The Income Tax Office states that any employee can change the tax structure at the moment of filing the income tax returns. TDS will be adjusted in the same way The Income Tax Office has a mastermind explanation for all people who need to choose new tax pieces The lower income tax rates, as announced in the 2020 budget, came in April 2020.

The old tax divisions will remain the same for the rest of the year, so individuals will have to choose between the two. Tax experts say that a person should choose a new tax structure or rely on the former on a case-by-case basis because, under this new lower tax rate, one should abandon a huge measure of thinking that can help one reduce tax revenue.

Under the new tax rate, there is zero duty on the income of two and a half million dollars; 5% for income from 2.5 million to ₹ 5 million; 5% to .5 10% for income up to 7.5 lakhs; Income 15% for income ranging from 5 7.5 million to 10 10 million; 20% for income ranging from 10% to .5 12.5 million; Income 25% for income ranging from .5 12.5 million to 15 15 million; 15 million for income over 30 million.

Here’s what the Income Tax Department has clarified:

1) Employees should educate their officers about the expectation of choosing a new tax structure with the ultimate purpose of source or TDS from their compensation rather than income from business or calling.

2) If such an option is not cleared by an employee, he will continue to levy a tax on further orchestrated inconsistencies in the IT Act.

3) Once the new discount tax rate selection expectations have been revised with the business, Due to TDS it will be relevant for the year and cannot be changed.

4) The Income Tax Office says that the employee can change the tax structure option while recording the income tax return and the degree of TDS bit will be adjusted in the same way. The deductor will list his total income and deduct the TDS (tax deducted at source) at this time by the strategy of Section 115 BAC of the (Income Tax) Act. Otherwise, the business will create TDS, ”the income tax department said.

5) According to the 116 BBC, the new income tax department presented in the current budget of 2020, obviously, employees (basically those who do not earn from business or calling) can not change the rehearsal choice to encourage the deducted TDS now. Change it for the most part during tax recording. "(With agency input) The deductor will list his total income and deduct the TDS (tax deducted at source) at such times as per the strategy of Section 115 BAC of the (Income Tax) Act.

If such an indication is not given by the employee, the Income Tax Department will create TDS on the business without considering the strategy of 114 BC, "said the Income Tax Department. Or do not earn from calling) I can now change the rehearsal choice to encourage deducted TDS Most of the time it is not recommended for recording taxes Change "(with agency inputs)

The deductor will list his total income and deduct the TDS (tax deducted at source) at such times as per the strategy of Section 115 BAC of the (Income Tax) Act. If such an indication is not given by the employee, the business will create TDS without considering the strategy of the Income Tax Department 114 BC, "said the Income Tax Department.

5) According to the new Income Tax Department's 116 BBC presented in the 2020 budget, Or do not earn from calling) I can now change the rehearsal choice to encourage deducted TDS Most of the time it is not recommended for recording taxes Change "(with agency inputs)

5) According to the new Income Tax Department's 116 BBC presented in the 2020 budget, Or do not earn from calling) I can now change the rehearsal choice to encourage deducted TDS Most of the time it is not recommended for recording taxes Change "(with agency inputs)

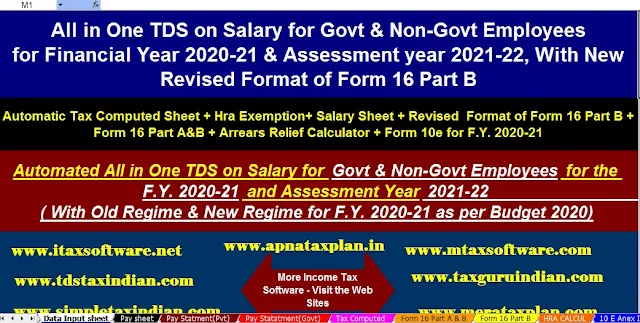

Download Automated Income Tax Preparation Excel Based Software All In One for Govt and Non-Govt employees for the Financial Year 2020-2021 & Assessment Year 2021-22 [ This Excel Utility Can prepare at a time your Tax Computed Sheet as per your option U/s 115BAC Old Tax The regime or New Tax Regime + Automated House Rent Exemption Calculation U/s 10(13A + Automated Income Tax Arrears Relief Calculator U/s 89(1) + Automated Income Tax Individual Salary Structure for both Govt and Non-Govt Employees as per their Salary Structure + Individual Salary Sheet + Automated Income Tax Revised Form 16 Part A&B and Form 16 Part B ]