Taxpayers can look for Deduction under Section 80C, which would assist them with decreasing their taxable income. There are a ton of deductions accessible under different sections to assist taxpayers with bringing their taxable income. Every one of these sections caters to a particular kind of investments or costs

Section 80C is the main method of saving taxes. It permits taxpayers to diminish their taxable income by making investments and a few costs and hence save money on taxes they pay. Presently, section 80C permits a deduction from net complete income (prior to showing up at taxable income) of up to Rs 1.5 lakh per annum on qualified investments and indicated costs.

You

May also, like: - Automated Income

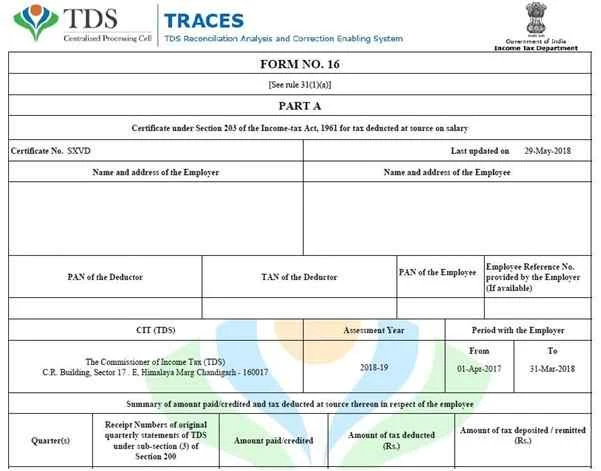

Tax Revised Form 16 Part A&B for the F.Y.2020-21[This Excel Utility can prepare at a time 50

Employees Form 16 Part A&B]

One can contribute the whole measure of Rs 1.5 lakh in one investment or diversify across more than one. Allow us to become familiar with deductions under Section 80C.

Home

Loan Principal

• The Indian government has consistently shown an extraordinary tendency to urge residents to put resources into a house. This is the reason a home advance is qualified for tax deduction under section 80C.

Life

Insurance Premium

Instalment of a premium on extra security strategy gives insurance cover to a taxpayer as well as offers certain tax benefits. The investment in life coverage can be deducted up to Rs 1,50,000.

You

May also, like: - Automated Income

Tax Revised Form 16 Part A&B for the F.Y. 2020-21[This Excel Utility can prepare at a time 100

Employees Form 16 Part A&B]

Provident

Fund Investment

A provident fund is a retirement fund run by the public authority. They are for the most part obligatory, frequently through taxes, and are funded by both employer and employee commitments. Governments set the standards with respect to withdrawals, including the least age and withdrawal sum. On the off chance that a member bites the dust, their enduring life partner and wards might have the option to keep drawing instalments.

Employee's commitment to any provident fund (aside from the unrecognized provident fund) is qualified for deduction under Section 80C up to Rs 1,50,000.

Investment in Value Connected Reserve funds Plan (ELSS)

• ELSS funds are value funds that contribute a significant bit of their corpus into value or value related instruments.

• ELSS funds are likewise called tax saving plans since they offer tax exception of up to Rs. 150,000 from your yearly taxable income under Section 80C of the Income Tax Act.

• Further, these plans have a required

lock-in time of 3 years.

• Therefore, on recovering the units, investors get long haul capital additions or LTCG. These increases are not taxable up to Rs. 1 lakh in one monetary year. Any LTCG over this cutoff is taxed at 10% of the increases surpassing Rs. 1 lakh without indexation.

You

May also, like: - Automated IncomeTax Revised Form 16 Part B for the F.Y.2020-21[This

Excel Utility can prepare at a time 50 Employees Form 16 Part B]

Investment

in (NSC)

• The Public Reserve funds Authentication is a fixed income investment plot that investors can open with any post office.

• An Administration of

• A fixed-income instrument like Public Provident Fund and Post Office FDs, this plan also is a protected and okay item.

• One can get it from the closest post office in their name, for a minor or with another grown-up as a shared service.

• The testaments acquire a fixed interest and accompany a fixed development time of five years. There is no most extreme cutoff on the acquisition of NSCs, however, just investments of up to Rs.1.5 lakh can acquire a tax break under Section 80C of the Income Tax Act.

You

May also, like: - Automated Income

Tax Revised Form 16 Part A&B and Part B for the F.Y.2020-21[This Excel Utility One by One Form 16 Part A&B

and Part B]

Investment

in Fixed Deposits

Any term store with a residency of at any rate five years with a planned bank additionally fits the bill for deduction under section 80C and the premium acquired on it is taxable.

Investment Unit-connected Insurance Plan (ULIP)

• Unit Connected Insurance Plan (ULIP)

is a blend of insurance alongside investment.

• From a ULIP, the objective is to give abundance creation along with life cover where the insurance organization puts a bit of your investment towards disaster protection and rest into a fund that depends on value or obligation or both and matches with the financial backer's drawn-out objectives.

• Premium paid on ULIPs is qualified for a deduction under Section 80C up to a limit of Rs 1.5 lakhs during a year.

You

May also, like: - Automated IncomeTax Revised Form 16 Part B for the F.Y.2020-21[This Excel Utility One by One Form 16 Part B]

Education

Expenses

A parent can guarantee a deduction on the sum paid as educational expenses to a university, school, school or some other instructive establishment. Different segments of expenses like improvement charges and transport charges are not qualified for deduction under Section 80C.

Download Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21[This Excel Utility can prepare at a time 100

Employees Form 16 Part A&B and Part B]