If you do not file Income Tax Return for the F.Y.2021-22 you should pay double TDS which effect from the 1st April 2021 as per Budget 2021. In this Budget 2021, a few changes have been made in the income tax rules in the Budget 2021. These changes will produce results on April 1, 2021

Union Finance Minister Nirmala Sitharaman has presented the budget for the financial year 2021 to 2022 in Parliament. Everybody was trusting that the Union Finance Minister would attempt to conciliate people in general by changing the individual income tax structure as the result of the Crown slaughter. Yet, in that trust, Nirmala Sitharaman kept the individual tax structure unaltered. Pensioners over the age of 65 don't need to file an income tax return The Finance Minister has additionally absolved the income acquired from the interest of these senior citizens A few changes have been made in the income tax rules in the budget. These changes will produce results on April 1, 2021.

The central government has changed a portion of the principles of TDS to twofold the TDS - ITR recording on the off chance that you don't file ITR. This causes it considerably harder for individuals to don't file ITR. For this, the government has added area 206AB in the Income Tax Act. As per the new law, in the event that you don't file an ITR, you should pay twofold TDS from April 1, 2021. As indicated by the new principles, the wellspring of tax assortment (TCS) will be higher on the individuals who have not filed their income tax returns.

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Jharkhand State Employees for the F.Y.2020-21[This Excel Utility

prepare at time Tax Computing Sheet + Individual Salary Structure as per the

Jharkhand State Employees Salary Pattern + Automated Income Tax H.R.A.

Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part A&B and

Form 16 Part B as per the new and old tax regime U/s 115 BAC]

EPF - The new Wage Code declared by the Union Finance Minister Nirmala Sitharaman in the current year's budget, whenever executed, will lessen the measure of bringing home salary. This, yet recreation reserve funds will likewise be diminished Reporting the budget, Nirmala Sitharaman said that if more than Rs 2.5 lakh a year is stored in the fortunate asset, it will be taxable. This standard will be executed from April 1.

Pre-Field ITR Form - The Finance Minister referenced Pre-Field ITR while presenting the budget. For the accommodation of the workers and to encourage the way toward documenting income tax returns, pre-field ITR structures will be given to the taxpayers from 1 April 2021.

LTC Plan Notice - In the 2021 budget, the Modi government has told the Live Travel Concession (LTC) Money Voucher Plan. The plan has been dispatched for the individuals who couldn't profit from the advantage of LTC tax due to Covid plague.

Income tax exemption for senior citizens - Income tax exemption for pensioners over 65 years has been declared. It has been declared that senior citizens over the age of 65 who are pensioners and subject to intrigue won't need to file income tax returns. It is accepted that senior citizens will get unique advantages.

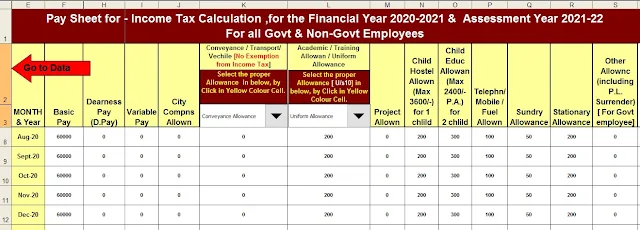

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2020

3)

Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2020-21 (Updated Version)

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Govt and Private Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

10)

Automatic Convert the amount into the in-words without any Excel Formula