Introduction

Navigating the intricacies of tax compliance can be a daunting task for businesses, especially when it involves preparing Form 16 for a sizable workforce. Therefore, In this guide, we'll break down the process of efficiently preparing Form 16 Part A&B in Excel for the fiscal year 2023-24. In other words, Follow these step-by-step instructions to streamline the task for 50 employees.

However, Understanding Form 16

What is Form 16?

Above all, Form 16 is a crucial document that outlines the details of an employee's salary and the tax deducted by their employer. It serves as a comprehensive record for income tax purposes.

Importance of Form 16

In addition, Form 16 is not just a piece of paperwork; it's a legal requirement. It helps employees file their income tax returns accurately and ensures transparency in the taxation process.

Step-by-Step Guide

Gather Necessary Information

Before delving into Excel, make sure you have all the required information at your fingertips. After that, This includes salary details, TDS information, and any other relevant allowances.

Create a Master Spreadsheet

Begin by setting up a master spreadsheet in Excel, with columns for employee details, income components, Similarly, deductions, and the final taxable income.

Input Employee Data

Therefore, Enter the data for each employee into the spreadsheet. Ensure accuracy and consistency to avoid discrepancies later on.

Calculate Taxable Income

In other words, Use Excel formulas to calculate the taxable income based on the provided salary details and deductions. Double-check the formulas to eliminate errors.

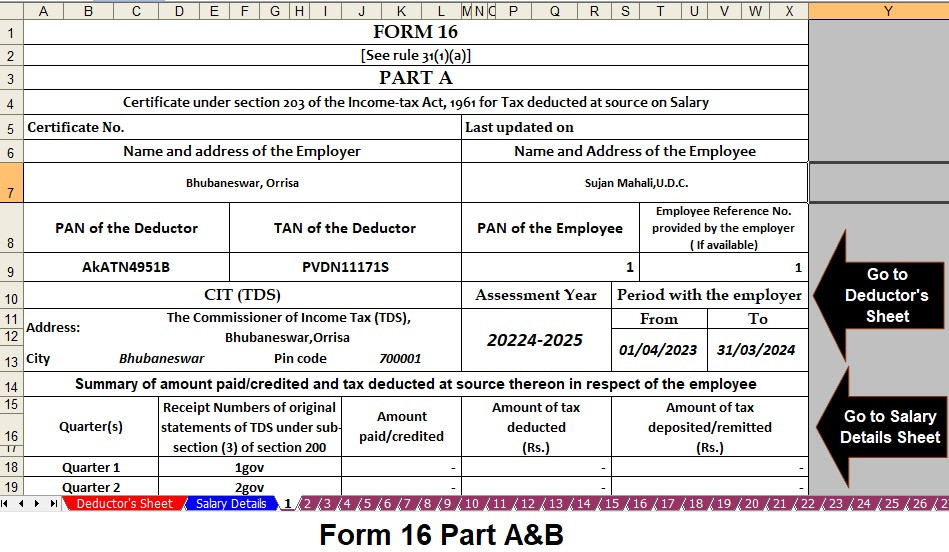

Generate Form 16 Part A & B

Create a separate sheet for Form 16 Part A&B, including employee and employer details, PAN, TAN, and a summary of taxable income.

Incorporate Amendments

However, Accommodate any changes or amendments required for specific employees. Excel's flexibility allows for easy adjustments.

Tips for Excel Efficiency

Utilize Excel Functions

Leverage Excel functions such as VLOOKUP and SUMIFS to streamline calculations and reduce manual effort.

Formatting Matters

Above all, Pay attention to formatting for a professional-looking Form 16. Use borders, colours, and bold fonts judiciously.

Validate Data

Regularly validate the data input and output to catch any discrepancies early in the process.

In Conclusion

Efficiently preparing Form 16 for 50 employees in Excel requires meticulous attention to detail and a strategic approach. By following this guide, you not only simplify the process but also ensure compliance with tax regulations.

FAQs

- Q: Can I use software other than Excel? A: While Excel is commonly used, specialized payroll software can also be employed for Form 16 preparation.

- Q: What if there are discrepancies in the provided data? A: It's crucial to communicate with the concerned departments to rectify any inaccuracies promptly.

- Q: How often should Form 16 be prepared? A: Form 16 should be prepared annually, reflecting the income and tax deductions for the financial year.

- Q: Are there any penalties for incorrect Form 16 submissions? A: Yes, incorrect submissions can lead to penalties. Accuracy is paramount to avoid legal consequences.

- Q: Can employees request changes in their Form 16? A: Yes, employees can request amendments if there are genuine discrepancies. Communication is key.

Download Automatic Income Tax Master of Form 10 Part A and B in Excel which can prepare at a time 50 Employees Form 16 for the FY 2023-24 and AY 2024-25

Feature of this Excel Utility

- This Excel Utility can prepare at a time 50 Employees Form 16 both of Part A and B for FY 2023-24

- This Excel Utility can prepare Automatic your Income Tax Liabilities as per the Income Tax Slab New and Old Tax Regime

- For instance, This Excel Utility have a unique Salary Structure for Individual as per the Budget 2023

- This Excel Utility have all the amended Income Tax Sections as modified in the Budget 2023-04 as per New and Old Tax Regime

- This Excel Utility can prevent your doubling or duplicating the PAN number of each employee, so you have no fear of double or duplicating name and PAN entry

- For instance, For Print Form 16 both Parts A&B in A-4 Papers Size

- For instance, Automatic Convert the Amount to in words without any Excel Formula

- This Excel Utility can be used by both Government and Non-Government Concerned

- This Excel Utility is just an Excel File, Download and start filling data in the input sheet and it magically prepares at a time 50 Employees Form 16 Part A&B

- You can prepare and Save the Employee's Data in your System. It works Office 2003, 2007 and 2010 also 2011 ms Office