One of the most

popular section when it comes to income tax saving is 80C. People are

enlightened of 80C and use this section fully when it comes to Income tax

deductions. But many times taxpayer forgot other misogynist income tax

deductions which can reduce their tax burden. In this post, we will take a

squint at less known income tax deductions which can be used to save

increasingly tax.

Section 80GG Deduction

on Rent Paid

Under section 80GG,

an individual can requirement a deduction for the rent paid. This is workable

only if you are not getting HRA from your employer. This section is workable

only for self-employed or salaried. You will be unliable to requirement up to

Rs.5000 per month or 25% of total income or very rent paid in glut of 10% of

total income (whichever is less).

Section 80TTA and 80TTB

for wall interest

Section 80TTA of the

income tax act offers a tax deduction on interest income earned from deposits

or saving wall account. Interest income earned from savings worth up to

Rs.10000 is deductible from the gross income. A new section 80TTB is introduced

this year. The new section is workable to senior citizen. As per 80TTB up to

Rs.50000 is unliable to be deducted from the gross income of senior citizen.

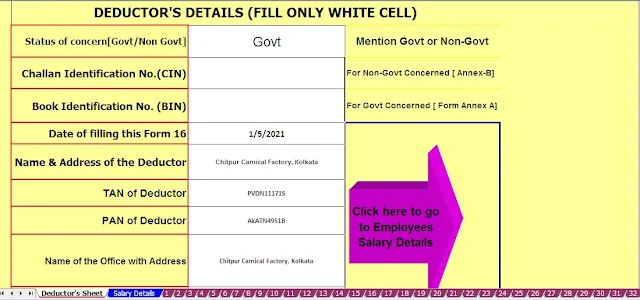

Download And

Prepare At a Time 100 Employees

Automated Income Tax Form 16 Part A&B (Modified

Format) [This Excel Utility Prepare At a time 100 Employees Form16 Part A&B in New Format for A.Y. 2020-21]

The main feature of this Excel Utility:-

1)

Prepare At time 100

Employees Excel Based Form 16 Part A&B ( Modified Format of Form 16 Part B Vide CBDT

Notification No.36/2019 Dated 12/04/2019 ]

2)

All the Amended Income Tax

Section have in this utility as per Budget 2019

3)

You can print individual Form

16 Part Part A&B

4)

Most easy to install just

like an Excel File

5)

Easy to Fill the all column

6)

Automatic Convert the Amount

to the In-Words

Section 80G for

Charitable Deduction

Suppose you have made

a donation to the charitable organization or to the unrepeatable relief fund in

last financial year. You can requirement the deduction of this value under

section 80G and save increasingly tax. There are a unrepeatable set of

organizations/institutions donation to them offers 100% deduction. You can take

wholesomeness of this section.

Interest on Loan taken

for higher education under 80E

Income tax section

80E allows you to requirement goody on interest paid for education loan. If you

have taken education loan don’t forget to make requirement for interest

deduction. This deduction is unliable for maximum eight years or till the

interest is fully paid.

Section 80DDB for

Medical Treatment

An expense incurred

for the treatment of specified diseases such as AIDS, Cancer, Thalassemia etc

can be personal for income tax deduction under section 80 DDB. The maximum

value permissible under this section is Rs.40000. The limit for 80DDB for the

senior resider is Rs.60000. You will need document Form 10-I from a qualified

medical practitioner for this.

Interest payment for

Home Loan of Second House

If you have taken a

home loan for ownership a second house you can requirement up to 2 Lakh per

year towards interest payment. This as per income tax section 24b. If you have

rented a second house you need to declare income from that. If second house is

rented or not rented you need to declare one house as deemed rented and other

as self-occupied.

Download And Prepare At a Time 100 Employees Automated Income Tax Form 16 Part B (Modified Format) [This Excel Utility Prepare At atime 100 Employees Form 16 Part B in New Format for A.Y. 2020-21]

The main feature of this Excel Utility:-

7)

Prepare At time 100

Employees Excel Based Form 16 Part B ( Modified Format of Form 16 Part B Vide CBDT

Notification No.36/2019 Dated 12/04/2019 ]

8)

All the Amended Income Tax

Section have in this utility as per Budget 2019

9)

You can print individual Form

16 Part B

10)

Most easy to install just like

an Excel File

11)

Easy to Fill the all column

12)

Automatic Convert the Amount

to the In-Words

Premium for Health

Insurance under 80D

You can requirement

deduction up to Rs.25000 for health insurance premium paid (for self, spouse,

and children). If health insurance is taken for senior resider payment you can

requirement deduction up to Rs.30000.

Amount Invested in NPS

under section 80CCD

Most of the people

are not enlightened of section 80CCD of NPS. You can invest up to 1.5 in NPS

under section 80C to avail tax benefits. Apart from this you can invest spare

Rs.50000 in NPS and get income tax deduction under section 80CCD. This goody is

misogynist for investment in NPS only.