Leave Travel Exemption (LTC / LTA) [U/s 10 (5)].The employee is entitled to a waiver under section 10 (5) in respect of the value or honour of the travel waiver or assistance received by or from his own employer or ex-employer as relating to his activities—

A. Holidays

anywhere in

B. Anywhere in

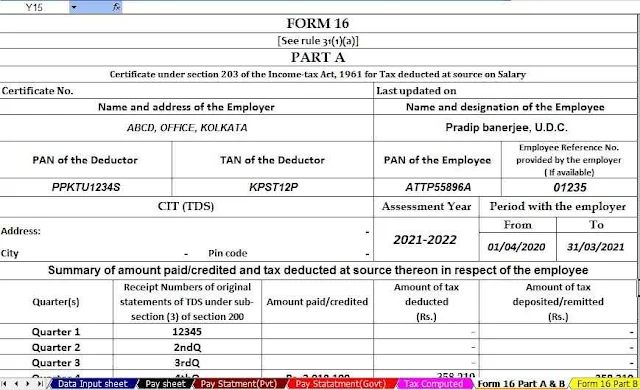

You may also, like- Prepare at a time 50 Employees Automated Income Tax Form 16 Part A&B for the F.Y.2020-21 as per the new and old tax regime U/s 115 BAC

The benefit can be allowed subject to the following:

i. Where the aircraft is flown - the maximum discount is not the amount the national carrier's air economy fare exceeds on the shortest route to the destination;

ii. Where the source of the journey and the destination are connected by rail and the journey is performed by a mode of transport other than by air - the maximum discount is not the amount of air-conditioned first-class rail fare on the shortest route shall be the destination; And

iii. Where the source of the trip and the destination or parts of it are not connected by rail and travel within these places - the amount eligible for the discount is:

A. Where there is a recognized public transport system, first-class or deluxe class fares will not be higher for the shortest route to the destination; And

B. Where there is no recognized public transport system, the air-conditioned first-class rail fare for the shortest route is the same as if the journey had been performed by rail.

You may also, like- Prepare at a time 100 Employees Automated Income Tax Form 16 Part A&B for the F.Y.2020-21 as per the new and old tax regime U/s 115 BAC

The exemption, will not exceed in any case, the actual cost will be on the performance of the ride.

How many times can a discount be claimed?

a) The appraiser can claim a discount on any two trips in the 4-year block. In this regard, the first block of 4 years was the calendar year 1986-89, the second block was 1990-93, the third block was 1994-97, the fourth block was 1998-2001, the fifth block was 2002-05, the sixth block was 2006-09, the seventh block was 2010. From 2013, the eight-block will be 2014-2017 and the ninth block will be 2018-2021

b) If the appraiser does not take advantage of LTC discounts on a particular block, for both trips or on one trip, he can claim that the first trip discount in the calendar year can immediately complete the completion of four calendar blocks. In other words, a maximum of one trip can be taken forward.

You may also, like- Prepare at a time 50 Employees Automated Income Tax Form 16 Part B for the F.Y.2020-21 asper the new and old tax regime U/s 115 BAC

And also only for the first trip in the next calendar year if the deadline is not extended otherwise. In the extended period, such journeys will not be considered for determining the tax exemption of two journeys for successful blocks.

Discounts are only available for two children