You may

have heard stories where a genuine ailment in a family has depleted them of

their riches. These are stories as well as can transpire. To prepare for such

issues – you should purchase Health Insurance. The great part is you

additionally get tax advantage on the premium paid for Health insurance. In

this post, we settle what's and How's of Tax Deduction on Health Insurance sec

80D!

The amount Tax Benefit I jump on Health Insurance?

Financial

plan 2018 has upgraded the restriction of Health Insurance premium qualified

for tax deduction under section 80D for Senior residents. The breaking point is

Rs 25,000 for individuals with age under 60 years and it's Rs 50,000 for senior

residents. You can likewise claim Rs 5,000 for Preventive Health tests. This is

inside the Rs 25,000/50,000 breaking point.

You can

likewise, claim extra tax advantage on Health insurance premiums paid for your parent.

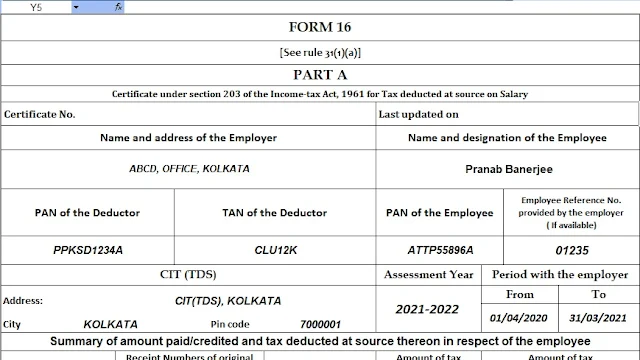

Download Automated Income TaxRevised Form 16 Part A and B for the Financial Year 2019-20 [This

Excel Utility can prepare at a time 50 Employees Form 16 Part A and B ]

What's the Tax Benefit for Health Insurance of

Parents?

You can

claim an extra tax deduction on the premium paid for Health Insurance of your

folks. This can be up to Rs 25,000/- on the off chance that your folks are

under 60 years old enough and Rs 50,000/- on the off chance that any of your

folks are over 60 years old enough.

Be that as

it may, simply paying premium isn't sufficient. The strategy ought to have been

purchased by you for example you ought to be the propose of the strategy. There

are situations when individuals pay a premium for a current arrangement which

was repurchased a couple of years by their folks and claim tax deduction u/s80D. This can land you in a tough situation. So the most ideal route is to

either purchase another arrangement or keep in touch with the concerned

insurance organization to change the proposed at the hour of reestablishment.

Download Automated Income TaxRevised Form 16 Part B for the Financial Year 2019-20 [This

Excel Utility can prepare at a time 100 Employees Form 16 Part B ]

Assume you

purchased family floater Health insurance which has a premium of Rs 35,000

which covers self, life partner and youngsters. Presently would you be able to

part this premium among a couple with the goal that both can claim advantage?

The appropriate response is NO. The explanation being there must be one propose

for strategy and subsequently, the tax advantage must be claimed by one.

To get

around this, you may pick two separate strategies yet remember the general

premium may be higher. So do your counts before choosing.

Download Automated Income TaxRevised Form 16 Part B for the Financial Year 2019-20 [This

Excel Utility can prepare at a time 50 Employees Form 16 Part A and B ]

What does the

Income Tax Benefit on preventive health

exam?

Tax

exclusion up to Rs 5,000 is considered a preventive health exam of Self, Spouse,

subordinate Children and Parents. This cutoff is inside the Rs 25,000/Rs 50,000

deduction.

The most

extreme tax deduction u/s 80D can be Rs 1,00,000 on the off chance that you

purchase Health insurance for self and your folks and both you and your folks

are senior residents.

2. HUFs likewise, claim this deduction for premium paid for guaranteeing the health of

any individual from the HUF

3. To

profit deduction, the premium ought to be paid in any mode other than money. In

any case, the instalment for Preventive Health exam should be possible in real

money.

Feature of this Excel Utility:-

1) This

Excel Utility calculate your tax both of New Tax Regime and Old Tax Regime as

per the Budget 2020 in new Tax Style U/s 115 BAC

2) This

Excel Utility have the Salary Structure as per the all Non-Government (Private)

Concerns Salary Pattern.

3) This

Excel Utility can calculate your House Rent Exemption U/s 10(13A)

4) This

Excel Utility has the Individual Salary Sheet

5)

Automated Income Tax Form 12 BA

6)

Automated Income Tax Revised Form 16 Part A and B in New Format

7)

Automated Income Tax Revised Form 16 Part B in New Format

8)

Automatic Convert the Amount into the In-Words without any Excel Formula