deposits (for 5 Years)

7. Life Insurance Premium

8. Pension Plans from Mutual Funds

9. Pension Plans from Insurance Companies

10. New Pension Scheme (NPS)

11. Tax Saving Mutual Funds (ELSS)

12. Central Govt. Workers Pension Scheme

13. Principal Payment on Home Loan

14. Tuition Fees for up to 2 kids

15. Stamp Duty for the enlistment of Home

The post underneath proposes the way to deal with select the ventures for duty arranging.

Consumptions Eligible for Tax Benefit:

The initial step is to check all consumptions which are qualified for expense finding. The following is the rundown:

1. Educational cost Fees for up to 2 youngsters

The costs on educational cost expenses for full-time courses for a limit of two kids are qualified for finding u/s 80C. Be that as it may, the derivation isn't accessible for educational cost charge to instructing classes or private educational costs. The accompanying costs are not considered as educational cost expenses – Development Fee, Transport charges, lodging charges, Mess charges, library charges, Late fines, and so on.

2. Stamp Duty for enrollment of New Home

Stamp obligation and enrollment energizes to Rs 1.5 Lakh can be guaranteed for conclusion u/s 80C. The installment ought to have been made in the equivalent money related year for which the assessment is being paid. for example, the conclusion can't be conveyed forward to one year from now. Additionally, the house ought to be for the sake of assessee guaranteeing deduction. In case you have paid stamp obligation for a new home, you most likely would debilitate your 80C limit for the year and no further venture may be required.

Necessary Deductions:

There are some necessary conclusions that are qualified for tax break u/s 80C. Check in the event that you contribute in any of such reasoning:

1. Provident Funds (EPF/VPF)

EPF is mandatory reasoning for most salaried workers. The conclusion can be 12% of the essential pay and dearness stipend or Rs 1,800 consistently. Take a gander at your pay explanation to realize what amount have you contributed for the year. Tally just your commitment. Manager's commitment isn't qualified for expense sparing speculation. You can likewise have some sum contributed through Voluntary Provident Fund (VPF), which can be up to 100% of the essential compensation and DA.

2. National Pension Scheme (NPS)

NPS (Tier 1) is obligatory for most Government representatives who joined after 2004. Take a gander at your pay slip to check your conclusion. Again just your commitment is a legitimate conclusion. Boss' commitment isn't qualified. The beneficial thing is you can utilize this commitment to guarantee extra assessment reasoning up to Rs 50,000 under the recently presented Section 80CCD(1B). We have clarified this at the last passage of the post.

Repeating Deductions:

There are a few conclusions which happen year on year like home advance reimbursement, protection premium and so forth.

1. Home Loan Principal Amount

Is it true that you are paying home advance? The vital part paid each year is qualified as an assessment finding. For this, you can download the expense articulation from banks' site. On the off chance that not get it from the credit supplier. This would give you a gauge of main and intrigue paid for the budgetary year.

2. Protection Premium

Have you purchased disaster protection items like ULIP, Endowment Plan or Term Insurance where you have to pay the premium for consequent years? On the off chance that you need to keep putting resources into a similar, you can keep on asserting tax cut.

3. PPF (open Provident Fund)

In the event that you have PPF account, you ought to contribute least Rs 500 out of a budgetary year. On the off chance that you don't do, a fine is demanded.

4. Sukanya Samriddhi Account (SSA)

Least store of Rs 1,000 should be made each year else punishment of Rs 50 is demanded.

5. NPS

Do you have NPS account? A base commitment of Rs 1,000 is required each money related year to keep the record dynamic.

For some individuals, the 80C derivation limit is come to at this point. On the off chance that not, look over the rundown underneath relying upon your hazard profile and speculation objectives:

New Investment for 80C:

1. Term Life Insurance

Do you have wards? Would they endure fiscally on the off chance that something transpires? Do you have enough disaster protection? On the off chance that no go get term protection first. It's critical to choose insurance first.

Valuable Tips:

• Online term designs are a lot less expensive than disconnected. So it bodes well to go for online plans.

