How to do

Income Tax Count for FY 2020-21? Which Tax Structure to Choose U/s 115 BAC?

According to Financial plan 2020, you

can't claim any tax deduction or exception on the off chance that you intend to

pick a new tax structure. Along these lines, as an individual taxpayer on the

off chance that you choose the new tax system with diminishes tax rate you have

to swear off all tax breaks available today. Luckily, you have an alternative to proceeding with the old tax structure. A salaried individual can switch among old and

new tax structure.

Right off the bat, we will discuss which tax

deduction and exception you have to renounce on the off chance that you settle

on new tax structure with decrease tax rate. Also, we will step through hardly

any exam cases and do income tax figuring for FY 2020-21 to realize which tax

structure to choose?

1 Tax Deduction Under Section 80 C

The most mainstream tax deduction of 1.5 Lakh under section 80C isn't

material for new tax structure. This implies you can't claim any profit for

venture made in the instruments, for example, PF, PPF, Disaster protection

premium, school education costs of kids, ELSS, PPF, NPS and so forth.

You can claim deduction under section 80 CCD for the business

commitment because of representative for NPS.

2 Tax Deduction Under Section 80 D

No tax deduction is considered the clinical protection premium and

preventive wellbeing test under section 80D for new tax structure.

3 No LTA Advantages

For new tax structure LTA – Leave travel stipend exclusion which is right

now available to a salaried representative for twice in a square of four years

isn't permitted.

4 HRA

HRA is house lease stipend. HRA is paid to salaried people by the manager as

a piece of compensation. The prior taxpayer had the option to claim HRA up as far

as possible. In new tax structure it isn't passable.

5 Standard Deduction

A standard deduction advantage of Rs.50000 as of now available to

the salaried tax payer isn't appropriate in new tax piece.

6 Section 80TTA Advantages

Section 80TTA gives a deduction of Rs.10000 on intrigue income. On new tax

system of this advantage isn't available.

7 Section 80DDB Advantages

Advantages for handicap under section 80DDB up to Rs.40000 not available

on the off chance that you are intending to choose new diminished tax

structure.

8 Section 80E Instruction

Credit

Tax break allowable on the intrigue paid on training credit won't be

claimable under section 80E.

9 Section 80G

You had the option to make gift under section 80G and claim income tax

advantage of the identical sum. The said deduction isn't available in the decreased tax

structure.

10 Section 24 Home Credit

Intrigue

Under section 24 of the Income-tax act, an individual had the option to

claim tax deduction on the intrigue instalment on the lodging credit up to a

greatest measure of Rs.200000. This advantage isn't expanded on the off chance

that you choose new tax structure.

So, all deduction material under part By means of like section

80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA,

80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, and so on) won't be claimable by

those selecting the new tax system.

Conclusion:-

In a large portion of the cases

old tax rate with deduction offers higher tax benefits. New diminished tax rate

is helpful just in the event that you are not claiming any deductions starting

at now. (which is uncommon)

On the off chance that you have home

advance and higher income you will get higher tax benefits in old tax rate

contrasted with new tax rate.

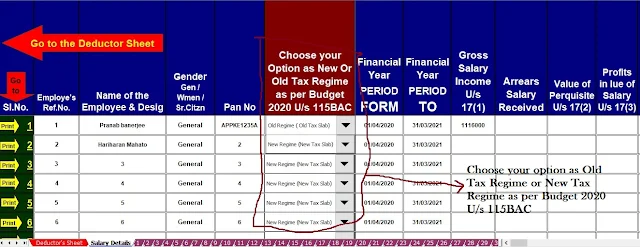

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculate your income tax as per the New Section 115

BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for All the Non-Government (Private) Employee’s Salary Structure.

4) Automated

Income Tax Form 12 BA

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2020-21

7) Individual Salary Sheet