How to do Income Tax Calculation for FY 2020-21?

Which Tax Structure to Select?

As per budget 2020, you cannot claim any tax

deduction or exemption if you plan to opt new tax structure. So, as an

individual tax payer if you opt for the new tax regime with reduce tax rate you

need to forgo all tax breaks available today. Fortunately, you have option to

continue with old tax structure. Salaried person can switch between old and new

tax structure.

Firstly, we will talk about which tax deduction and

exemption you need to forgo in case you opt for new tax structure with reduce

tax rate. Secondly, we will take few test cases and do income tax calculation

for FY 2020-21 to know which tax structure to select?

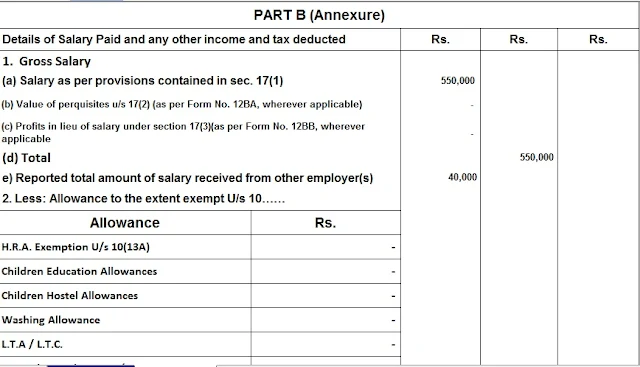

Also Download Automated Income Tax Revised Form 16 Part B for F.Y. 2019-20 [ This Excel Utility can prepare at a time 50 employees Revised Form 16 Part B ]

List of Tax Deductions and Exemption not allowed in new Tax Structure

1 Tax Deduction Under Section 80C

The most popular

tax deduction of 1.5 Lakh under section 80C is not applicable for new tax

structure. This means you cannot claim any benefit for investment made in the

instruments such as PF, PPF, Life insurance premium, school tuition fees of

children, ELSS, PPF, NPS etc.

You can claim

deduction under section 80CCD for the employer contribution on account of

employee for NPS.

Also Download Automated Master of Form 16 Part A&B for the Financial Year 2019-20 [ This Excel Utility can prepare at a time 50 employees Form 16 Part A&B, who are not able to download the Form 16 Part A from the TRACED PORTAL, they can use this Utility]

2 Tax Deduction Under Section 80D

No tax deduction is

allowed for the medical insurance premium and preventive health checkup under

section 80D for new tax structure.

3 No LTA Benefits

For new tax structure

LTA – Leave travel allowance exemption which is currently available to salaried

employee for twice in block of four years is not allowed.

4 HRA

HRA is house rent

allowance. HRA is paid to salaried individuals by employer as a part of salary.

Earlier taxpayer was able to claim HRA up to certain limit. In new tax

structure it is not permissible.

5 Standard Deduction

A standard

deduction benefit of Rs.50000 currently available to salaried tax payer is not

applicable in new tax slab.

6 Section 80TTA Benefits

Section 80TTA

provides deduction of Rs.10000 on interest income. On new tax regime this

benefit is not available.

7 Section 80DDB Benefits

Benefits for

disability under section 80DDB up to Rs.40000 not available in case you are

planning to opt for new reduced tax structure.

8 Section 80E Education Loan

Tax break

permissible on the interest paid on education loan will not be claimable under

section 80E.

9 Section 80G of Donation

You were able to

make donation under section 80G and claim income tax benefit of equivalent

amount. The said deduction is not available in reduced tax structure.

10 Section 24 Home Loan Interest

Under section 24 of

the Income tax act, an individual was able to claim tax deduction on the

interest payment on the housing loan up to a maximum amount of Rs.200000. This

benefit is not extended if you opt for new tax structure.

Other deduction applicable under chapter VIA like section 80C,

80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA,

80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc) These Tax Section are not entitled for New Tax Regime – Only allow

to get relief who are Opt in Old Tax Regime.

Income Tax Calculation FY 2020-21 (AY 2021-2022)

Now let’s calculate

actual tax benefits by doing Income Tax Calculation and comparing both the tax

structures in various cases.

