Income Tax Revised Form 16 Part B for the F.Y.2020-21 as per the New and Old tax Regime U/s 115 BAC.

Most taxpayers make the most of the tax deduction benefits under Section 80C. But in many cases, it is limited to one stage. But did you know that even more taxes can be saved? Yes, there are several tax saving options. For those who have already reached the limit of Rs 1.5 lakh, there is a way to save more.

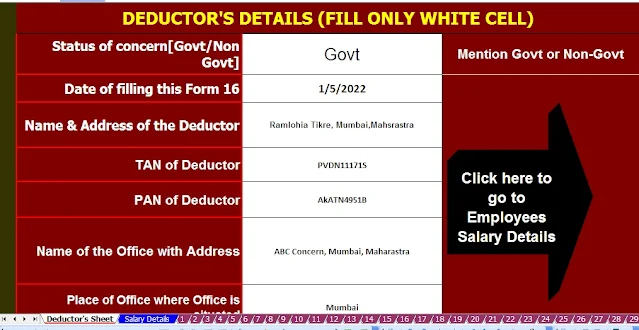

Download and prepare One by One Automated Income Tax Revised

Form 16 Part B for the Financial Year 2020-21 as per new and old tax regime

1. Section 80D: Health insurance premium

If you pay a health insurance premium up to Rs. 25,000 for yourself, wife or child, you will get an additional discount as per Section 80D. In addition, if you pay a health insurance premium for your parents, you can still get an additional discount of around Rs 25,000. If the parents are senior citizens, the discount can be up to Rs 50,000.

2. Section 80CCD (1B): Additional deduction for NPS investments

If you invest up to Rs 1.5 lakh per annum in the National Pension Scheme, you will usually get an 80c-one discount. However, if you invest in NPS Tier 1 account, you will get a discount of up to Rs 50,000.

3. Section 80GG: Deduction on rent for those not receiving HRA

Those who live in a rented house and work in a place where HRA is not paid or do business - will get an income tax exemption as per Section 80GG for rent.

4. Section 10 (13A): Availing exemption on HRA by paying rent to parents

It's a little different. Although many receive a paid HRA from the workplace, many stay with their parents at their ancestral home. There are ways in their case. If they rent to their parents on a monthly basis as tenants, they will be covered under Section 10 (13A) of the HRA Tax Exemption. However, in this case, it should be kept in mind that there should be rent paper, proof of bank transfer, etc. At the same time, the landlord has to mention the income from rent in his income tax file.

5. Section 80DDB: Deduction for medical treatment of certain diseases

In the case of certain diseases, the income tax exemption is given in accordance with Section 80DDB for the cost of health services for the affected. If the patient is a senior citizen, then the discount is up to about 1 lakh rupees. In other cases, discounts of up to Rs 40,000 may be available.