5 new rules are being introduced in the income tax in April 2021. Changes have been made in the field of income tax in line with the new labour and wage policy.

Union Finance Minister

Nirmala Sitharaman announced several new policies on income tax in the Union Budget. The new policy is going to be effective from 1st April 2021.

A number of new policies are being introduced to ensure that more citizens file their income

taxes on time. That is why the new tax policy is being introduced in the

case of PF. Besides, the Union Finance Minister has also announced an increase in TDS and TCS. Not only that, changes have been made in the

field of income tax in line with the new labour and wage policy. The Union Finance

Ministry has also tried to facilitate the process of paying income

tax. Pre-field income tax return application is being introduced.

Take a look at what

changes are coming from April 1:

1

1) Benefits for Senior

Citizens:

Those aged 65 and above who are dependent on full pension and

bank interest money for income does not have to file income tax returns. The

money will be deducted from the bank where they get their pension.

2

2) Pre-filled Income

Tax Return Form:

Every taxpayer will get a pre-field income tax return form. This

means that all the information of the taxpayer will be filled in the form

beforehand. All the information like income, interest income from savings,

payment of tax etc. will be mentioned there in advance. So the tax payment

process will be easier.

3) New tax policy for

PF:

If more than Rs 5 lakh is deposited on behalf of the employee

for PF, the tax will be applicable from now on. Tax will be levied on the

interest accrued on deposits above Rs 5 lakh. However, in this case, the

money that the employer is depositing will not be caught.

In the words of the Union Finance Minister, 'The new EPF policy

should be done keeping in mind the interests of the workers. This policy

will not have any effect on a person earning less than Rs 2 lakh per month.

4

4) TDS:

In this case, the main purpose of the new policy is to encourage

more citizens to file income tax. In this year's budget, the finance

minister has announced an increase in TDS and TCS.

The Union Finance Minister also announced the addition of two

new sections, 206AB and 206CCA, to the Income Tax Act in the

budget. According to this policy, those who do not file income tax will be

deducted TDS and TCS at an extra rate.

5

5) LTC:

In the Union Budget 2021, the Finance Minister announced tax exemption on Leave

Travel Concession (LTC). The centre announced the policy during the Corona

Lockdown last year. This year the workers will get the whole

money. Basically, government employees will benefit from this.

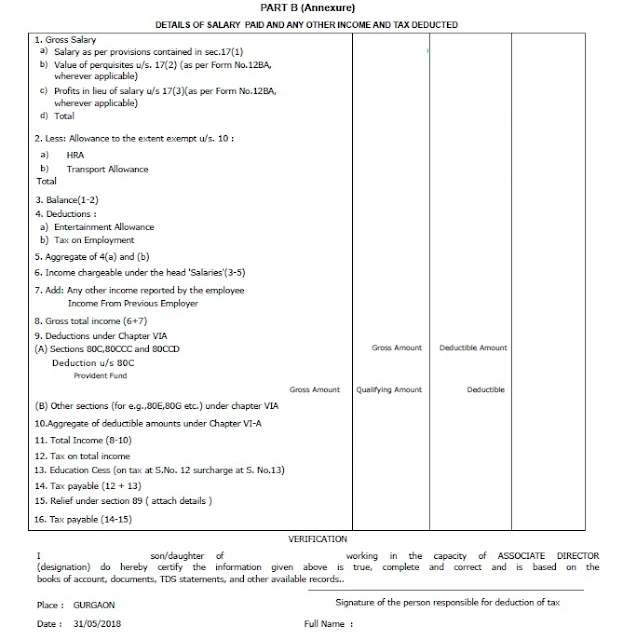

Download and Prepare at a time 50 Employees Form 16 Part B for the F.Y.2020-21 as per the new and old tax regime U/s 115 BAC