Case 1 – Salaried Individual claiming common deduction (80C,80D) and Home Loan Benefits

In first case I

will take example of salaried individual with income of 20 Lakh & 10 Lakh.

Let’s consider in both the cases individual takes benefits of standard

deduction Rs.50000, deduction of Rs.1.5 Lakh under section 80C, Rs.25000 under

section 80D and Interest on home loan up to Rs.200000.

Now two options are

available to the salaried individual. First he/she can opt for old tax

structure with all above deduction or he/she can forgo all deduction and opt

for new reduced tax structure.

If individual has

annual income of 20 Lakh and old tax structure is opted with tax deductions.

Applicable tax is 2.85 Lakh. If new tax structure is adopted applicable tax

amount is 3.37 Lakh. Similarly, if annual income is 10 Lakh and old tax

structure is adopted applicable tax is Rs.27500. For new tax structure

applicable tax is Rs.75000. Calculation is given below.

Example Picture of

Calculation of Tax 1 and 2

Case 2 – Salaried Individual claiming common deduction under section 80C, 80D and Standard Deduction

In second case

let’s assume that salaried individual is taking full benefits of section 80C,

80D and standard deductions as of now. Under new tax regime these deductions

are not applicable. Suppose income level of individual is 10 Lakh. If old tax

regime is selected payable tax is Rs.70200 on the other hand if new tax regime

is selected payable tax is Rs.78000.

Gross

Income Rs/-

|

Tax

as per Old Tax Structure Rs/-

|

Tax

as per New Tax Structure Rs/-

|

Additional

Tax Saving Rs/- / Payable

|

7.5

Lakh

|

18200

|

39000

|

-20800

|

10

Lakh

|

70200

|

78000

|

-7800

|

12.5

Lakh

|

124800

|

130000

|

-5200

|

15

Lakh

|

202800

|

195000

|

7800

|

20

Lakh

|

358800

|

351000

|

7800

|

Case 3 – Salaried Individual not claiming any deduction or exemptions

In third case let’s

assume that salaried individual is not claiming any deduction of exemptions as

of now. So, under new tax regime he/she will get benefit of reduced tax rates

and he/she needs to pay less taxes. Suppose income level of individual is 15

Lakh. If old tax regime is selected payable tax is Rs.257400 on the other hand

if new tax regime is selected payable tax is Rs.195000 only.

Gross

Income Rs/-

|

Tax

as per Old Tax Structure Rs/-

|

Tax

as per New Tax Structure Rs/-

|

Additional

Tax Saving Rs/-

|

7.5

Lakh

|

54600

|

39000

|

15600

|

10

Lakh

|

106600

|

78000

|

28600

|

12.5

Lakh

|

179400

|

130000

|

49400

|

15

Lakh

|

257400

|

195000

|

62400

|

20

Lakh

|

413400

|

351000

|

62400

|

Conclusion:-

From above cases example it is obvious that in most of the cases old tax rate with deduction offers higher tax benefits. New reduced tax rate is helpful only if you are not claiming any deductions as of now. (which is very rare)

If you have home loan and higher income you will get higher tax benefits in old tax rate compared to new tax rate.

From above cases example it is obvious that in most of the cases old tax rate with deduction offers higher tax benefits. New reduced tax rate is helpful only if you are not claiming any deductions as of now. (which is very rare)

If you have home loan and higher income you will get higher tax benefits in old tax rate compared to new tax rate.

Free Download Automated Income Tax All in One Excel Based Software for only Non-Govt ( Private ) Employees for the Financial Year 2020-21and Assessment Year 2021-22 as per Budget 2020 with Option in Old Tax Regime and New Tax Regime

Feature of This Excel Utility :-

1) You can choose your option as Old or New Tax Regime as per

Budget 2020

2) This Excel Utility Prepare at a time your Income Tax

Computed Sheet + Automated H.R.A. Calculation U/s 10(13A) + Automated Income

Tax Form 16 Part A&B in Revised Format + Automated Revised Form 16 Part B +

Automated Income Tax Form 12 BA for the F.Y. 2020-21.

3) Automatic Convert the Amount in to the In-Words without any

Excel Formula

4) All the Income Tax Section have in this Utility as per the

Budget 2020

5) The Salary Structure have in this utility as per the all of

the Private Concern’s Salary Pattern.