Introduction:

All-in-One Income Tax Preparation Software in Excel for the Non-Govt Employees for F.Y.2023-24. Navigating income tax complexities can feel daunting. Therefore, In this comprehensive guide, we explore the revolutionary "All-in-One Income Tax Preparation Software in Excel for Non-Govt Employees for F.Y.2023-24." Dive into an insightful journey that demystifies the process and empowers you with financial confidence.

1. Understanding Income Tax Software

In other words, Uncover the essence of the software, offering a seamless tax preparation experience.

1.1 Therefore, Features and Benefits

However, Explore the myriad features and benefits that make this software a game-changer. From user-friendly interfaces to real-time updates, discover how it revolutionizes tax management.

1.2 LSI Keyword Integration

Above all, Delve into the importance of LSI Keywords in enhancing search visibility. Without explicitly mentioning them, witness how they seamlessly blend into the headings and subheadings, optimizing the article.

2. However, Navigating F.Y.2023-24 Changes

Stay ahead of the curve with insights into the latest fiscal year changes.

2.1 Tax Law Updates

Unravel the complexities of recent tax law amendments for a smooth transition into the new financial year.

2.2 Streamlined Data Entry

Therefore, Discover how the software streamlines data entry, ensuring accuracy and compliance with updated tax regulations.

3. However, a Step-by-Step Guide to Software Utilization

Above all, Embark on a journey through the user-friendly interface of the tax preparation software.

3.1 For instance, Navigating the Dashboard

Get a firsthand look at the intuitive dashboard design, making tax preparation a breeze.

3.2 Efficient Data Input

In addition, I mastered the art of efficient data input with detailed guidance on maximizing the software's capabilities.

4. Advantages for Non-Govt Employees

Tailored to meet the specific needs of non-government employees, this software offers unparalleled advantages.

4.1 Customized Deduction Suggestions

Therefore, Unlocks the potential for personalized deduction suggestions, optimizing returns for non-government employees.

4.2 In addition, Real-time Assistance

Above all, Experience real-time assistance features that provide instant support for any tax-related queries.

5. Frequently Asked Questions

How does the software simplify tax filing for non-government employees?

Navigate the intricacies of tax filing effortlessly with our software designed specifically for non-government employees.

Can I use the software on multiple devices?

Yes, the software is designed for multi-device usability, ensuring flexibility and convenience.

Is my data secure?

Rest assured, our software employs robust security measures to protect your sensitive financial information.

How does this software distinguish itself from others in the market?

Our software stands out with its user-friendly interface, real-time updates, and personalized assistance features.

After that, How frequently is the software updated?

To ensure compliance with the latest tax regulations, the software undergoes regular updates, keeping you ahead in your financial planning.

Similarly, Can I file joint tax returns using this software?

Absolutely, our software accommodates joint tax filing, providing comprehensive solutions for various filing scenarios.

In Conclusion:

To conclude, the "All-in-One Income Tax Preparation Software in Excel for Non-Government Employees for F.Y.2023-24" stands out as a symbol of simplicity and efficiency in the intricate landscape of income tax. Empower yourself with a tool that not only eases the process but ensures financial clarity for non-government employees.

All-in-One Automated Income Tax Preparation Excel-Based Software designed for Non-Government (Private) Employees for the Financial Year 2023-24 and Assessment Year 2024-25 by downloading it

Features of this Excel Utility

1) The tax calculation will adhere to the Budget 2023, considering both the New and Old Tax Regime under Section 115 BAC

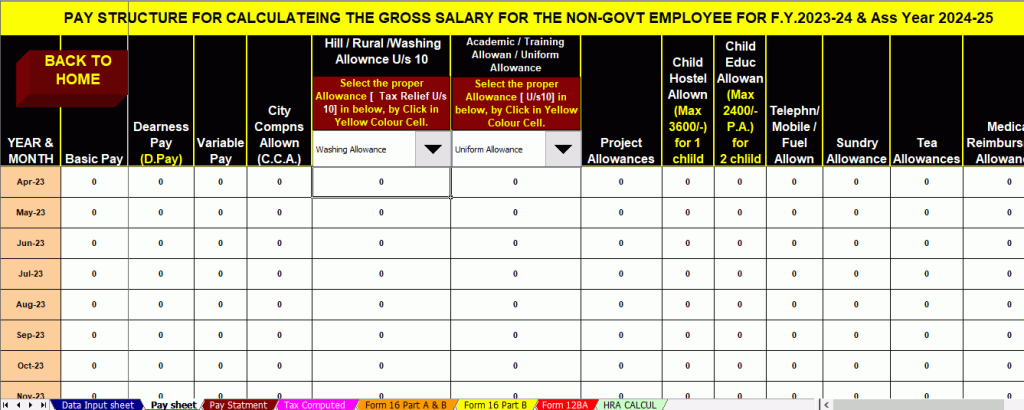

2) For instance, This Excel Utility has its own Salary Structure as per the Non-Government (Private) Employees' Salary Structure

3) For instance, Just fill in the data, and this Excel utility will automatically generate your income tax computed sheet.

4) For instance, This Excel Utility can Calculate your House Rent Exemption U/s 10(13A)

5) For instance, This Excel Utility has a separate Salary Sheet

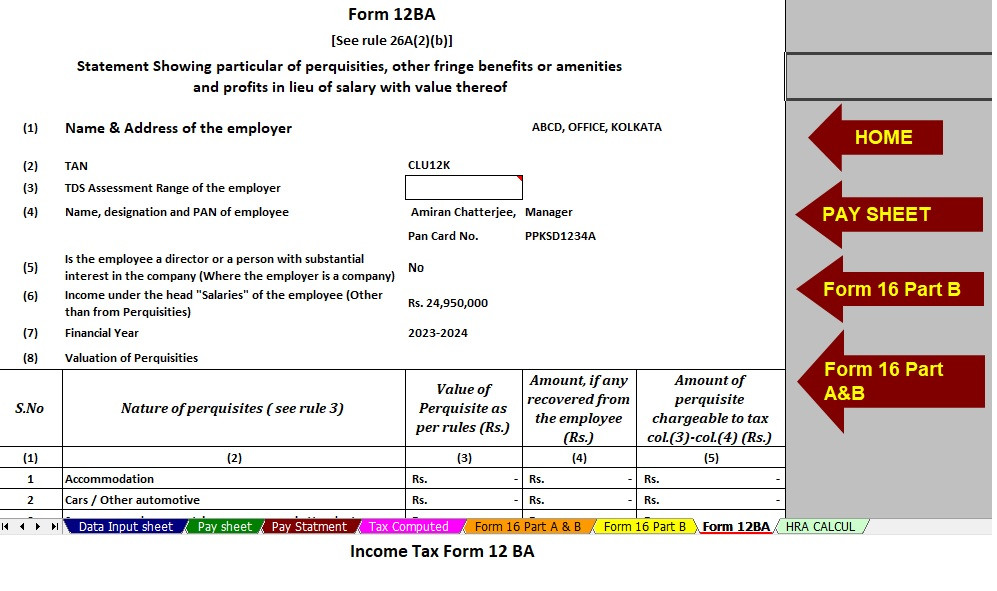

6) This Excel Utility have the Value of Perquisite Form 12 BA

7) For instance, This Excel Utility can prepare at a time your Form 16 Part B automatically for FY 2023-24

9) For instance, This Excel Utility can prepare at a time Form 16 Part A and B automatically for FY 2023-24