• Do not give false data in the protection frame. The protection guarantee can be rejected for wrong data.

Do not purchase something besides Term Plans from insurance agencies. No cash back, enrichment designs!

2. ELSS (Equity Linked Saving Scheme)

Prominently known as Tax sparing Mutual Fund. These are value-based shared assets and a standout amongst the best venture alternatives to make riches over the long haul while sparing assessment. In the event that you can process the unpredictability of securities exchange, this is the suggested choice.

Secure Period: 3 Years

The Good:

• Among the assessment of sparing ventures, ELSS has the least secure time of 3 years.

The gains on ELSS Fund is Tax-Free.

Convenient to purchase and oversee as ELSS can be purchased and recovered on the web.

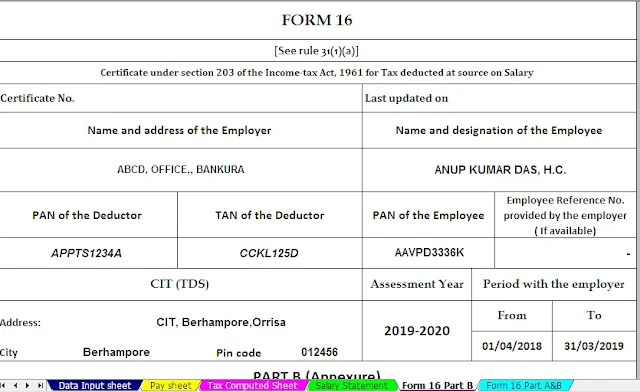

Download Automated Income Tax Form 16 Part B for f.Y. 2018-19 [ This Excl Utility can prepare Form 16 Part B One by One for the financial year 2018-19 ]

The Bad:

There can be extensive instability in returns and you can get negative returns toward the finish of 3 years.

Supportive Tips:

• Invest through SIP (Systematic Investment Plan). This aids in holding over instability to some degree.

• Choose "Development" choice over "Profit Payout" as this makes riches over the long haul.

• Try to contribute straightforwardly to finance as this would give you 0.5% to 1% higher returns when contrasted with when you contribute through merchant

If doing singular amount check for securities exchange valuations. In the event that you contribute to high valuations, you may see low or negative returns toward the finish of 3 years.

Avoid "shut finished" ELSS NFOs which are propelled during this time.

3. PPF (Public Provident Fund)

PPF is another well-known expense sparing venture alternative for 80C, particularly for individuals with no other provident reserve.

Secure Period: 15 Years. Anyway, fractional withdrawal is permitted from the seventh year

The Good:

The premium earned on PPF is Tax-Free

After opening the PPF account, venture should be possible online consistently (for a few banks)

Highest Safety – upheld by the Govt. of India

The Bad:

The secure is for a long time however there is incomplete liquidity from the seventh year onwards

Supportive Tips:

• Investment done till fifth of the month acquires an enthusiasm for the month. So store your cash before the fifth of the month

You can utilize a blend of PPF and ELSS for expense sparing speculations. On the off chance that you discover securities exchange over-esteemed, PPF is a great choice.

4. Senior Citizen's Saving Scheme (SCSS)

SCSS is a great alternative for senior subjects (over 60 years old) as it gives ordinary quarterly premium salary straightforwardly in financial balance.

Secure: 5 years

The Good:

• Highest Safety – sponsored by Govt. of India

The loan fee offered is most noteworthy among the little sparing plans

The Bad:

• The intrigue got is assessable.

TDS would be deducted if the absolute enthusiasm for a year is over Rs 10,000. In any case, if qualified Form 15H can be submitted to stay away from TDS.

Supportive Tips:

• SCSS record can be shut following 1 Year (with punishment) however in the event that you have profited Sec 80C advantage, it would be turned around.

The shared service can be opened just with your life partner. There is no age limit material for the shared service holder.

5. Sukanya Samriddhi Account (SSA)

SSA can be opened by guardians of young lady kid subject to specific conditions. SSA can be a decent choice for settled salary speculation for the tyke. Anyway, you ought to likewise put resources into ELSS or other value shared assets for objectives identified with a youngster.