Tax exemption U/s 80D for the F.Y.2020-21 as per New and Old Tax Regime U/s 115 BAC.

One of the most common expenses of the common man is medical / health insurance/health insurance premium if the tax is paid in the previous year outside the taxable income and is paid by any mode other than cash, then health insurance discount is allowed. Health insurance discounts are approved for individuals and HUFs. It agrees to the treatment / the health insurance premium paid for the notification schemes accepted in the case of certain persons:

A) Provided by individual

For: self, wife, dependent children

You may also, like-

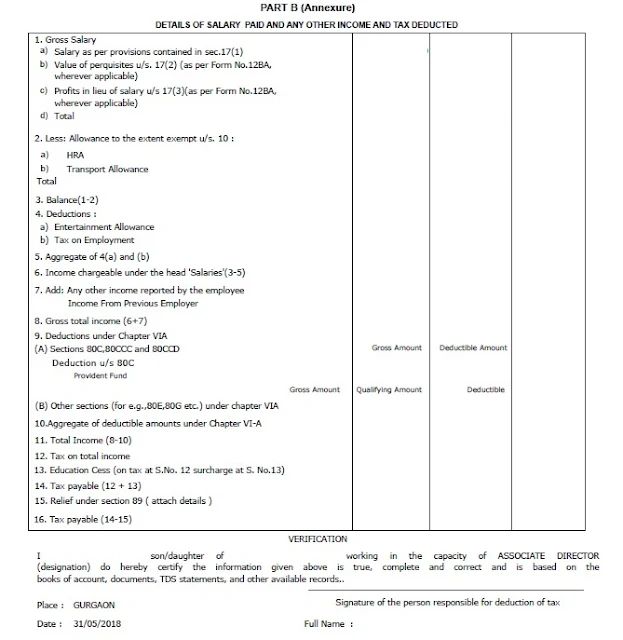

Automated Income Tax Revised Form 16 Part A&B and Part B in One Excel file

for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC.

Eligible scheme

(A) the medical insurance policy of the GIC (approved by the Central Government) or any other insurer approved by the IRDA; Or

(B) Contributions of the Central Government Health projects or such national health projects may be informed by the Central Government.

(C) Preventive health check-up for: Parents

I. Medical insurance policy or individual, wife and dependent children policy and contribution to CGHS

At least 2 discounts will be allowed:

(1) The assessor, his / her spouse and all dependent children are kept together and deposited in any mode other than cash for the amount of preventive health examination and the amount of the preventive health, the examination is up to Rs. 5,000 and contributed to CGHS. Or

(i) Rs. 25,000 (Rs. 50,000 for senior citizens).

II. Medical insurance policy or parental or parental policies

You may also, like- Automated Income Tax Revised Form 16 Part B in Excel for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC.

At least 2 deductions will be allowed:

Deposit of actual premium in any mode other than cash for parent/guardian medical insurance policy and preventive health check-up. Parents may or may not be dependent on the determinant. Or

(ii) Rs. 25,000 (Rs. 50,000 for senior citizens).

III. Medical insurance policy adopted by HUF In this case, the exemption under Section 80D is HUF. The amount of medical insurance premium paid in any mode other than cash on the health of any of its members shall be Rs. 25,000 (Rs. 50,000 for senior citizens).

III. Medical insurance policy adopted by HUF

H.U.F. In this case, the exemption under Section 80D is HUF. The amount of medical insurance premium paid in any mode other than cash on the health of any of its members shall be Rs. 25,000 (Rs. 50,000 for senior citizens).

You may also, like- Automated Income Tax Revised Form 16 Part B in Excel which can prepare at a time 50 Employees Form 16 Part B for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC.

Assessors will be allowed discounts for husband, wife and children’s medical insurance as well as discounts for parents. 2014-1. From the assessment year onwards, any amount paid to health insurance will be paid

Other notified projects will also be eligible for exemption under this section within the existing limits

If a senior citizen does not receive health insurance coverage (sometimes insurance companies do not provide such coverage to senior citizens), senior citizens shall be allowed a maximum discount of Rs. 50,000 on any payment for medical expenses incurred. One parent is medically insured and the other is not medically insured as a senior citizen, but will have to bear the cost of treatment, health insurance premiums and overall discounts on medical expenses will be allowed but limited to Rs.500 only. 50,000