As per the rules, every eligible candidate has to file an income tax return. 2020-21

The income tax rules for the new financial year have undergone some major

changes. These changes are being followed from 1 April 2020.

As per the rules, every eligible candidate has to file an income

tax return.

Through the Union Budget, 2020-21 FM Nirmala Sitharamanhos has made some major

changes to the income tax rules. From 1 April 2020, these changes will take effect.

From April 1, 2020, FM Nirmal Sitharamanhas introduced a new tax system. Those who

choose such disciplinary forces should expect some concessions and concessions.

For Individuals and HUFs:- It is proposed to introduce new section 115BAC for lower

rates of duty. People without business income / HUF can take such steps. The once used

option can be withdrawn at once. If the person / HUF stops earning business, they may

choose this type of project again.

The rates of surcharge will be as under: -

• Total income has exceeded Rs 50 lakh but not more than 10 percent

• Total income exceeds Rs 1 crore but does not exceed Rs 2 crore 15%

• Total income exceeded Tk 2 crore but did not exceed Tk 25 crore

• Total income exceeds five crore %%%

The new income tax will be calculated for the total tax assessors

excluding the following income: -

Section 10AA, 32AD, 33BA, 35 (1) (ii), 35 (1) (IIA), 35 (1) (iii), Section 35 (2AA), 35 AD, 35 cc,

and Chapter VIA Discount VI (excluding)

Release the travel allowance under paragraph 5 of section 10 (5).

House rent allowance under section 10 (13A).

Allowance for Members of Parliament / MLAs under Section (1 17).

Minor Minor 10/32 (etc.) Allowance for income etc.

Standard discount of 50,000 U/S 16.

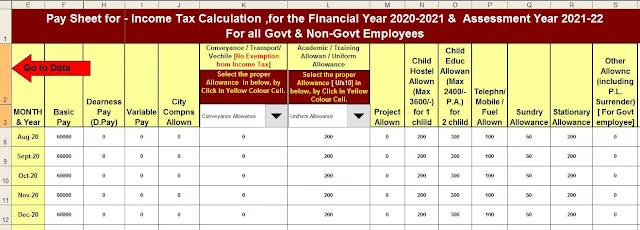

DownloadAutomated Income Tax Preparation Excel Based Software All in One for the Govt& Non-Govt Employees for the Financial Year 2020-21 and Assessment Year2021-22 As per the New Tax Style New and Old Tax Regime U/s 115BAC in theBudget 2020 [ This Excel Utility Can Prepare at a time Tax Computed

Sheet + Individual Salary Structure + Individual Salary Sheet + Automated

Arrears Relief Calculation U/s 89(1) With Form 10E + Automated Revised Form 16

Part A & B and Revised Form 16 Part B ]

Exemption from home property Home-outs (self-occupied / vacant) Interest income paid on

24(b)

Entertainment allowance and employment / professional tax are not available.

15,000 / -

It is not allowed to set bearable losses and depreciation from previous assessment years.

Home without loss under principal income from home property.

Accelerate u / s 32 (1) (iia) without the benefit of severe devaluation. However the general

devaluation can claim you

However, the exemption / discount / discount / discount / allowance of the new tax assessors

is still as follows:

Financial International Financial Services Center (IFSC) / HUF, 80 /

Individuals with Discount Units

• Discount U / s 80CCD (2) and 80JJAA will be available.

Ad discount is available for post discount interest (Rs. 3500 for individual account holder and

Rs. 7000 for joint account holder).

Mature amount received in LIC will be discounted

The amount of interest received on Sukanya Samriddhiway and the amount of maturity will

still be discounted.

In the case of NPS, EPF or supervision fund, the employer's contribution will still be deductible

up to Rs.5.5 lakh and will be taxable in the hands of some more employees.

Employees will still get a discount of over Rs 5,000 from the employer. Additional amount will

be taxable.

Meal coupons received from year recruiters will get a maximum discount of Rs 50 per day for

meals.

