Anticipating your income tax or figuring your income

tax liabilities is by all accounts an exceptionally overwhelming undertaking

for huge numbers of us. On the off chance that you had confidence in this

legend, without a doubt the Fund Budget 2020 would refute you.

Now according to Budget 2020, to add salt to the

injury, not just you are required to deal with your taxes yet in addition you

need to choose which income tax regime is useful to you.

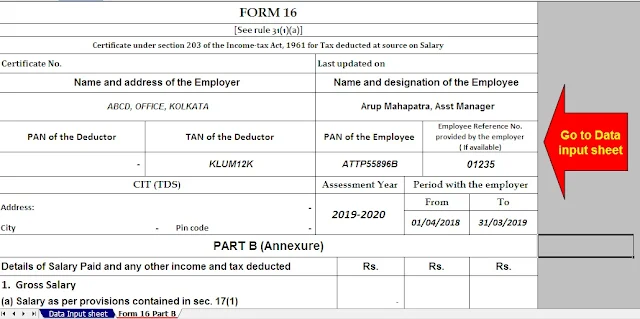

Download Automated Income Tax Revised Form16 Part B for the Financial Year 2019-20 [This Excel Utility can prepare at a time 100 Employees Form 16

Part B]

It isn't obviously known to me whether there are some

other nations on the planet where two distinctive income tax section is

operational at the same time.

India has never had two independent and equal income tax

regime throughout the entire existence of income tax. In any case, I am certain

that the income office has faith in 'Change is the main consistent' suggestion.

The Money Pastor has obviously told in her budget

discourse this new tax regime will offer help to the tax-payers. In this

manner, in this post, you would see a relative investigation of the Income Tax

Adding machine F.Y 2020-21 and see if it is to be sure advantageous or not.

Comparison of 2 Tax Regimes

Points

of interest - Old Tax Regimes

• It

energizes interest in tax sparing instruments

• Existing

income tax deductions are suitable

• Standard

deductions and Expert tax are deducted from income

• This

the tax regime is increasingly helpful for income up to Rs.15 lakh.

Weaknesses - New Tax Regimes

• It

debilitates ventures to spare tax

• No

existing deductions are reasonable

• No

deduction reasonable for Standard Deduction and Expert tax

• This

the tax regime is increasingly valuable for income above Rs.15 lakh.

Previously, delving into the profound we should

simply observe what are the significant features of the New Income Tax Regime

for F.Y 2020-21.

Download Automated Income Tax Revised Form16 Part A & B for the Financial Year 2019-20 [This Excel Utility can prepare at a time

100 Employees Form 16 Part A & B]

Standard

Deduction on Compensation income isn't allowed any more;

1. Professional

Tax additionally not allowed under the new tax regime;

2. Deduction

because of Income from House Property for example enthusiasm on oneself

involved house not allowed now;

3. Set

off of conveyed forward misfortunes and Deterioration is not allowed now;

4. Deductions

for any recompense are not allowed now;

5. Main

deductions U/S 80 C, 80 CCC, 80 D, 80E, 80 U, 80 G and so on are not allowed

under the new income tax regime.

Income Tax Piece pertinent for F.Y 2020-21 and A.Y

2021-22

Old Tax Regime for General

Taxpayers as long as 60 Years old

Sl No

|

Tax Slab(Rs.)

|

Tax Rate

|

Income Tax (Rs)

|

1

|

Income up to Rs.2,50,000

|

0

|

Nil

|

2

|

Rs.2,50,00 to Rs.5,00,000

|

5%

|

Taxable Income X 5%

|

3

|

Rs.5,00,001 to Rs.10,00,000

|

20%

|

Rs.12,500 + (TI – Rs.5,00,000) X 20%

|

4

|

More than Rs.10,00,000

|

30%

|

Rs.1,12,500 + (TI – Rs.10,00,000) X 30%

|

All Deductions are allowed under the

Old Tax Regime

New Tax Regime for General Taxpayers up

to 60 Years of Age

Sl No

|

Tax Slab(Rs)

|

Tax Rate

|

Income Tax (Rs)

|

1

|

Income up to ₹2,50,000

|

0

|

Nil

|

2

|

Rs 2,50,00 to Rs 5,00,000

|

5%

|

Taxable Income X 5%

|

3

|

Rs 5,00,001 to Rs 7,50,000

|

10%

|

Rs 12,500 + (TI – Rs 5,00,000) X 10%

|

4

|

Rs 7,50,001 to Rs 10,00,000

|

15%

|

Rs 37,500 + (TI – Rs 7,50,000) X 15%

|

5

|

Rs 10,00,001 to Rs 12,50,000

|

20%

|

Rs 75,000 + (TI – Rs 10,00,000) X 20%

|

6

|

Rs 12,50,001 to Rs 15,00,000

|

25%

|

Rs 1,25,000 + (TI – Rs 12,50,000) X 25%

|

7

|

More than Rs 15,00,000

|

30%

|

Rs 1,87,500 + (TI – Rs 15,00,000) X 30%

|

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2020

3)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

4)

Individual Salary Structure as per the West Bengal

Govt. Employees Salary Pattern as per ROPA-2019

5)

Individual Salary Sheet

6)

Individual Tax Computed Sheet

7)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21