Finance Budget 2018 alongside numerous progressions to tax laws also presented another Section 80TTB. As per this Senior citizens can guarantee tax exemption up to Rs 50,000 on the interest income from bank/post office fixed store, repeating store, or investment account. Also, if a senior citizen picks to exploit Section 80TTB, he can't guarantee further tax advantage

Download Automated Income Tax Revised Form 16 Part B for theA.Y.2020-21 [ This Excel Utility Prepare at a time 50 Employees Form 16 Part B for F.Y.2019-20]

Non-senior citizens and HUFs are not qualified for 80TTB exemption. Anyway, Non-senior citizens can in any case keep on profiting the tax advantage offered under section 80TTA, where interest income up to Rs 10,000 from a bank account is tax excluded.

In this way, going ahead from FY 2018-19 (AY 2019-20) there is NO change for individuals beneath the age of 60 while for Senior Citizens, they get extra tax exemption for the interest income.

Moreover, on account of Senior Citizens, the edge for TDS (Tax Deduction at Source) on interest income has been raised from Rs 10,000 to Rs 50.000 from FY 2018-19. On the off chance that your income is not exactly the income tax limit, you can dodge TDS by filling and submitting Form 15H to applicable banks and financial establishments.

Section 80TTB Vs 80TTA:

Section 80TTA

|

Section 80TTB

|

|

Eligibility

|

Available for all taxpayers. Moreover, if Senior citizens opt for 80TTB, they cannot take 80TTA advantage

|

Only Senior Citizens can avail

|

Tax Relaxation

|

Max Rs 10,000/-

|

Rs 50,000/- exemption

|

Entitled Income

|

Only interest income in savings

the account is considered (both

Post office & bank account are eligible)

|

Interest income from Fixed Deposit, Recurring Deposit and Savings Account in Banks or Post Office is eligible

|

Section 80TTB is uplifting news for senior citizens who for the most part are subject to interest income for their post-retirement costs.

Feature of this Excel Utility:-

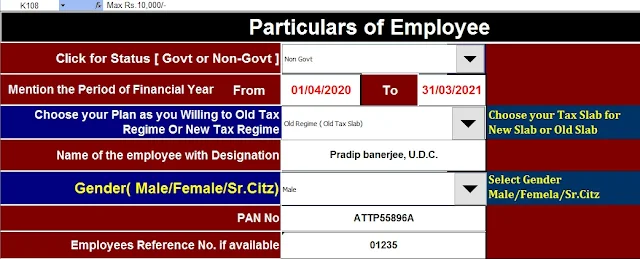

1) Tax Calculation as per the New and Old Tax Regime U/s 115BAC as per your option with the all relevant Modified Tax Section

2) This Excel Utility have the Salary Structure as per the Government and Non-Government Employees, so it is easy to fit your salary in this salary structure

3) This Excel Utility can calculate your Salary Revived Arrears Relief Calculation U/s89(1) with Form 10E from the F.Y.2000-01 to F.Y.2020-21 (Updated Version)

4) Automated Individual Income Tax Salary Sheet for both Govt and Non-Govt Employees

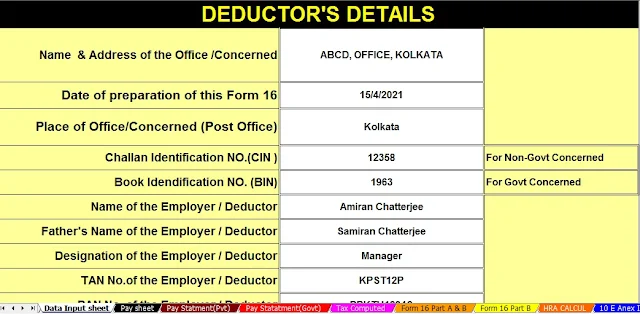

5) Automated Income Tax Revised Form 16 Part A & B for the F.Y.2020-21

6) Income Tax Revised Form 16 Part B for the F.Y.2020-21

7) You can prepare the Tax Liability of your all employees and save the same to your system, for future usages