Form 12BA is an income-tax statement form which depicts the particulars of prerequisites, other

fringe benefits, amenities, and profits in lieu of salary. It particularly

highlights the value of such payments and the taxable amount indebted by the

beneficiary. This form is rendered to employees along with Form 16. The article

looks at form 12BA in terms of its applicability and scope.

A Note on Perquisites

Perquisites,

commonly referred to as perks, is a casual emolument or benefit according to an employee on account of his/her services to an employer. These benefits, which

are rendered in addition to the periodical remuneration, are classified into

the following kinds:

- Monetary Perks – benefits provided in cash, the likes of which include holiday expenses, travel expenses, etc.

- Non-monetary perks – benefits provided in kind, which includes rent-free accommodation/accommodation at concessional rent, employee stock options/restricted stock units, free meals, water, gift vouchers, car, etc.

Applicability

Form 12BA is only

issued to an employee if his/her annual salary is more than Rs. 1,50,000. If

not, the particulars specified in ‘Part B’ of Form 16 is considered sufficient

for this purpose. In this respect, the calculation of salary includes:

- Basic pay

- Allowances

- Bonus

- Commission

- Any other monetary payment

- Dearness allowance

- Employer’s contribution towards provident fund

- Exempt allowances

- Value of perquisites

- Payments which are not a part of perquisites

- Lump-sum payments provided during the cessation of service

- Superannuation

- Voluntary retirement benefits

- Commutation of pension and the like

It may be noted

that Form 12BA must be issued If the salary of an employee is more than Rs.

1,50,000; whether or not perquisites were provided in the particular

year. In the case of the latter, the employer is required to mention the

same in the form.

Deadline

Employers may furnish

this form by June 15th of the financial year that immediately succeeds the

particular year. The date is determined in accordance with the due date for

Form 16, given that these two documents are to be furnished simultaneously.

Difference Between Form 12BA and Form 12B

The only aspect of the similarity between these forms is that both of them are governed by the same

Rule (Rule 26). Form 12BA, as we now know, is a statement of perquisites issued

by an employer to an employee, whereas the statement in Form 12B is provided by

an employee who moves to another employer in the middle of a financial year.

The latter is issued to ensure that the employees joining a new organization

under these circumstances has submitted the requisite details pertaining to TDS

deductions of the previous salary. This form must include the particulars of

income earned by the employee and the tax deducted at source on such income.

Structure of the Form

Form 12BA comprises

of the following sections:

The First Section

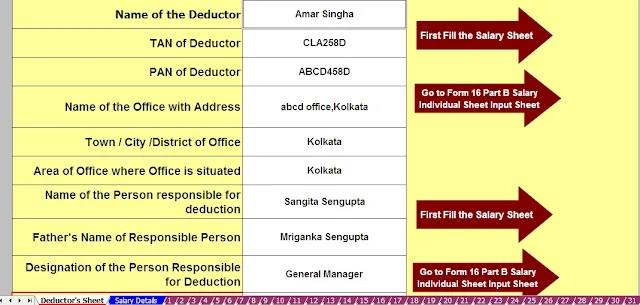

The initial part of

the form relates to the particulars of both the employer and the employee. The

particulars related to the employer include:

- Name and Address of the employer

- TAN Number

- TDS Assessment range of the employer

The

details of the employee include:

- Name of the employee

- His/her designation

- Details of income

- The relevant financial year

- The value of perquisites (if any)

Value of Perquisites

This section

comprises of the details of particulars and its calculation. Further reference

to its contents can be found on the below-given image.

Details of Tax and Deduction

This section

necessitates the re-speciation of data already mentioned in Form 16. The

details to be furnished here are:

- Tax deducted from the employee’s salary.

- Tax remitted by the employer on behalf of the employee.

- Total tax paid.

- Date of remittance into governmental accounts.