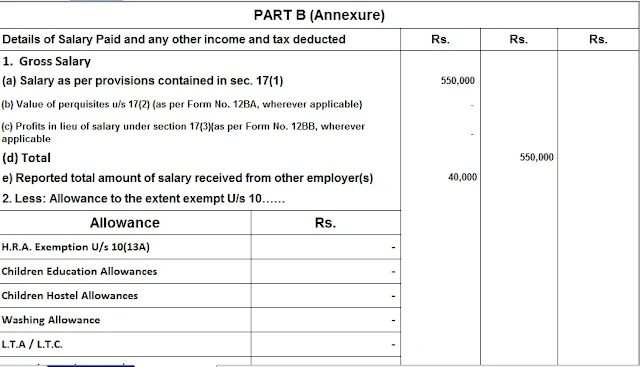

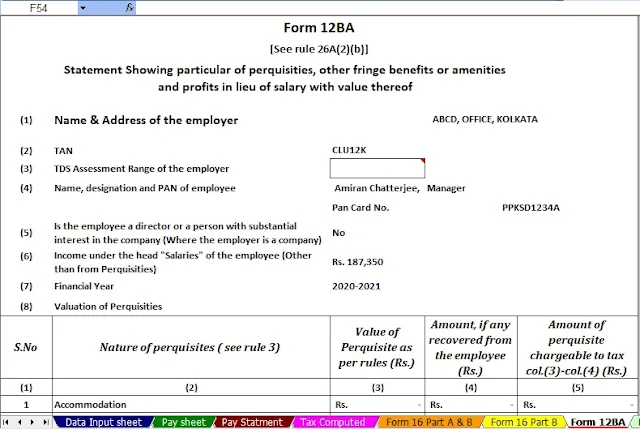

Download Automated Income Tax Preparation Excel Based

Software for the Private Employees for the

F.Y.2020-21 & A.Y.2021-22 As per the New and Old Tax

Regime U/s 115BAC in Budget 2020 (This Excel Utility can

prepare at a time your Tax Computed Sheet + Individual

Salary Structure as per Private Concerns Salary Patterns

+ Automated Income Tax Form 12 BA + Automated Income

Tax Revised Form 16 Part A&B and Form 16 Part B ]

There will be a discount on the amount received in the holiday

encashment.

The amount received in the voluntary retirement scheme will be discounted up to

Rs. 5,00,000.

For Cooperative Societies: - New section 115BAC has been introduced to provide

taxability at the rate of 22% of residential co-operative societies. Surcharge @ 10% will be

charged No AMT liability on those who have opted for the new tax regime for residential

cooperatives

Will not be pressed. The option once used by a residential co-operative

society cannot be withdrawn in subsequent years.

FM Nirmal Sitharaman also made some changes during the old regime.

Some of the changes are as follows:

Distribute dividends from 1 April 2020 Deductions are now taxable in the hands of recipients

Direct new tax rebate project has been launched. Those who pay this amount by

March 31, 2020 will have their interest advertising penalty waived. However, the March 31,

2020 deadline has been extended due to the Covid-19 effect.

The tax audit threshold has been increased from 1 crore to 5 crore if the previous

year's cash cover / total receipts do not exceed 5%. Also, the cash payment in the previous

year is not more than 5%.

A 15% discount has been introduced for manufacturing companies for the new generation

and power sector companies.

• Section 234G (Insert new section) Rs. 200 per day for default of statement or

certificate submitted under section 35 by research institute, university, college, institution or

any other institution

Major changes for the following fiscal year 2019-20:

201 tax-1 fiscal year has brought some changes in the income tax rules. Consistent with the

previous years, the expectations and sentiments of Indian central taxpayers, especially

salaried and pensioners, have increased when former Union Finance Minister Mr. Piyush

Goel presented the budget for the financial year 2010-2010.

Income up to five lakh rupees is tax free

A person whose income is less than five lakh rupees does not have to pay any tax. Under

section 87, the tax exemption has been increased to Rs.5000. to 12,500, income 5 lakh free.

What will happen if the income is more than 5 lakh rupees?

If the net income is more than five lakh rupees, then a person has to pay tax and no exemption

will be given.

Note: Considering the above two issues, it is mandatory to submit ITR

(Income Tax Return) even if the threshold is five lakhs or less. If the limit

of the original discount is two and a half lakh rupees, you have to file ITR.

How much has the standard discount been increased?

The standard deduction has been increased from Rs 40,000 to Rs 50,000.

When was the standard discount reintroduced?

Standard discounts were reintroduced in 2018. After it was rebuilt, the government waived

taxes on transportation and medical care provisions, which reduced the change in benefits.